From bright to bleak to hopeful

“Outlook remains cautiously bullish, prospects continue to be bright, while most economic indicators point to a sustained, robust growth for the local real estate industry.”

This was how the future of Philippine real estate had looked like in January this year—back when no one had even the slightest idea of how the COVID-19 pandemic would turn out to be one of the most challenging crises faced by humanity in modern history.

Sharply underestimated, the severity of the new coronavirus was staggering and devastating to say the least—bringing the whole world to its knees, stirring uncertainties and confusion, overwhelming healthcare systems, and fundamentally disrupting every known aspect of people’s lives, of businesses, of economies and of governments.

From bright to bleak in a matter of months, the outlook for Philippine real estate became uncertain as the pandemic and the lockdowns halted many businesses, restricted travel and other activities, and forced work stoppages, some of which eventually led to permanent closures. Some property segments like hotels and resorts bore the harsh brunt of the pandemic, while others saw tempered activity—that is, slower to no demand and softer prices, as expected during a crisis.

Amid all the drastic changes and the lessons learned, real estate stakeholders and experts are finally seeing green shoots of recovery—hopeful for an opportunity to bounce back as early as next year. Inquirer Property polled industry experts who shared their insights and forecasts, as well as their most important takeaways from this pandemic.

A VIABLE INVESTMENT AMID THE PANDEMIC

Joey Roi Bondoc

Colliers International Philippines

Occupiers meanwhile should accelerate the adoption of modern technology and consider implementing a flex-and-core strategy or a mix of traditional and flexible workspaces. Colliers believes that remote work provides an opportunity for tenants to re-examine office space demand. We further see tenants exploring short term lease renewals during this period of uncertainty, complementing traditional offices with remote work models.

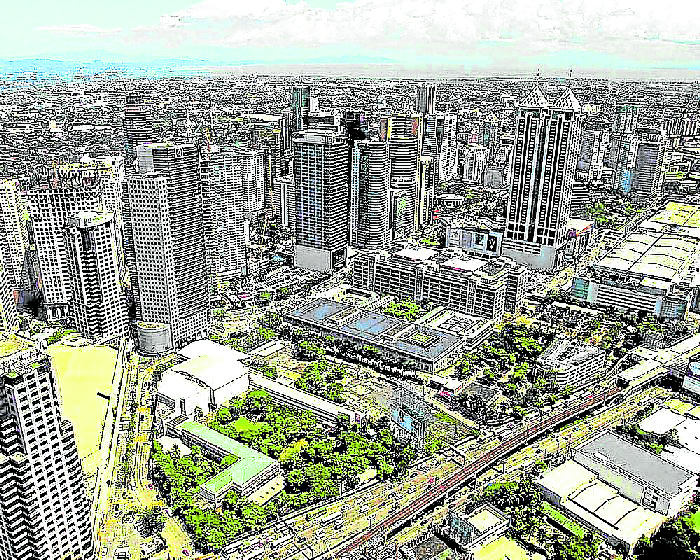

Stable demand

For the residential segment, Colliers Philippines has observed a sustained demand for pre-selling condominium projects in Metro Manila. The number of units sold (25,000) in the first nine months of 2020 outpaced total launches (16,000) during the period.

Overall, there is liquidity in the market and the recovery in demand should be supported by low mortgage rates and attractive, extended payment terms.

During this period, developers should highlight property management measures; explore creative leasing models particularly those that have substantial supply of Ready-for-Occupancy units; and highlight integrated features as the pandemic emphasized the need to be in a community where residents can easily access essential goods and services. Developers should also highlight projects outside Metro Manila amid steady demand for house-and-lot and lot-only projects in Pampanga, Cavite, Laguna, and Batangas.

Innovations

In retail, it is crucial that retailers and mall operators innovate, otherwise they will evaporate. The pandemic has caused a significant interruption to the long run of growth of the Philippines’ consumer-driven economy, severely affecting mall operators and retailers.

Mall operators should monitor changes in households’ spending patterns, repurpose vacant mall space into flexible workspaces, and continue providing concession to struggling tenants. Some have introduced curbside pickups while others have rolled out personal shopper services to reduce the risk of transmitting the COVID 19.

Retailers, on the other hand, should aggressively differentiate by tapping technological advantages and pursuing omni-channel strategies. Swedish furniture giant Ikea recently announced that they will likely open their online store months before the completion of their physical store in the Bay Area. Merrymart is pioneering the dark grocery store concept that intends to provide a 15-minute delivery service in selected cities in Metro Manila.

Alternative models

The hotel segment meanwhile continues to suffer from the sluggish impacts of the global pandemic and imposition of travel restrictions. But Colliers believes that now is an opportune time for operators to ramp up use of technology in providing innovative services.

Hotel operators could consider other leasing models and repurpose their facilities into co living facilities and flexible workspaces. They should also continue utilizing technology to enhance customer experience and customize accommodation offers, while highlighting compliance with health and safety protocols.

For the industrial segment, Colliers believes that manufacturers of essential items such as food, medical, and other household products are likely to lead industrial space take up in 2020 and 2021. This should offset a subdued absorption from electronics manufacturers due to the economic slowdown.

Forecasts, growth prospects

Colliers believes that office leasing recovery will primarily hinge on recovery of general business sentiment which should entice local businesses to reopen; and recovery of global economies that outsource services from the Philippines. In our opinion, key segments such as telecommunications, medical coding, health information management, and e-commerce should help lift leasing and hence, rental growth recovery in the second half of the year.

Viable investment

Due to the pandemic, we now project the delivery of 6,000 residential condo units in 2020. This is a significant drop from our estimate of 14,720 new units prior to the pandemic. Take-up in the secondary market remains subdued due to a slowdown in demand from foreign employees including those from the POGO sector.

By the end of 2020, we see prices in the secondary market declining by 13 percent while rents are likely to drop by 7.7 percent. From 2021 to 2022, we expect rents and prices to post an annual average growth of 2.5 percent and 2.1 percent, respectively. Despite our projected drop in prices in 2020, Colliers believes that property remains a viable investment despite the pandemic.

Consumer confidence

Starting 2021, Colliers believes that the pace of construction of new malls will likely hinge on the improvement of Filipino households’ consumer confidence and purchasing power; and the retailers’ propensity to continue taking up physical mall space despite the growing popularity of online shopping.

Consumer demand is unlikely to recover for the remainder of 2020. The fourth quarter is traditionally a strong period for retail spending in the Philippines but slower remittance inflows from overseas Filipinos, rising unemployment, decreased disbursement of employees’ holiday bonuses, and a generally bleak consumer sentiment based on the central bank’s latest survey indicate that retail spending is likely to languish by the end of 2020, which may even persist into first half of 2021.

No significant improvements

Hotels are likely to depend mostly on Filipinos being repatriated, as well as professionals within business districts on long term stay including those employed by outsourcing firms. We do not a see a significant improvement in hotel occupancy for the remainder of 2020 until the end of 2021. Colliers expects average daily rates to drop by 30 percent in 2020 due to lower occupancy. We do not see a pick up in ADR over the next 18 to 24 months as the leisure sector continues to suffer from the global economic crunch and limited spending of local tourists.

Stable rates

We expect both land leasehold and lease rates for warehouses to be stable for the remainder of 2020. Colliers projects a rebound starting 2021 as previously committed investments materialize and absorb space and global and domestic demand recover. As we expect e-commerce and deliveries to continue to thrive, Colliers sees warehouse lease rates growing by a faster 4.8% annually from 2021 to 2022 compared to the 4.6% per annum growth we project for land leasehold.

OF RECOVERY AND GROWTH AREAS

Janlo delos Reyes

JLL Philippines

The accelerated and wider technology adoption is one of the key trends from the pandemic which we anticipate to remain relevant under the next normal.

Organizations had to fast track and/or launch their tech initiatives and platforms to keep afloat and remain relevant under this challenging environment. Meanwhile, individuals across demographic are more open in the use of technology in their daily lives. Altogether, this increased technology adoption by companies and households has changed how we live and work, and we expect that technology will likely continue reshaping these domains moving forward.

L-shaped recovery

We still retain our view of an L-shaped recovery between 18 and 24 months—of course, contingent on developments in the next coming months.

The main element to the recovery is regained business and consumer confidence that would drive economic activity. And vaccine remains key to this regained confidence and, depending on how soon this is rolled out, would influence the window of recovery.

Currently, logistics continue to be a bright spot across the globe, while data centers, life sciences, and multi-family dwellings are gaining traction in other markets. We also anticipate tech and security companies to grow as we expect greater online activity moving forward.

2021 forecast

With the current landscape, we maintain our forecast of a subdued real estate market in early 2021 with recovery beginning middle to late next year. We can expect market practices that were adopted under the pandemic—such as focus on safety and well-being, technology adoption and digitalization, and flexible work arrangements—to become part of the norm.

Lastly, logistics, data centers, tech and security companies, as well as the real estate investment trust (REIT) market are the potential growth areas for the real estate industry.

TWIN GROWTH OF REAL ESTATE, TECHNOLOGY

Claro dG. Cordero Jr.

Cushman and Wakefield Philippines

The most important lesson that we think will be most useful in the post-pandemic era is centered around the ability of the real estate players to capture the gains brought about by the twin growth of technology and real estate.

Prior to the pandemic and the lockdown, the digital revolution showed how the various real estate industry processes and practices will benefit from the use of new technologies for more efficient conduct of business. Real estate players and sectors that adopted these technological innovations, such as Big Data analytics and artificial intelligence, have the unique advantage to transition into the new normal seamlessly.

Diversified portfolio

The investors and the developers who have diversified its offerings and portfolio are also most prepared to move into the post-pandemic era.

The pandemic has shown that players must expand into sectors that show high investment return potential even during economic recession. Investors and developers who are well-diversified have exposure in various development offerings—a balanced portfolio on traditional segments (office, residential, retail, hotel and industrial) and up-and-coming sectors such as infrastructure, healthcare, automation and research and development.

During the pandemic, the flexibility of the asset to be repurposed has also been highlighted. Future developments should thus have the flexibility to be converted into other profitable uses.

Development densities of office spaces and residential condominium units should likewise be carefully assessed. Future pandemic episodes should be better addressed despite high development densities and crowding in existing developments. The amenities and facilities as well as urban design of future developments should promote physical and mental well-being.

The Nuvali estate in Sta. Rosa offers commercial lots with easy access to outdoor activity venues and retail centers.

Return to growth trajectory

We can expect a recovery in real estate, as soon as consumer and investor confidence return. Consumer confidence will aid in the recovery of the retail and hospitality sub-sectors and further strengthen the growth of the industrial/logistics sub-sector. Investor confidence will further boost the office and residential sub-sectors.

One of biggest drivers will still be the office sub-sector due to the expected growth of the outsourcing business which, in turn, should be supported with the following: more stable connectivity and stringent online security measures, which will allow flexible work arrangements for the workers; and appropriate, predictable business incentives for outsourcing companies.

However, the return to growth trajectory of both consumer and investor confidence does not rest solely on the mass production of the vaccine against the COVID-19 virus. Equally important is the choice of policies and proper economic stimulus that will support this recovery.

PH real estate in 2021

Digitization remain a must among key real estate stakeholders and we predict the industry will be quick to adopt these practices. Real estate services such as leasing management, property/building management, valuation and analytics, space planning and AI-enhanced virtual viewings for clients, among others, are rapidly transitioning to technology-driven processes.

What will also emerge in the future is an office that is more tailored to the work that corporations do. This will mean that certain functions will still be centralized, but many other functions will be established as fit for function – client interfacing, touch down, collaboration.

As corporations embark on this journey, the key drivers of real estate remain—location, logistics and cost. But what will soon have a greater say is the environment that corporations create. If people are not going to the office as frequently, they want the experience to be more impactive than just functional. This will see companies focus on a new set of drivers including well-being, intelligent building management, safety management and of course, amenities.

Growth contributors

Other segments that will contribute to the growth are those related to logistics, data centers, health-related sciences, essential retail.

Logistics and data centre assets are more resilient due to the surge in e-commerce and remote working. These assets could be suitable for investors who are more risk-averse and desire income resilience. Investors with long investment horizon should re-examine their portfolio and take this window of opportunity to review, re-strategise and prepare for the upturn.

With the COVID-19 pandemic pushing the local and global economy into recession after a decade-long period of economic growth, this is the perfect opportunity for investors to seek out assets with repricing potential.

Also, the success of the initial REIT offering by Ayala Land, Inc. is expected to be replicated by other developers. To date, there are currently more than 2 million sqm of prime and grade A office developments that can potentially be included in the REIT pool.

IF YOU BUILD, THEY WILL NOT COME

Prof. Enrique Soriano

Wong + Bernstein Advisory Group

Positive territory

Real estate activities are back and we can expect that in two to three quarters, the pendulum will swing back to positive territory. Admittedly, the effects of the lockdown are sharp and severe and the coronavirus pandemic has exposed chinks in the armor of property players.

Executives have realized their mistakes and have returned to their war rooms to search for opportunities and to institute changes that will allow their companies to navigate through this Black Swan event and position them for long-term success.

After exchanging notes with developers and senior property executives over the last three months, it is clear that the sector has endured the initial impact. But unless organizations change, overcoming this extraordinary event will be a long uphill climb. After decades of resisting change and innovations, the industry is now encountering a situation that makes it impossible not to change.

As the country reopens and slowly pivots to some form of normalcy, developers must act now to address longstanding priorities. The following lessons are worth sharing.

Digital transformation

The pandemic is a wake-up call. Regardless of your role in the ecosystem, you will need data. It is an end to end process, from understanding homebuyers, digitizing sales, to converting inquiries into happy, engaged homebuyers and tenants. Thanks to the pandemic, what took years for your chief information officer to roll out, COVID-19 did in one quarter.

If you build they will not come anymore

To thrive in the post pandemic era, developers must re-imagine and embrace a combination of innovation, better GPM and EBIT, solid cost management, focus on technology, aspiring for sustainability ratings, people centric programs and leveraging on brand power while pursuing scalability. These are critical variables that developers must integrate in their business model in 2021. Organizations are at a crossroads—they either innovate or they die.

Human-centric business model

Fundamentally, the sector is about building four walls, selling, re-selling or renting them. But the lockdown in March changed the way we regard our homes, as well as our behavior—on how we work, live, play and shop. Moving ahead, we can expect a dramatic shift towards a human centric developmental model. The key is to engage buyers and occupiers, deep dive into their expectations, and anticipate future homebuyer needs.

Industry stakeholders believe that real estate activities are back, and that in two to three quarters, the pendulum will swing back to positive territory.

Strategy for breakfast, innovation for lunch, transformation for dinner

Balancing productivity and making sure the workforce is safe are important. While we are still in a pandemic mode, developers must now direct their attention towards people policies and the desire to change a culture of complacency. Performance management systems, strategies, work tools will never stand a chance against a bad culture.

Now is the best time to invest in people and organizational culture building while the property market is slowly recovering. A bad culture is a giant strategy and innovation killer. The key takeaway in transforming a culture of mediocrity to productivity and excellence is investing in the right people with a shared vision.

Proactive government

The mindset that the state as a mere regulator must change. It must transform and be attuned to the expectations of a battered global economy. In advanced economies, the role of government is changing and expanding. Authentic collaboration will be key between the public, housing agencies and developer associations. It is time for our housing leaders to walk their talk.

AN ERA OF FLEXIBILITY, CHANGE

Fred Rara

KMC Savills

Organizations are quickly pivoting to new directions in anticipation of the new normal—even when it is against the regular flow of the market. In the retail sector, we have seen shopping malls trying to cope by either changing their tenant mix or adopting an omni-channel approach.

Flexible and asset-light operations aren’t new business concepts, but the pandemic clearly reminded us how the landscape is constantly and quickly changing.

Recovery triggers

We would want to see improvements in the health situation to assure a resilient and lasting economic recovery. In addition, we should also look at the recovery of advanced economies in North America and Europe to see how business process outsourcing (BPO) revenues and overseas Filipino workers’ remittances will fare in 2021.

It is hard to say how real estate will perform next year, but the economic backdrop in the coming quarters will define its growth in the years to come.

Logistics requirements fueled by e-commerce activity is likely to perform well. Horizontal residential developments are also a good bet if we see more permanent work-from-home arrangements. On office tenants, BPOs in the healthcare industry are meanwhile expected to expand during this time.

Given our current state and the rate of our health response, we may expect deeper and more permanent structural changes in the market such as work-from-home arrangements, telecommuting, shorter workweeks, among others. If the pandemic changes our behavior in occupying or using space, we should expect this to ripple through the real estate market.

In this scenario, the numbers may not be pretty in the coming quarters, but it will be an era of change for all economic stakeholders. Those who are flexible and quick to pivot will be the biggest winners in this era.