RCBC is first bank to offer loans marketplace via DiskarTech, to extend products to SMEs, individuals

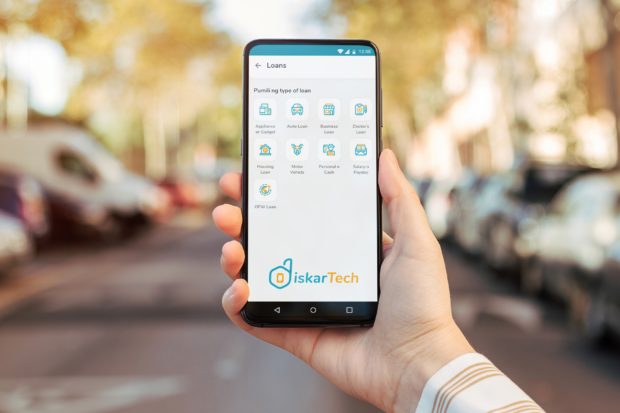

The Rizal Commercial Banking Corporation (RCBC), through its financial super app DiskarTech, continues to lead financial inclusion by becoming the first local universal bank to offer a loans marketplace.

Following the approval by the Bangko Sentral ng Pilipinas’ (BSP) Monetary Board, DiskarTech will soon offers its users access to safe and affordable loans products that they can rely on in these uncertain times.

As of January this year, around four million Filipinos are currently jobless, which is almost double that of 2.2 million unemployed in the previous year. The unemployment rate is currently at 8.7%, with some provinces recording double-digit numbers.

The DiskarTech loans marketplace, shall initially offer taxi/PUV loans, tricycle loans, multicab loans and refinancing for micro and small entrepreneurs, among other products that can be used as alternative livelihood for unemployed Filipinos.

Users can choose from the different loan providers housed inside the mobile app, which products best fit their needs in terms of interest rates, duration, and many other important variables they need to consider.

Article continues after this advertisementBorrowers can enjoy the Taglish financial app’s loans features by answering a set of questions, from which DiskarTech will assess what loans product fits the user’s profile.

Article continues after this advertisement“This is a good timing for us so we can showcase the big help that small lending institutions can provide,” said Lito Villanueva, Executive Vice President and Chief Innovation and Inclusion Officer of RCBC.

While trying times usually push low-income families to borrow from loan sharks and informal lenders with high interest rates, Villanueva explains that the loans marketplace is a good opportunity to take loans conveniently online and with the assurance of an established bank like RCBC. This is also a way for them to participate in the formal financial system.

Other loans to be offered by DiskarTech are doctor’s loan, car loan, truck loan, second-hand car loan, second-hand truck loan, OFW loan, and seafarer’s loan.

Villanueva also explained how taking loans from DiskarTech can help an individual and micro, small, and medium enterprises (MSMEs) improve their credit ratings. This in turn, helps them become credible borrowers which will entitle them to more loan opportunities for future needs.

“We are also having a collaboration with the Credit Information Corporation on educating the public, especially the unbanked or underserved segment of the population on the relevance or importance of credit score on how we can help we can create credit profiles so that they will be able to enjoy a much higher loanable amount at a much lower interest rate,” he added.

Helping onboard Filipinos through the loans market can also positively impact the number of unbanked Filipinos, which accounts for 71 % of Filipino adults based on a 2019 survey by the Bangko Sentral ng Pilipinas (BSP).

Factors such as proximity from physical banks and availability of banking institutions should be considered, especially during the pandemic. This is what DiskarTech was built for, with RCBC as the first local universal bank to have the most extensive reach. DiskarTech itself has registered customers from across all 81 provinces in the Philippines.

The DiskarTech experience

With DiskarTech’s high-interest savings account at 3.25% interest rate per year versus regular savings account, users will be able to grow their savings just by keeping the money safe in their individual DiskarTech accounts. That means with a regular savings account (with, say, 0.25% interest per annum), your P20,000 will earn only P50 annually. Subtract the 20% tax, and you will receive a meager P40 per year. With DiskarTech, your P20,000 will earn 3.25% per year (minus the 20% tax) will make a total of P520 pesos annually!

The good news is, unlike its counterparts, DiskarTech offers unlimited fund transfers to all banks and e-wallets for free (without extra charges) for the whole 2021!

With BSP’s plan to engage further in digital finance programs to reach out to the unbanked majority, RCBC has immediately responded with DiskarTech, the bank’s way of promoting financial inclusion to the undeserved and unbanked Filipinos, via a more responsive, inclusive, and relevant super app.

This is not surprising for RCBC which has, for more than 60 years, been a partner of Filipinos for financial literacy and convenience. And to keep up with the changes this pandemic crisis has brought us, DiskarTech will definitely be one iconic solution that will empower all unbanked and underserved Filipinos to reach for a financially literate, madiskarte, and money-secured future that each one rightfully deserves.

(Download the #DiskartechbyRCBC #AppNatinTo now via Play Store: https://tinyurl.com/DiskarTechAndroid or App Store: https://tinyurl.com/DiskarTechiOS. For more information, watch videos thru youtube.com/diskartech)

ADVT.

Read more Business stories: