Agri-food processing hubs in Asean

Many countries survive on importing raw materials and exporting the finished food products. Prime example is Switzerland, which imports cocoa beans and exports fine chocolates. The same is true for Belgium, Spain and Ukraine. The four do not produce cocoa beans.

What are the lessons? I will discuss in the context of Asean (Association of Southeast Asian Nations) cases.

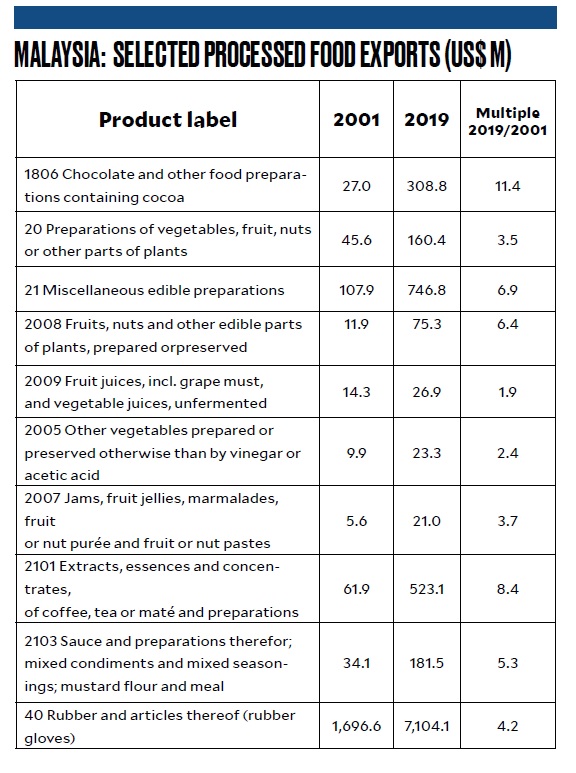

Malaysia

The country is a cacao grinding center. It used to be a key cacao producer, but shifted to palm oil due to disease and better palm economics.

It now imports cocoa beans from Indonesia and West Africa grinders produce cocoa powder and butter. It is the location of chocolate brands in the Asean.

Guan Chong Cocoa Manufacturer is the largest cocoa grinder in Malaysia and fourth in the world with a grinding capacity of 250,000 metric tons a year, as cited in the website. Brands coming from Malaysia include Barry Callebaut, Chocolat Frey AG, Ferrero and Cadbury. Malaysia is the largest cocoa grinder in Asia and the fifth largest globally, behind Netherlands, Cote d’Ivoire, Germany and the United States based on the same website. Indonesia once stood as the third largest cocoa bean exporter.

Asia’s biggest grinder is Guan Chong Bhd behind Barry Callebaut, Olam and Cargill.

Malaysia also exports a variety of processed products, from mixed fruits and nuts, mixed juices, other prepared/preserved vegetables, food preparations, as well as extracts, essences and concentrates of coffee, tea or mate, and mixes and sauces.

On agri but nonfood products, Malaysia imports rubber latex from Thailand to manufacture for glove export. Top Glove, Hartalega, Kossan and YTY are the leading exporters.

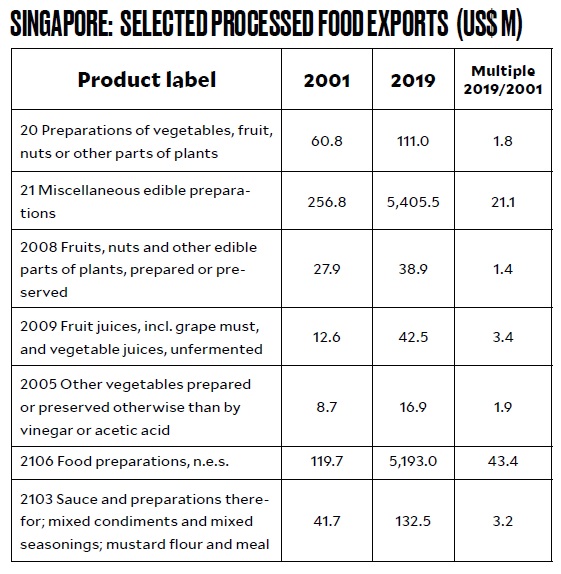

Singapore

Total food industry output was valued at $8.3 billion in 2019 (www.foodexport.org). The food processing industry included flavorings, sauces, ready-to-eat meals, noodles, deli meat, sausage, confectionery, chocolates, snacks and beverages (including beer). The island country imports 90 percent of its food, but it is a billion-dollar exporter of various food products.

Underlying factors: Strategic location, low tariffs, efficient port

Thailand

It is a major exporter from rubber to rice to seafood. It also exports a variety of processed foods, mainly mixed fruits and nuts, other prepared/preserved vegetables, mixed juices as well as food preparations and sauces and mixes.

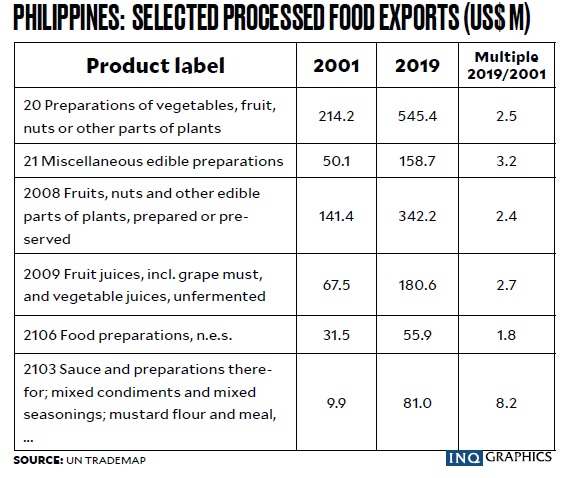

Philippines

The country, because of its single product strategy, exported only $159 million worth of miscellaneous edible preparations in 2019, up 3.2x from $50 million in 2001. Exports have not been able to substantially move up and diversify as the large areas of tree-crops have been neglected, especially coconut, rubber and coffee.

Key lessons

While locally-produced raw materials present an advantage in terms of ease of sourcing for food processing hubs, they are not a prerequisite for establishing processing facilities geared for export. Many countries have managed to export products, even if they do not necessarily produce the raw material in substantial quantities. Rather, they rely on imports to supply their requirements. This is exemplified by Switzerland, Belgium, Malaysia, Singapore, among others.

There are several underlying factors. Talk about manufacturing and exporting tradition; infrastructure, especially for land and sea travel; strategic location, especially nearness to international sea lanes; presence of ports with regular stops by container lines; low tariffs; competitive import prices; conducive business environment; and the like. The Philippines has potential for food processing hubs.

The key areas can include the Clark-Subic Corridor in Central Luzon; Iloilo Port Zone in Panay; and Anflocor Industrial Estate in Panabo City, Davao del Norte. INQ