“Although operators’ capex will decline marginally, it will remain high at about 22 percent of revenue on average in 2021, well above the United States and European telcos’ ratios. But most companies should be able to fund their spending largely with internal cash,” Dhruv said.

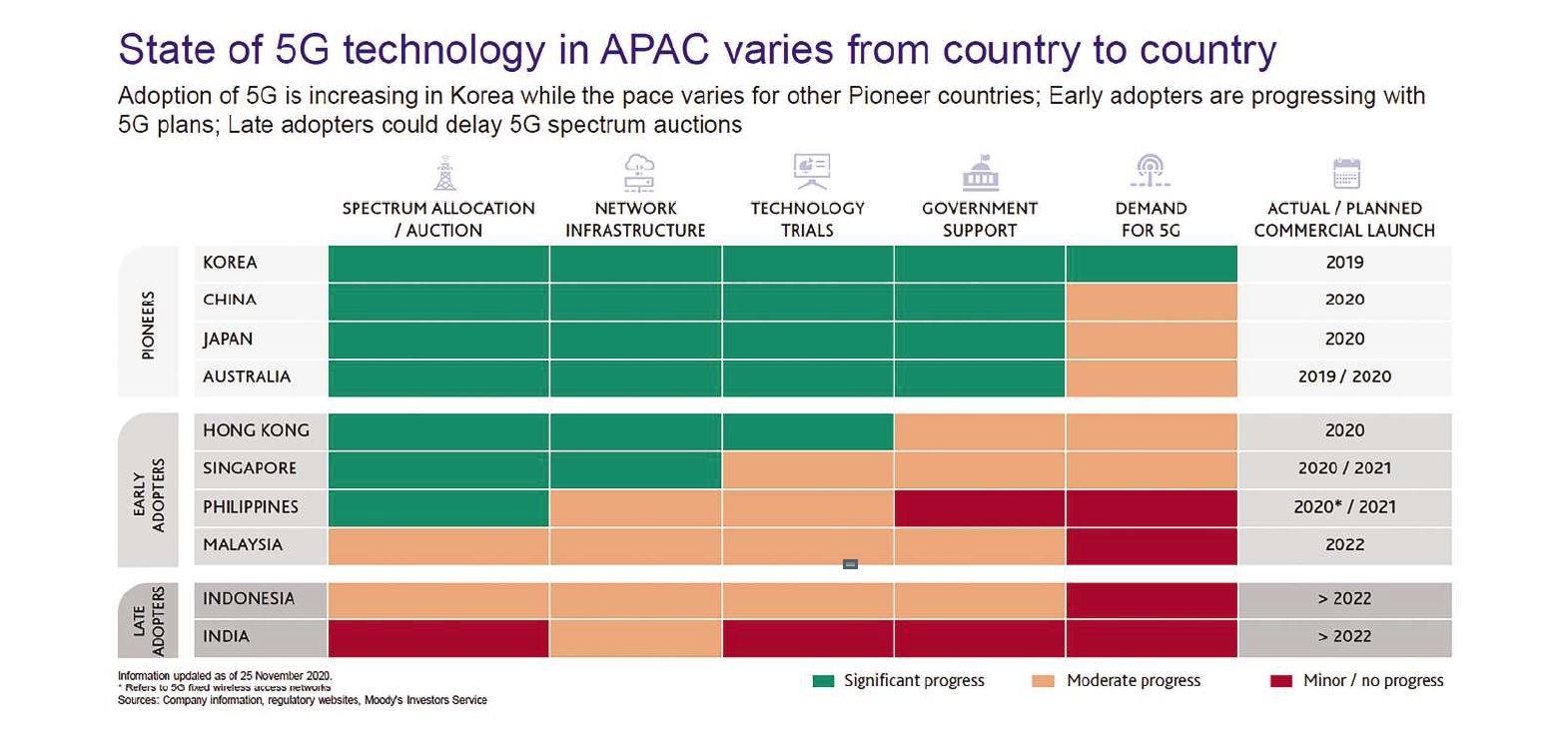

Lastly, free cash flow will remain negative but some reduction in shareholder returns will lead to gradual improvement. Meanwhile, the adoption of 5G technology varies across the region, with Korea leading pack followed by China, Japan and Australia.

Moody’s rates 18 telecommunications service providers in Asia-Pacific. Moody’s outlook for the APAC telecommunications sector reflects its expectations for fundamental business conditions for this sector over the next 12to 18 months, and does not reflect its outlook for individual issuers.

The report is part of Moody’s 2021 Outlooks, which can be accessed on Moody’s dedicated outlooks page: https://www.moodys.com/newsandevents/topics/2021-Outlooks-007058

Subscribers can access the report “Telecommunications – Asia Pacific: 2021 Outlook” at: https:// www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1248670