The good news is that after a horrible 2020, when the coronavirus (COVID-19) pandemic wreaked havoc on the global economy, this year will be better. The Philippines is expected to exit an economic recession with the reopening of businesses and the rollout of COVID-19 vaccine to a critical mass of the population, which should shore up consumer and business confidence.

The bad news is that the pace of recovery will not be enough to return to the level of productivity prior to the pandemic. Downside risks likewise remain on the much-awaited inoculation program and the amount of fiscal stimulus that the government will execute this year.

For the first time since the rice crisis of 2018, inflation breached the upper end of the Bangko Sentral ng Pilipinas’ 2-4 percent target early in the year on higher food prices arising from the series of typhoons last year that cut farm output as well as the African swine fever that affected pork supply. Transport costs have also risen as global oil prices trended higher. Inflation rose by 4.2 percent year-on-year in January from 3.5 percent in December. This surged past the market expectation of 3.5 percent year-on-year.

The domestic economy is expected to remain in recession in the first quarter of 2021, before bouncing in the second quarter coming from a low base in 2020. To recall, it was in mid-March 2020 that the government placed Metro Manila and other key regions under strict lockdown protocols.

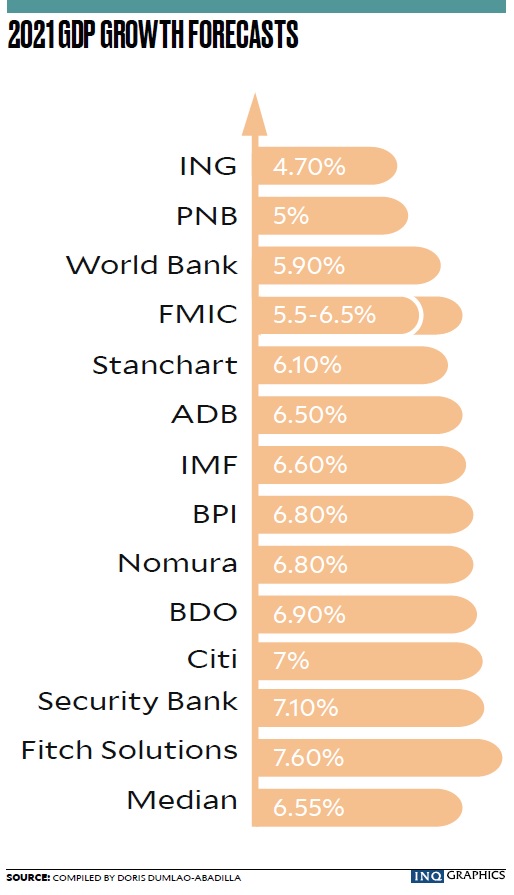

Based on median forecasts of 13 institutions, including big financial institutions and multilateral agencies, the Philippines will grow by 6.5 percent this year, coming from the 9.5 percent record contraction seen last year.

“Based on our estimates, GDP (gross domestic product) growth is still expected to contract mildly in the first quarter 2021. However, it seems consumer confidence is starting to show a more meaningful recovery based on the mobility data in the last six weeks of 2020. Combined with some easing in transport protocols, consumers have learned to take the necessary precautions to confidently go out,” said Emilio Neri Jr., lead economist at Ayala-led Bank of the Philippine Islands.

Assuming that the government will not impose additional restrictions on movement, double-digit GDP growth may be seen during some quarters of 2021, Neri said. BPI is forecasting growth this year to reach 6.8 percent.

“However, even at this brisk pace, economic output will not be able to return to the 2019 level yet and a full recovery may only happen in 2022,” Neri said.

British banking giant HSBC said the Philippine economy remained far from recovery, judging from the fourth-quarter GDP performance. The country’s GDP fell by 8.3 percent year-on-year in the fourth quarter but rose by 5.6 percent quarter-on-quarter seasonally adjusted.

While sequential GDP growth appears robust on a quarter-on-quarter basis, HSBC said the underlying data suggested that the economy remained sluggish, noting that private consumption did not improve much. This suggests that despite a reduction of COVID-19 cases toward the end of the year, households remained wary of spending amid ongoing movement restrictions and economic uncertainties, HSBC said.

“The recovery in fixed investment also appears lackluster as new capex (capital expenditure) spending remains minimal despite a moderate pick-up in construction activity. Meanwhile, the slight increase in government spending (3.4 percent quarter-on-quarter seasonally adjusted) during the quarter was not nearly enough to offset the weakness in the broader economy,” HSBC said.

Overall, HSBC said the Philippine economy was on the path to recovery, but it remained far from reaching its prepandemic levels. It also noted that the Philippines’ local mobility data remained among the weakest in Asia even as of the first quarter 2021.