When news of the first Philippine COVID-19 case broke out, we immediately rolled out the drawing board. While hoping for the best, we prepared for the worst. We subscribed to the work-from-home setup, a week before enhanced community quarantine was declared on March 16.

The pandemic indeed has forced all stakeholders to go digital. The government mandated that all its transactions quickly transition to electronic for swift delivery of public services. RCBC heeded this call by promptly scaling-up key digital platforms, and inking over 50 key partnerships vital to social service delivery.

This includes government agencies like the Department of Trade and Industry (DTI) for digitally enabling micro, small and medium enterprises, and the Department of Social Welfare and Development (DSWD) and Department of Labor and Employment (Dole) to assist in the efficient and fast digital disbursement of cash assistance to sectors affected by the pandemic under the government programs covered by the Bayanihan 1 and Bayanihan 2 laws.

Scaled up banking services, like the RCBC’s hand-held automated teller machine (ATM) mobile point-of-sale device called ATM Go, met the challenge head on. Nationwide, more than 1,800 ATM Go devices were deployed ahead of the lockdown to hundreds of RCBC payout partners in 72 of the 81 provinces, the first private universal bank to do so in this magnitude. Partners include rural banks, microfinance institutions, cooperatives, pawnshops, money business operators, drugstores and “sari sari” stores.

The DSWD tapped RCBC’s ATM Go and endorsed its use across its regional offices as the disbursement device to service ATM cards issued by any Bancnet-member bank including cash cards used for its conditional cash transfer program called Pantawid Pamilyang Pilipino Program. And for the digital “ayuda” disbursements of social amelioration program, both the DSWD and Dole tapped the new RCBC DiskarTech disbursement platform.

As of Dec. 24, over P12 billion has been disbursed to about 3.17 million households benefiting approximately 15.83 million individuals nationwide.

On the mobile app front, covering the entire market spectrum has been the emphasis. This is a testament to RCBC’s thrust of not only being the bank for all generations, but for all segments of society as well.

Exceeded metrics only stoke the determination to continuously enhance user interface, and to optimize digital customer experience. These efforts further set unprecedented milestones, such as the recorded jump of 681-percent in InstaPay fund transfers compared to prequarantine figures. Daily transaction count and amount of cardless ATM withdrawal were up by 2,763 percent and 4,535 percent, respectively. Alongside these are digital banking enrollment and send cash remittances, which surged by 186 percent and 523 percent, respectively.

Even at the height of the lockdown, scale-up efforts remained razor focused on trailblazing online and mobile features responsive to the call of the times, such as the use of virtual banking technology to provide secure and more convenient alternatives for various financial transaction across segments.

Grassroots banking

Standing out in the very crowded mobile app space, with almost 200 in the country and over four million worldwide, is daunting, even to the savviest. However, there lies a gaping hole in the entire setup, detectable only to those that keep their ears close to the grassroots’ ground. With millions of mobile financial apps, none caters primarily to the needs of this segment starting with the most basic, i.e., addressing the language barrier.

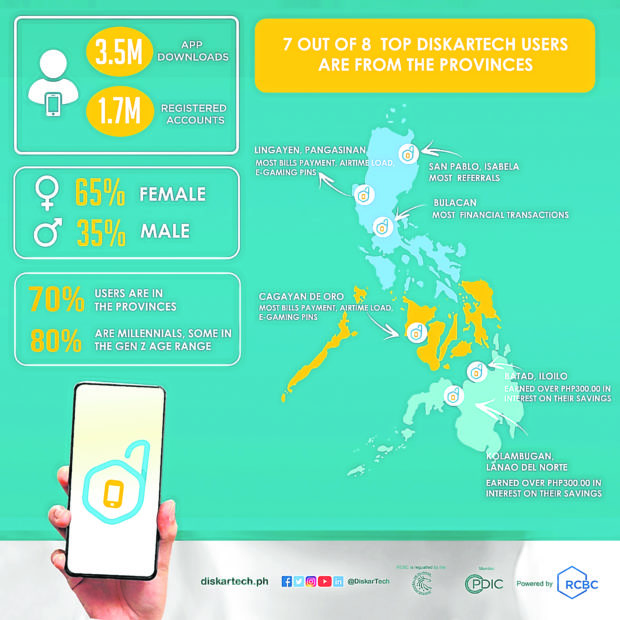

In July 2020, RCBC launched DiskarTech, the first Taglish financial inclusion “super app” in the Philippines, the only Filipino app that hit over a million app downloads in its first 30 days. There are close to four million downloads in less than five months, making it one of the fast-growing financial apps in the country with over 50 percent monthly active user rate.

It aims to make banking services more accessible to the masses. Over 58 million adult Filipinos now find it simple to quickly open a bank account with just a single government ID through their smartphones. This levels the playing field as every Filipino can now benefit from a 3.25-percent per year interest-bearing basic deposit account. This is 13 times higher than industry savings interest rates while also insured with the Philippine Deposit Insurance Corp.

DiskarTech’s demographics tells the whole story. Over 70 percent of registered users reside outside Metro Manila, while more than 80 percent are millennials with some already in Gen Z age range and dominated by females at 65 percent. In fact, seven out of eight top users of key DiskarTech app features are from the provinces. Two account holders have earned over P300 in interest on their savings, thus far. Both live in low-income rural areas particularly in a fourth class municipality of Kolambugan in Lanao del Norte province, and in a fifth class municipality of Batad in Iloilo province. This validates a 2011 Urban Institute study that indeed the poor and low-income people can save. It says that “despite very low incomes, 44 percent of households accumulated enough to escape asset poverty after 12 years.”

Making DiskarTech a “hardworking” app is in its DNA. This paved the way for the introduction of “NegosyanTech” program to unlock Filipinos’ inherent entrepreneurial spirit in partnership with the DTI. Customers without smartphones or access to data services can now be serviced through “pakisuyo.” Pakisuyo refers to a Filipino culture of requesting another person to do a favor on one’s behalf. These services include bills payment, prepaid smartphone loading, insurance and telemedicine.

DigiFin education defined

Our strategic intent has always been aligned with Bangko Sentral ng Pilipinas Governor Benjamin Diokno’s twin goals to accelerate inclusive digital finance. These are for 50 percent of financial transactions to be done digitally, and 70 percent of adult Filipinos to be part of the formal financial system by 2023.

We can support this vision by optimizing various social media platforms. Programs include the pioneering “Pisonomics” podcast and the 20-minute regular livestream that break down complex banking concepts like interest rate, inflation, insurance and savings through fun and relatable conversation. The “#DisIsIt Buhay Diskarte” YouTube online show was able to do just that, consistently registering social media engagement rate as high as 34 percent.

Again, the proposition does not hinge on just deploying innovations. Success will depend on consumer adoption and traction on one hand, and building trust on the other. Case in point is on how an abstract image such as quick response (QR) code functions allowing financial transactions to happen. Making ambulant vendors selling “taho,” balut, squid balls, assorted nuts, or barbeque, including online and physical market sellers prefer to switch to digital payments is one huge success indicator.

Purposive ‘ubergrowth’

Taking off from the learnings of 2020, this 2021 will mean heightened collaboration, alternative social interactions and access to pervasive information. Open finance or interoperability will drive the industry forward and further empower customers. Among the many initiatives toward this direction is the inclusion of RCBC in the API Exchange of the Asean Financial Innovation Network in recognition of the wide array of digital innovations that the bank undertook in 2020.

The digital arena is a data-driven world. It is precise, rigid and always demands accuracy. But behind the hard data, the cold numbers, are the people who breathe life into them. Striking a balance between the evolution of technology and the customer’s personal journey is key. Because the people are the bloodstream that pumps energy to digital and the purpose behind all the efforts. They are the essence of technology. The heart of banking.—CONTRIBUTED INQ

The author is the executive vice president and chief innovation and inclusion officer of RCBC and concurrently the chief digital transformation advisor for Yuchengco Group of Companies. He is also the founding chair of the FinTech Alliance.ph.