What’s in store for the Philippine property market this 2021?

Amid the prolonged COVID-19 pandemic, the real estate industry is seen to face slow recovery and subdued market activity this year, marked by rising vacancies, softening of prices and declining rental rates. Despite these however, certain segments continue to display resilience, while some industry players remain confident about their prospects in the local market.

Offering that much needed boost in confidence, according to some of the country’s leading real estate services and investment management firms, are the government’s vaccine rollout, which is now heavily impacting most real estate decisions across all sectors, and the anticipated Corporate Recovery and Tax Incentives for Enterprises (CREATE) bill, which some see as a major stimulus that can help support the country’s economic recovery.

‘Optimism in the market’

Although the pandemic continues to hamper residential demand in both the pre-selling and secondary markets, Colliers Philippines said it expects the delivery of 10,387 new residential units this year, more than double the 3,370 delivered in 2020. This recovery in new supply can be attributed to developers exploring the viability of new project launches in key areas across Metro Manila, while the vaccination rollout and economic recovery are expected to boost demand.

Further corrections in prices and rents are expected this year, while vacancy is seen hitting a record high of 17.2 percent given the completions. Starting 2022, however, the pace of growth for prices and rents is expected to reach 1.5 percent and 1.7 percent, respectively, due to the government’s vaccine roll out and a rebound in office space absorption, Colliers reported.

“In our opinion, certain recovery drivers provide a sense of optimism in the market. From January to February 2021, cash remittances from OFWs reached $5.1 billion (P244.8 billion), up 1.5 percent annually. This is a reversal from the 0.8 percent decline year-on-year in 2020. The Bangko Sentral ng Pilipinas (BSP) projects cash remittances to reach $31 billion (P1.5 trillion) in 2021, up 4 percent year-on-year. OFW remittances continue to be one of the key drivers of residential demand. The central bank’s benchmark interest rate also remains steady at 2 percent, a record-low. This should help support economic recovery and keep mortgage rates attractive to investors,” Colliers said in its report.

Cushman & Wakefield meanwhile noted that “house and lot developments in urban areas remain as an attractive residential option… Residential condominium developments with superior property management and less dense population are expected to remain attractive in the market.”

Recovery beyond 2021

Colliers said it saw in the first quarter this year the highest level of office lease transactions since the lockdown began in 2020, driven primarily by e-commerce, data centers and outsourcing companies. Net absorption, however, remained negative due to lease cancellations and/or non-renewals, as well as the surge in COVID-19 cases.

JLL Philippines also pointed out the continuous move outs, pre-terminations, downsizing and softening of demand, which pushed office vacancy to hit 14.7 percent.

“(The first quarter of) 2021 saw sustained move outs and downsizing from Philippine offshore gaming operators (Pogos) and outsourcing and offshoring firms, as well as occupiers who are continuing to focus on cost optimization and putting their re-entry and expansion decisions on hold due to the pandemic,” Janlo de los Reyes, JLL Philippines’ head of research and consultancy, said in a statement.

“Occupiers and investors are hesitant to pull the trigger regarding their return to office or expansion activities due to the highly fluid environment. Employee safety and wellness, as well as cost optimization, remain their top priorities. Key to all these concerns is the vaccine rollout which will impact a lot of corporate decisions across all sectors,” de los Reyes added.

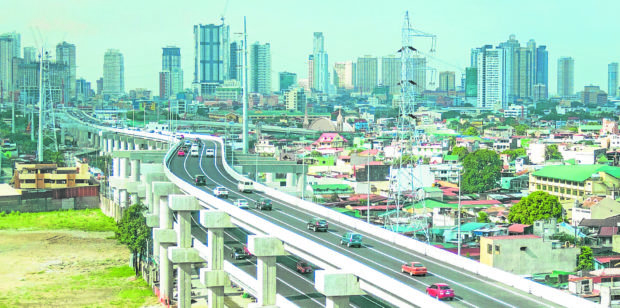

For 2021, Colliers projects new supply to reach 878,200 sqm. Crucial however to the recovery of Metro Manila’s office market demand is the vaccination program, which may bolster confidence for companies to return to the office. The implementation of the CREATE law, the continued roll out of infrastructure projects as well as adequate supply in key locations outside the capital region where many outsourcing companies have set up offices are likewise crucial to office leasing recovery beyond 2021, Colliers said.

Bright spot

The logistics sector remains a bright spot in a still sluggish 2021 property market, according to JLL Philippines. Some 45,800 sqm were completed during the first three months of the year in Cavite and Laguna, pushing the total supply to 1.6 million sqm.

De los Reyes said this sector is expected to continue growing until next year as more developers and operators are looking at this particular asset class for growth. What’s good about logistics is that it’s driving demand not only in the industrial sector but also in the office sector. As more e-commerce and retail players come in and take up logistics space, they also require office space to support their business and operations, he explained.

Slow recovery

Lingering economic uncertainties, reinforced with the high level of prices and joblessness, hamper the growth momentum of consumer spending and dims the immediate recovery of the retail sub-sector, according to Cushman & Wakefield.

Filipinos are thus expected to limit spending to essential retail categories such as food and beverage (F&B), groceries and medical services, and avoid non-essential purchases this year, prompting Colliers to project muted retail space absorption for 2021.

Data from Colliers showed that it expects lockdowns in Metro Manila and subdued consumer confidence to push retail vacancy to 16 percent, the highest since 2002, while rents are seen to decline by another 5 percent this year.

A slow recovery in terms of vacancy and rents is expected to begin by 2023, but the projected rebound will hinge on the pace of the government’s vaccination program, confidence of retailers to occupy physical mall space, and willingness of consumers to visit brick-and-mortar shops.