RiteMed webinar gives financial advice to teachers

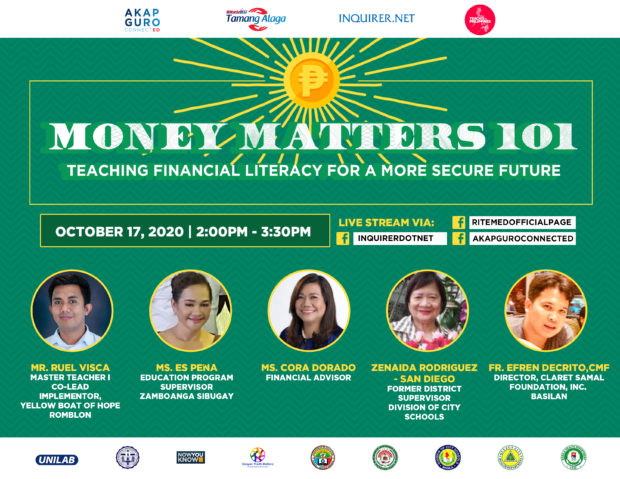

RiteMed, the country’s leading unibranded line of medicines, in partnership with INQUIRER.net and AKAP Guro CONNECTed, mounted a webinar dubbed as “Money Matters 101: Financial Literacy for a More Secure Future” to discuss practical management of financial matters, particularly for the education sector. As part of RiteMed’s Tamang Alaga program, the webinar tackled the challenges confronting teachers in the financial front and the opportunities available to them to overcome those.

“If the government has a disaster reduction management plan and companies have business continuity plan, individual Filipinos should have financial preparedness plan to cushion ourselves during uncertainties and unexpected events,” said Cora Dorado, a financial advisor and the speaker of the webinar.

Financial planning is the process of managing one’s financial resources to achieve long-term goals while living a desired lifestyle. It is accompanied by strategies and sets of activities. It basically means earning more income and spending less money by managing cash flow, getting out of debts, and living within our means.

The teachers who were part of the webinar admitted that their salaries were barely or just enough to cover their basic necessities and that of their families. Thus, they look for ways to augment their income and to prepare for their future. Dr. Es Pena, Education Program and lead implementor of Yellow Dorm of Hope in Zamboanga, Sibugay, who is a mother of five said she, like other teachers, sell various merchandise after their classes to earn additional income.

It was the same for Zenaida Rodriguez-San Diego, when she was still a teacher. San Diego is currently the head of Quezon City Retired Teachers’ Association, Inc., and President of Senior Citizen of Brgy. Nagkaisang Nayon-Damong Maliit Chapter. She shared that she took advantage of available loan packages such as that from GSIS and Pag-IBIG to sustain the needs of her family. She also made use of scholarship opportunities for her five children’s educational needs. After 43 years as a teacher, principal, and district supervisor, San Diego managed to invest her retirement money.

“I paid all my outstanding loans from GSIS before I claimed my retirement funds, which I put in time deposit and invested on insurance. My advice to teachers? Iwasan ang pangungutang (avoid borrowing money) especially on credit cards, it is stressful,” said San Diego.

Debt per se, according to Dorado, is not bad. “There is good and bad debt. A debt only becomes bad if it’s not paid on time. Just pay on time”. Getting into the saving habit is of course the best way to improve cash flow. It is possible to still be able to save and invest even with a teacher’s salary. Ideally, 20 percent of one’s salary should go into savings, but this could be adjusted depending on the situation.

She said there are various ways on how to cut down expenses such as prioritizing needs over wants, minimize or eliminate vices or luxuries, avoid “window” and online shopping, pay debts on time event in small amounts.

There is also a choice between savings and investment. Savings is basically just safekeeping while investment is growing your money to strengthen its purchasing power. “You have to make your money work for you. The secret of becoming rich is the power of compounding interest. It’s your money making more money,” said Dorado. It refers to both the interest you earn on the money you have saved or invested, and also the interest you have earned on your interest.

Dorado also advised not to get scared of exploring investment opportunities or instruments such as stocks, bonds, or even houses or lots. Everything can be customized according to people’s profiles and preferences in terms of level of risks and other factors. She said, “Huwag mahihiyang magtanong (don’t hesitate to ask questions) from a financial advisor”.

Another important fundamental in financial planning is preparing for emergencies and setting up a financial safety net or an emergency fund, which is normally three times to six times of monthly expense. An emergency fund acts as a safety net to help finance expenses in the event of emergencies so that you don’t have to use your savings or investments set aside for other purposes.

Dorado cited that within the eight months of the extended community quarantine in the country, most people would have probably used up their emergency funds, teachers included, especially those who did not get cash assistance from the government. Private school teachers in particular have appealed to the government to include them in the government aid program. Some teachers in small and newly established schools did not even get their salaries. Others were retrenched or laid off due to decrease in enrolment or school closure.

Such financial difficulties and loss of income highlight Dorado’s point in the webinar that working individuals or salaried people are the most important asset. Thus, it is important to get a life insurance and health plan, or even a critical illness plan.

“What if the income provider or the breadwinner is taken out of the picture? Who will take care of the needs of the family?” She adds that based on a survey, 95 percent of people who get sick use their savings and 53 percent borrow from family members or relatives. This demonstrates the lack of planning or protection.

It’s time to make that all-too-important first step in financial planning before it’s too late. “At the end of the day, Dorado cited, it’s not how much money you make each month. It’s how much money you save and invest each month that counts”. Money does matter.

ADVT