Amid the uncertainty brought about by the COVID-19 pandemic, taxes have lived up to the reputation of being one of two certain things in people’s lives. A few months ago, Filipino online entrepreneurs were reminded of this—to the frustration of many—when government set a July 31 deadline for the registration and tax payments of such businesses.

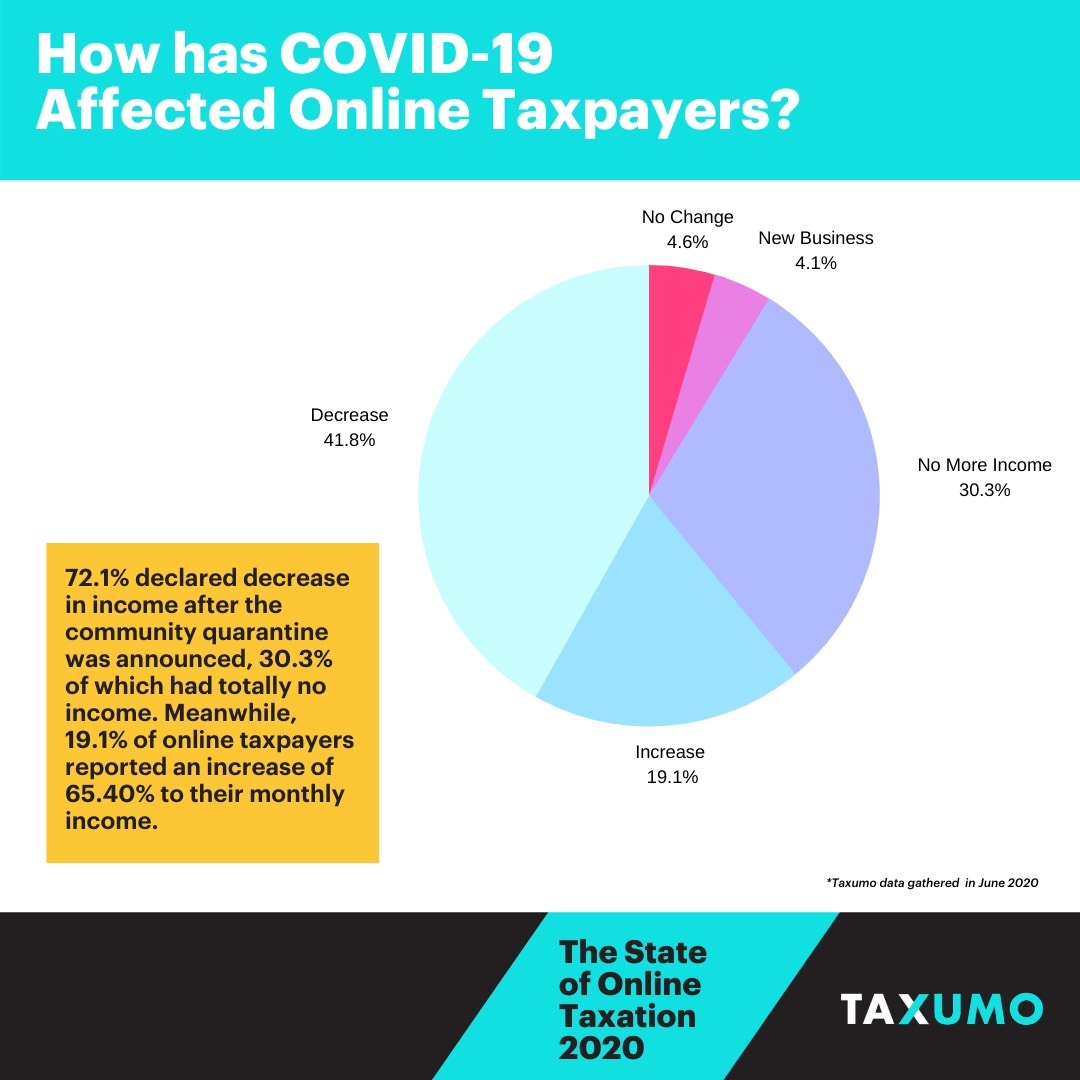

A recent study by online web-based tax filing and payment platform Taxumo, which helps small business owners, self-employed professionals, and freelancers in the Philippines conveniently prepare, file and pay their taxes, could explain the uproar: According to “The 2020 State of Online Taxation,” over 72 percent of online taxpayers “declared a decrease in income after the community quarantine was announced,” and around 30 percent said they totally lost their income, based on insights gathered by Taxumo in June.

(A smaller percentage—19 percent—however, said their income increased by almost 66 percent.)

Timely reminder

A clarification soon came after from the Bureau of Internal Revenue (BIR), explaining that online businesses earning less than P250,000 a year need not worry about paying income tax. Still, with the proliferation of online food, retail and other enterprises, the BIR, together with tax law experts, continue to remind new business owners: the taxation of online sales is covered by existing laws, and shouldn’t be misconstrued as a knee-jerk reaction to the sharp increase of such transactions.

“When we observed this, we had to, again, remind those [involved] in digital transactions of their tax obligations,” says lawyer Elenita Quimosing, BIR assistant commissioner for project management and implementation service, at the webinar “Taxes for Online Sellers” hosted by law firm DivinaLaw, referring to the recent issuance of Revenue Memorandum Circular No. 60-2020.

“It’s not a new requirement to register, [nor to] issue invoices, receipts, keeping books of accounts, filing returns and paying taxes due,” Quimosing says. “[These are all] under the Tax Code of 1997 under Title 9. As long as you are into business, whatever is your medium of marketing, you are taxable.”

Seven years ago, Revenue Memorandum Circular No. 55-2013, already “reiterate[d] taxpayers’ obligations in relation to online business transactions,” explains lawyer Lean Jeff Magsombol, senior associate at DivinaLaw.

Under that circular, the four most common business transactions are: online shopping/online retailing; online intermediary service (a third-party who acts as a merchant’s agent, or controls collections/payments of buyers, or markets products/services for its own account); online ads/classified ads; and online auction.

Tax regimes for online businesses differ based on income levels, says Quimosing.

Tax rates

As mentioned earlier, individuals whose income does not exceed P250,000, and are earning solely from their online enterprise, are not subject to income tax. However, they may be subject to business tax-percentage tax of 3 percent (instead of the 12 percent value-added tax or VAT), depending on the tax regime they choose, and there are two available, if their total income does not exceed P3 million: A flat tax rate of 8 percent on one’s gross sales/receipts in excess of P250,000; and the regular graduated income tax rate, which varies depending on one’s net taxable income.

“For those who are purely self-employed, even if you have many businesses, you only need to file one [income tax] return,” Quimosing notes.

As she illustrated, if Person A, who is purely into online business, had gross sales/receipts last year amounting to only P240,000, he or she would not be subject to income tax under the 8-percent flat rate regime (because there is no income exceeding P250,000) nor business tax-percentage tax.

However, if he or she opts to be taxed at the regular graduated income tax rate, then he or she has to pay business tax–percentage tax of P7,200 (3 percent of P240,000).

Now, if Person B—still purely into business—had gross sales/receipts from his online business last year amounting to P2.5 million (still below the P3-million limit), his or her taxable income would be P2.25 million under the 8-percent flat rate regime. Therefore, his or her income tax due would be P180,000, and the business would still not be subject to business tax-percentage tax.

On the other hand, if Person B goes for the graduated income tax rate, then net taxable income would need to be computed first—total gross sales/receipts minus cost of sales and allowable operating expenses. If the latter is at P1.7 million, then total taxable income would be P800,000, and business tax-percentage tax at P75,000 (3 percent of P2.5 million).

Side hustle

Now, if a person’s income from an online business already exceeds P3 million—and it is still his or her only source of livelihood—Quimosing says he or she is confined to just one tax regime, the graduated income tax rate, and is subject to 12 percent VAT.

Of course, many of those who have decided to go into online businesses because of the pandemic probably did so as a side hustle, most likely to augment their income as employees. In this case, Quimosing explains that these “mixed-income earners” will be taxed based on their compensation income, which is always computed using the graduated income tax rate, and also their income from their online business—which, again, will be computed based on the tax regime that individual chooses (graduated or flat rate), provided that the business’ income does not exceed P3 million.

In this scenario, Quimosing illustrates the computation income tax due as follows:

Option 1 = (Taxable compensation income + net taxable business income) x graduated rate; or

Option 2 = Taxable compensation income based on graduated rates + 8 percent income tax due on gross business sales/receipts.

However, if a mixed-income earner’s online enterprise makes more than P3 million, then the only option available to the proprietor is the graduated income tax rate.

Computations

All these computations are applicable, Quimosing emphasizes, to all online businesses, regardless of the platform they choose to sell on (online marketplace, social media, website). She does note, though, that if you are a registered brick and mortar business that decided to open an online shop, then there is no need to register the business as a separate entity.

And because online businesses are no different from those with physical stores, Magsombol also reminds such business owners to register at their respective revenue district offices. They also need to secure an Authority to Print invoices and receipts, and register their books of accounts.

Income tax returns, regardless of whether an online business is exempted from paying or not, should also still be filed diligently, says Quimosing. Otherwise, the business owner will become subject to applicable penalties under the Tax Code.

“People think going into [online] business is a different kind of animal than one with a physical space, when it’s not,” she says. “It’s the same banana.”