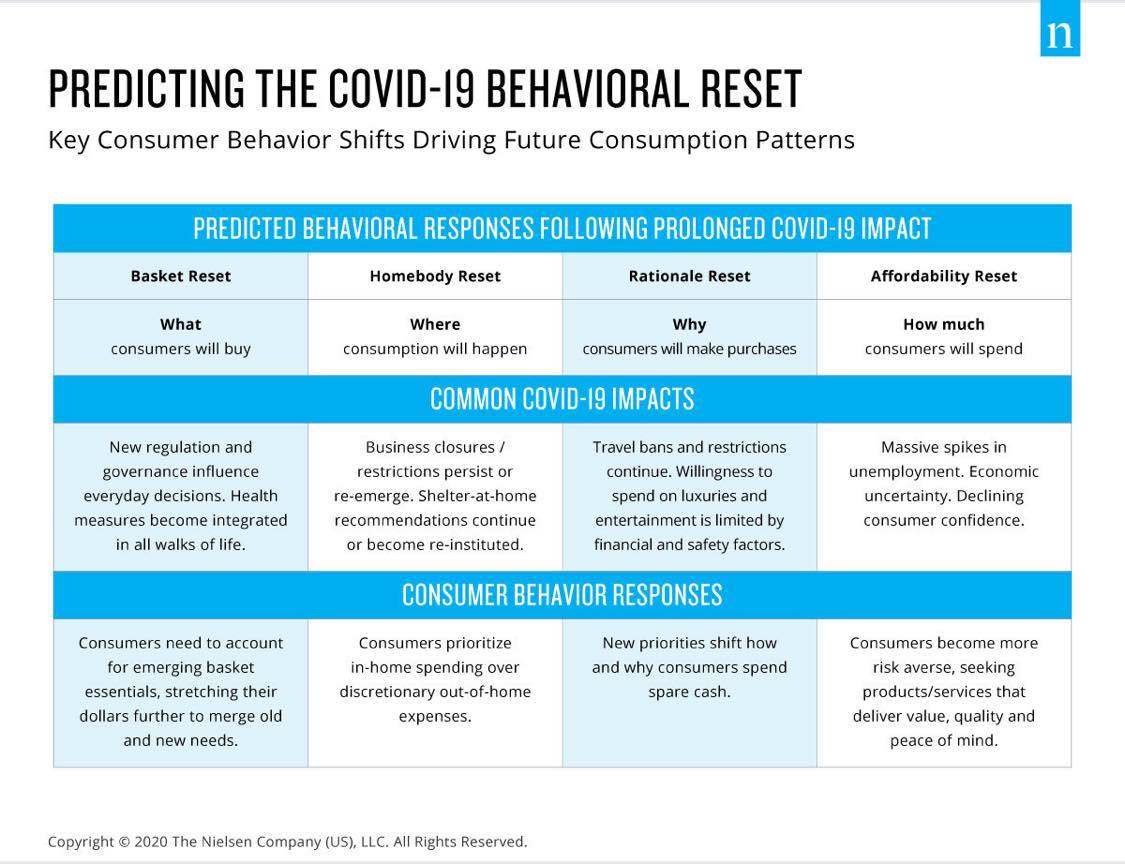

A basket reset, a homebody reset, a rationale reset and an affordability reset.

More than half a year into the pandemic, these four emerging purchasing patterns are now driving future consumption habits instead of news about COVID-19, says a report by global measurement and data analytics firm Nielsen.

While at the onset of the crisis, purchase shifts were tied to the news cycle—hence the rise in demand for hand sanitizers, cleaning products, as well as food—the correlation has now waned, Nielsen says, as the pandemic persists.

However, Nielsen clarifies that the demand for FMCG (fast-moving consumer goods) hasn’t dipped.

“Their purchasing just no longer mirrors media reports about increasing rates of virus transmission,” the report reads. “Even in countries that have experienced fresh or ever-growing outbreaks of the virus, such as the United States, Brazil and Russia, FMCG purchases remain relatively steady.”

Based on this observation, the Nielsen Intelligence Unit identified the four emerging patterns that could explain what people will buy, as well as where, why, and how much they will buy. These patterns could help predict what would drive new pandemic purchase decisions.

According to the report, these patterns are “underpinned by rising unemployment levels and concerns about the future of the economy.” Expect also behavior of “insulated spenders,” who are financially stable but cautious, and the “constrained spenders,” those with limited resources, to differ greatly.

Below are the details of each emerging pattern:

Basket reset. Consumers are expected to be more careful about and scrutinizing of what they place in their baskets, rethinking which items are truly “essential.” Shopping will also be done through a mix of traditional retail and e-commerce. According to Nielsen, weekly e-commerce basket size in June and July in the United Kingdom was 130 to 160 percent larger than measures taken in the same period last year, with overall FMCG spending online “steadily” climbing in more recent weeks.

Insulated spenders will be more careful about managing their basket size, since the list of “essential” items is growing as more health measures are implemented (i.e., requirement of face shields).

Constrained spenders will minimize stockpiling, and be forced to limit their basket choices.

Companies should take note that “there’s a critical window of opportunity to translate pandemic-minded consumption into continued, essential routine,” the report reads. Nielsen also notes that whether they are employed or not, consumers are less optimistic about the future, and will therefore continue to be more cautious about what they buy amid the pandemic.

Homebody reset. After spending months at home, consumers have now developed a DIY (do-it-yourself) mentality and preference for self-service, which seems to be here to stay even though many lockdown measures have been eased across the world.

Insulated spenders will explore self-service in order to personalize food and care solutions at home.

Constrained spenders will also rely on self-service, but more out of necessity rather than choice.

Companies should understand new DIY behaviors, and respond to them, in order to “succeed in empathizing with current consumer interest in creative, cost-conscious and safe consumption,” the report states. According to Nielsen research, “bake-it-yourself” enthusiasts in Poland drove up the value growth of flour by 39 percent during the last week of June; in the United States, sales of electric razors, costume hair coloring, pet grooming and food preparation products all went up by 19 percent, 35 percent, 14 percent and 53 percent, respectively. And speaking of food, a big shift has been toward in-home eating, since many restaurants have closed, and more people continue to work from home.

Rationale reset. According to “The Conference Board Global Consumer Confidence Survey conducted in collaboration with Nielsen in the second quarter of the year,” 78 percent of consumers around the world say they are cutting back on their spending on household expenses, and that more than one-third are also spending less on takeaway meals, travels, entertainment and clothing.

According to the report, these changes could redefine the role of FMCG, and is expected to “fulfill a broader set of both essential and discretionary needs.”

Insulated spenders will “seek luxuries within FMCG to compensate for travel and entertainment they can no longer safely enjoy.”

Constrained spenders will give weight to the significance of each purchase they make because of their limited income.

Companies should have empathy, as it is necessary for FMCG brands to determine the rationale behind consumers’ purchasing decisions, and what kinds of small purchases brings them comfort and gives them a sense of reward.

Affordability reset. Promo strategies for FMCG are expected to change, the report says. According to Nielsen Intelligence Unit leader Scott McKenzie: “We see the early indication that the promotional baseline has been reset, prompting a huge opportunity to transform consumer behavior around affordability, too. The recent lack of “normal” promotional activity leads to an important, and perhaps historic, moment where companies can reset their approach to affordability in ways that offer greater efficiency than before.”

Insulated spenders will still consider price as a major purchase driver.

Constrained spenders will have to make spending adjustments, and may abandon certain brands, package formats and retailers.

Companies need to assess consumers’ perception of value, McKenzie says. “Companies that are unable to provide products that can fit the adjusted wallet and price sensitivities of constrained and insulated consumers may ultimately lose long-term traction with core users.”