An exposé on online investment scams, tricking Filipinos by using names of public officials and celebrities

With the prolonged pandemic putting many Filipinos in challenging financial conditions, a noticeable rise in fraudulent investment schemes appears to have sprouted out of an intention to take advantage of the unfortunate situations of many.

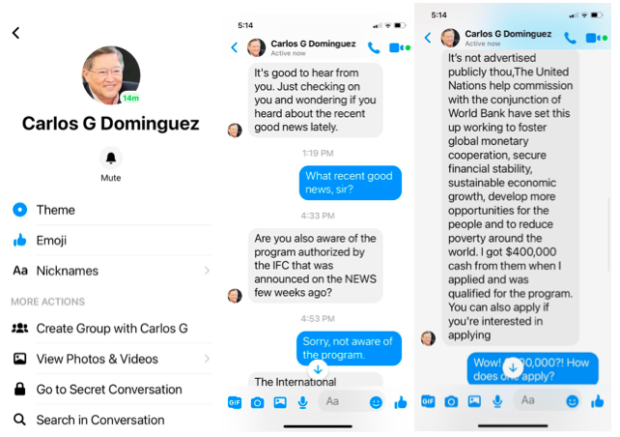

These scammers’ methods include posting fake ads on social media, claiming that known government officials or celebrities promote the use of their unauthorized and unregistered platforms. Others use pyramid schemes that ask new investors for their money and use it to provide returns for earlier investors. This then leads to a vicious chain of victims trying to lure others into the same scheme just to earn a bit of money. With such schemes rising in number, the government has decided to increase its involvement in helping Filipinos keep their personal finances safe.

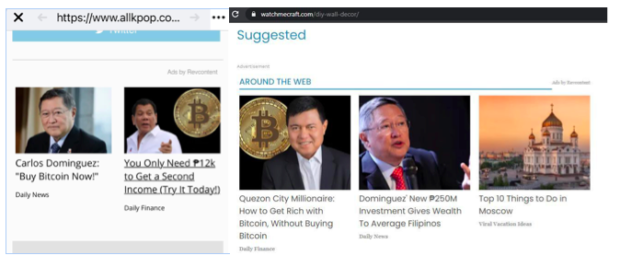

Firstly, the Department of Finance (DOF) was quick to clarify that the government was in no way involved with the fraudulent investment schemes claiming to have the approval of known government officials. These ads falsely cited the likes of Secretary of Finance Carlos Dominguez III, and even President Rodrigo Duterte himself.

Article continues after this advertisementOne unlicensed and unregistered investment platform known for using such methods goes by the name “Bitcoin Revolution”. Along with fake claims of inexistent endorsements from government officials, the site also falsely promises returns of up to $1,000 in one day for just a minimum investment of $250. Thus, government agencies have issued warnings against investment offers that ultimately just sound way too good to be true.

Article continues after this advertisementAnother fraudulent investment platform that implored similar methods operates under the name “Bitcoin Lifestyle”. The fake ads of this unregistered platform went to falsely claim that President Rodrigo himself “is urging all citizens of the Philippines to learn about Bitcoin Lifestyle quickly to get involved.”

Along with denying all these claims, the government, through the Securities and Exchange Commission (SEC), exposed over 30 fraudulent schemes. These scams often deceived unsuspecting Filipinos into investing in their illegal operations with the promise of large returns in a short period.

Despite this, there are still several fraudulent investment schemes out there. To supplement their efforts, the SEC has issued public warnings to protect citizens against unlicensed entities soliciting investments from others. Public advisories may be viewed through their official advisories page.

The DOF joins the SEC in advising the public to be alert and cautious when investing their hard-earned money. Stay away from questionable investment offers and report suspicious individuals or companies to government authorities.

Safe Alternatives

Along with discouraging entry into fraudulent investments comes promoting investments into legitimate opportunities that are both safe and secure. One good example is government bonds, which are considered one of the safest places to invest. These bonds provide guaranteed returns, project the principal, and contribute to projects that help the country’s development.

The government has also made efforts to make investing in these bonds easier and more convenient. Partnerships with banks have provided online facilities where anyone can easily purchase government retail bonds. A quick visit to https://www.treasury.gov.ph/premyobonds/ will show you the latest issue of bonds. Bonds may also be purchased via mobile apps, such as Bonds.PH. Another type of government bonds include premyo bonds that provide guaranteed returns and give you chances to win prizes during quarterly draws.

While providing citizens with safe and secure bonds, the government also promotes investments in legitimate opportunities. Currently, the government seeks to pass the proposed Passive Income and Financial Intermediaries Taxation (PIFITA) act. The provisions under this act will simplify the tax regime for bonds and stocks by reducing the number of tax rates on financial transactions from 80 to 36. Investing in safe and secure opportunities will become much easier for citizens interested in investing.

Report Fake Investments

To help in the fight against fraudulent investment schemes, you may report suspicious activity to the Enforcement and Investor Protection Department of the SEC by calling their landline at (02) 8818-6337 or e-mail [email protected]

You may also report malicious messages to the NBI Anti-Fraud Division by e-maling [email protected] or calling their landline at (02) 8525-4093. You may even send a message to NBI’s official Facebook account or send a report through their website at www.nbi.gov.ph.

Other government authorities you may report related crimes to include the PNP Anti-Crime Group (PNP-ACG). You may call their landline at (02) 9723-0401 local 5313 or visit their website at www.pncpacg.ph.

Under the Securities Regulation Code, those who act as salesmen, brokers, dealers, or agents of fraudulent investment schemes may be held criminally liable and penalized with a maximum fine of P5 million or imprisonment of 21 years, or both.

For more information follow DOF: Website | Facebook | Twitter | Instagram | Viber