DOE says Udenna deal in Malampaya shares a ‘voidable contract’

Malampaya natural gas plant. Source: https://malampaya.com/

MANILA, Philippines — The Department of Energy (DOE) said during Tuesday’s hearing at the Senate that the Chevron-Udenna deal approved in March concerning the 45-percent stake in the Malampaya shares is a “voidable contract.”

Energy Assistant Secretary Leonido J. Pulido III bared that the parties concur that the Chevron-Udenna deal sealed in March 11, 2020 could still be voided if it would not be approved by the DOE.

The 45-percent stake of businessman Dennis Uy’s UC Malampaya LLC is worth $565 million.

Pulido also stressed the sale is voidable in response to Senator Imee Marcos’ query if it is an “incomplete sale.”

This means that the divestment of the 45-percent Chevron equity in Malampaya could still fail without government approval.

Undersecretary Donato D. Marcos said the DOE is still evaluating the Chevron-Udenna sale as well as the financial and technical capability of the Uy-led firm to be in gas field operations.

Udenna and Chevron had claimed they are not covered by Section 11 of Presidential Decree (PD) 87, or that stature requiring DOE approval on their transaction.

Pulido reinforced this by saying the parties are bound by the joint operating agreement (JOA), which requires the concurrence of the consortium-members to the sale namely the Shell Philippines Exploration B.V. (SPEX) and Philippine National Oil Company-Exploration Corporation (PNOC-EC).

The Philippine Competition Commission (PCC) has also given its nod to the transaction. Udenna Malampaya LLC also told the Senate that loans for the transaction were acquired from the Australia New Zealand (ANZ) Banking Group and the ING Bank.

However, Senate Committee on Energy Chairman Sherwin T. Gatchalian argued that the Udenna-Chevron transaction is already a done-deal, “and DOE is now just a footnote. DOE is just a probably a footnote, trying to complete the transaction. I don’t agree that there’s no violation.”

Gatchalian stressed there was a violation in the sale and purchase agreement (SPA) as it had no prior approval from the DOE.

Pulido insisted though that without the DOE’s approval, the sale is not considered final and concluded.

Senator Panfilo Lacson similarly asked the DOE officials if state-run PNOC can exercise its right to acquire Chevron’s stake in Malampaya in case the sale with Udenna would fail and if they will end up in a legal challenge that may reach even the Supreme Court.

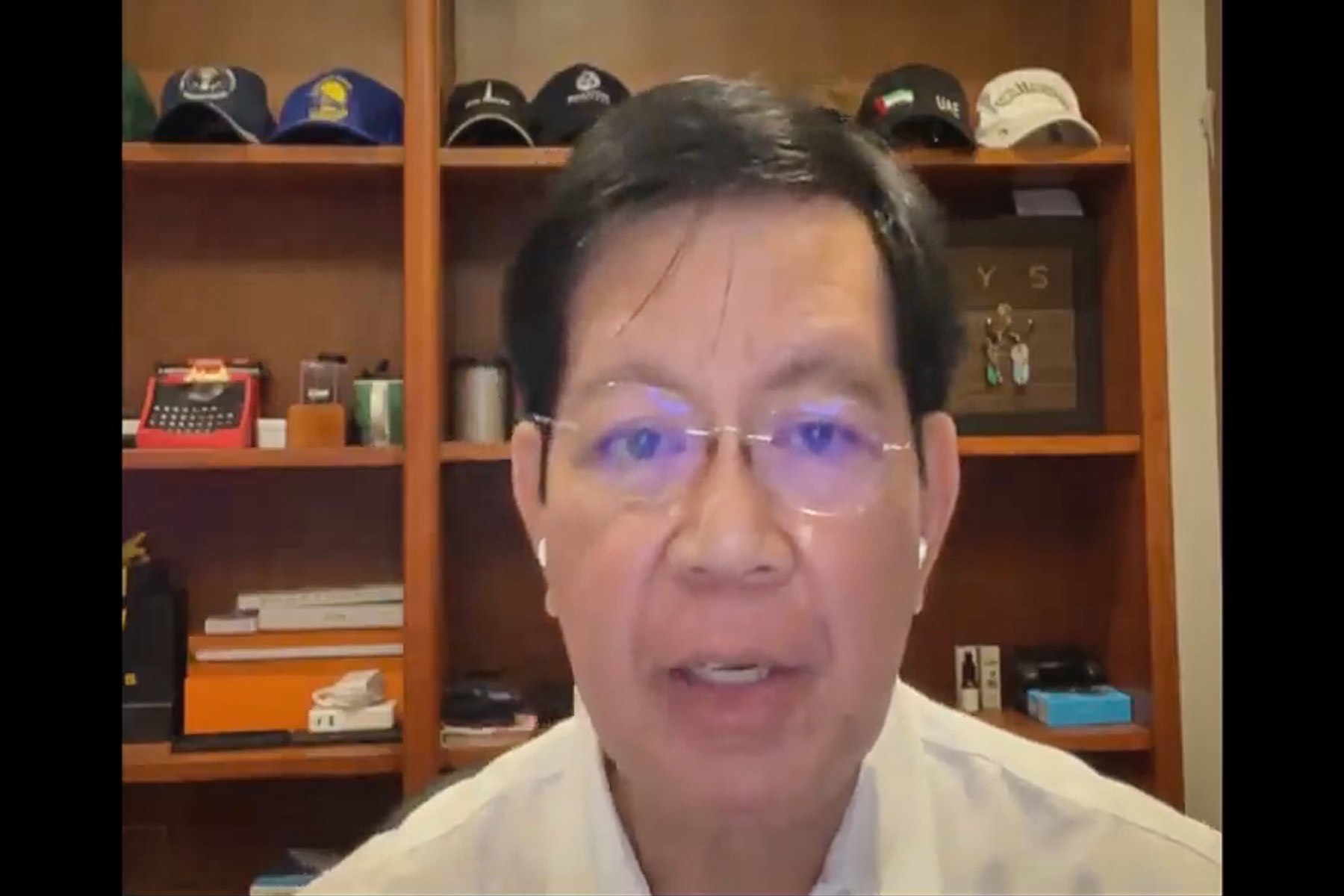

CAN PNOC TAKE OVER MALAMPAYA GAS PROJECT?: Sen. Panfilo Lacson asks the Philippine National Oil Company- Exploration Corp. (PNOC-EC) during the Senate Committee on Energy hybrid hearing on the Malampaya Deep Water Gas-To-Power Project Tuesday, November 10, 2020, if it is capable of taking over the Malampaya natural gas project in case the Udenna Corporation’s acquisition of Chevron’s 45 percent stake in the project will not push through. PNOC-EC President and Chief Executive Officer Rozzano Briguez admitted that they currently do not have the technical and financial capability of taking over such big operation, but noted that it has been part of the corporation’s long-term plan. (Screen grab/Senate PRIB)

PNOC President Reuben S. Lista indicated that the government is currently studying the possibility of increasing its stake in Malampaya – and this is done along with its subsidiary, PNOC-Exploration Corporation, which currently holds the 10-percent minority stake in the Malampaya project.

Nevertheless, PNOC-EC President and CEO Rozzano D. Briguez noted that their company may not be ready to take over gas field operations as large as that of Malampaya’s scale.

He said the company does not have extensive experience yet in deep water gas field operations; and what they had was just on smaller scale onshore gas field venture through the San Antonio gas field in the past.

“Technically and financially, we are not yet ready to take over such magnitude of operations,” Briguez stressed, adding that it will take 10 more years for them to gain that experience and they must have actual involvement on at least two large scale gas field projects first, including their planned foray into Service Contract 57 in Northwest Palawan if that will eventually end up to be a commercial scale discovery.