Demand for upscale, luxury condominium holds firm despite the pandemic

Colliers Philippines presented its third quarter property market updates on Oct. 29. Close to 500 investors, equity analysts and representatives of property developers dialed in during our webinar, which was followed by a briefing with reporters.

I presented the latest on office, retail and residential sectors. While the pandemic continues to hamper the local property market, we presented opportunities and recovery enablers for specific property segments beyond 2020.

Guests were particularly interested in the Metro Manila condominium market and how the economic crisis is affecting pre-selling and secondary residential markets. Are we seeing a price and rental correction? Which locations are more vulnerable to a correction? Which condominium price segments are more resilient and have the greatest potential for recovery?

Despite the pandemic, we are optimistic that the pent up demand for condominium units in Metro Manila will kick in once market conditions improve. The pace of recovery will rely on several factors, but we see economic indicators pointing to a glimmer of optimism.

Cash remittances by overseas Filipino workers (OFWs) contracted by 2.6 percent from January to August 2020, much slower than the 10 to 20 percent drop projected by some economic analysts.

Aside from the government-projected rebound of remittances in 2021, other potential recovery enablers include low mortgage rates (at 7.4 percent as of the third quarter of 2020 from the 21 percent recorded during the Asian Financial Crisis); a potential rebound in office leasing in 2021; and a likely pick up in demand from local and foreign end-users and investors as global economies start to recover and more local businesses reopen.

Article continues after this advertisementStable residential segment amid the pandemic

A stable sector during the period are the upscale and luxury markets. Under these segments, condominium units are priced between P6 million and P20 million while the ultra-luxury projects are those priced upwards of P20 million a unit.

Article continues after this advertisementDuring my webinars, I emphasize the fact that previous crises have affected demand for residential projects in Metro Manila. But as historical data would show, the upscale and luxury condominium segments are among the more resilient sectors, exhibiting stability amid financial crises and showing signs of immediate recovery after an economic slowdown.

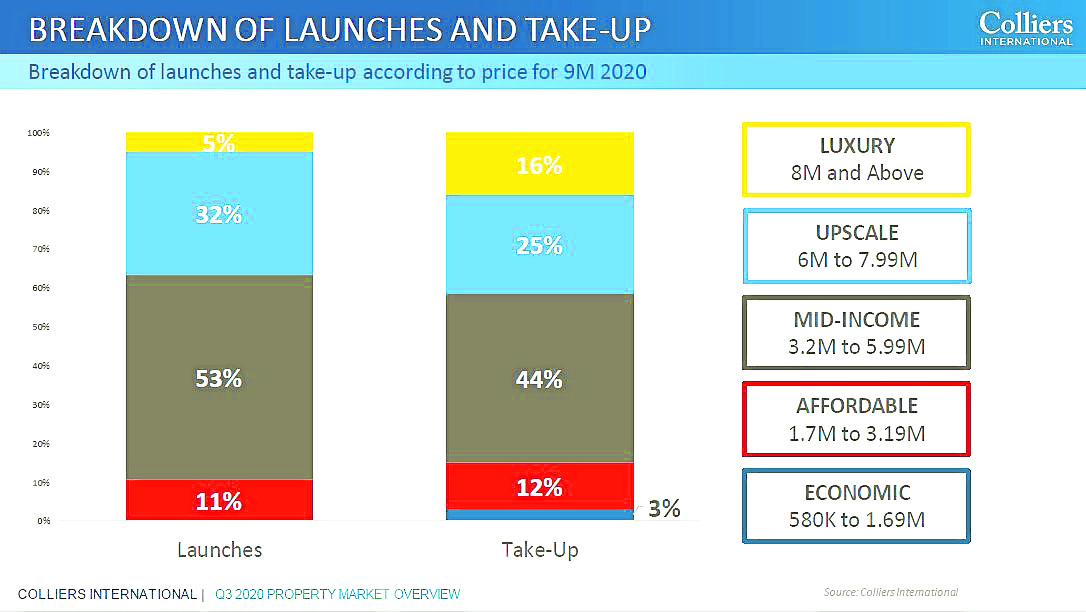

Despite the pandemic and lockdowns which resulted in an economic slowdown, the upscale and luxury condominium markets showed resilience in the first nine months of 2020. Of the total launches in the Metro Manila market from January to September, the upscale, luxury and ultra-luxury segments accounted for 37 percent. Despite this, the sector covered 41 percent of total sales in the pre-selling market during the period.

Over the past two years, the upscale and luxury segments accounted for 26 percent of the total pre-selling take up in Metro Manila, next to the mid-income segment which covered 42 percent of total demand.

We can also attribute the resilience of the upscale and luxury residential segments to the steady demand for residential units even in the middle of a global economic meltdown.

Upscale and luxury residential projects in Metro Manila have recorded a steady rise in prices after the Asian and global financial crises. Over the past five years, prices of these units in major business districts rose by about 10 to 18 percent a year, even outpacing the average price growth of condominium prices in Metro Manila during the period. Colliers Philippines data show that the upscale and luxury pre-selling projects in Metro Manila that are likely to be completed in the next six to 24 months have sold an estimated 91 percent of their inventory as of the third quarter.

Discerning preferences of investors

Given the prices of projects in the upscale and luxury condominium markets, Colliers believes that buyers will be more discerning moving forward.

In our opinion, investors are likely to look for innovative amenities and facilities, connectivity to masterplanned communities that offer open spaces, health facilities and services, new office buildings, and a high level of concierge services. Several projects that are being marketed to the luxury and ultra-luxury markets have even partnered with prominent personalities and brands. These features should ensure that these higher-priced units will continue to stand out in Metro Manila and hence sustain demand in the market.

In a survey conducted by Colliers Philippines during our property briefing on July 30, about 37 percent of respondents said they prefer condominium units in an integrated community while 16 percent are likely to invest in residential projects that implement strict health and safety protocols. Interestingly, some 38 percent consider discounts and flexible payment terms as a major factor.

And this is a reason why developers should continue to offer flexible payment terms and attractive packages to potential condominium buyers in Metro Manila. In our view, these payment schemes should be implemented even for higher-priced condominium projects including upscale and luxury units.

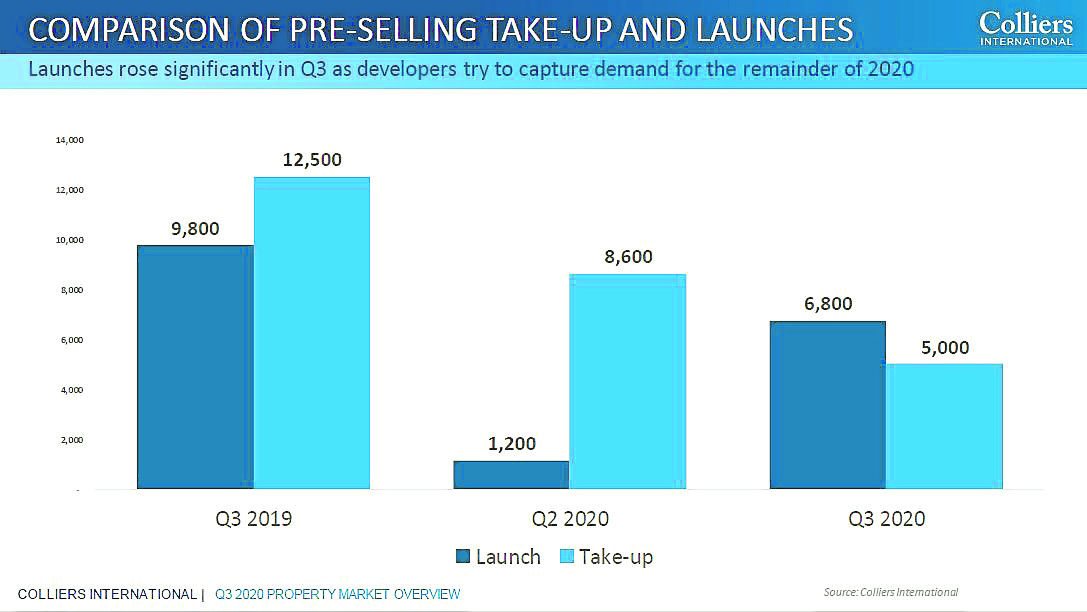

Colliers encourages developers to continue extending attractive payment terms to potential clients to prop up demand for the remainder of 2020. In our opinion, this should support the prevailing low interest rates in the market.

Recommendations for investors

Colliers Philippines believes that condominium demand should remain strong as Metro Manila continues to have one of the most attractive rental yields in the region; relatively low prices, compared to similar developments in the region); and sustained demand from affluent Filipinos as well as local and foreign investors.

Prior to the pandemic, the shift in lifestyle further encouraged high-end buyers from posh villages to embrace condominium living.

Aside from providing tight, round-the-clock security, these developments also offer well-equipped gyms, resort-like pools, ample parking spaces and quality interiors, among others. Most high-end projects are also near major shopping hubs in the metro. This is important as consumers need to have immediate access to basic needs such as food and beverage and medical supplies.

More affluent locals are seeing luxury condominium projects as a viable investment option aside from the stock market. Investors have been looking at rental prospects immediately after the turnover of units, as well as the potential for price appreciation.

The potential for price increase should be complemented by the country’s strong macroeconomic fundamentals and the prospects of recovery in the office leasing market in both established and non-core locations across the capital region.

And as I highlighted in my previous columns, investors and developers should consider the infrastructure projects within Metro Manila due to be completed from December 2020 to early 2021 such as Skyway 3 and the BGC-Ortigas link bridge. In our view the maintenance of the MRT 3 should also help stoke demand for condominium units near train stations.