TOKYO — Asian shares were mixed on Friday as investors studied fresh data out of China showing that its recovery remains subdued.

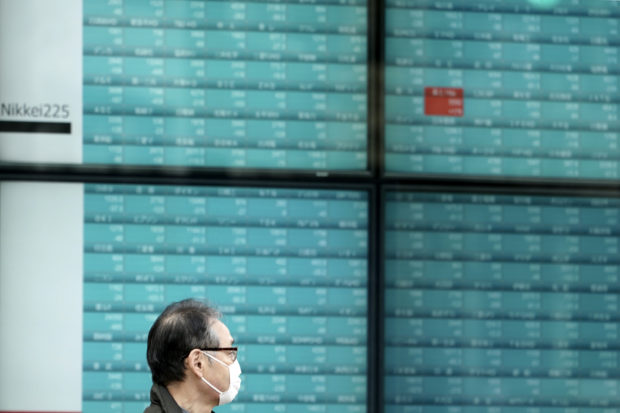

A man walks past an electronic stock board showing Japan’s Nikkei 225 index at a securities firm in Tokyo (AP Photo/Eugene Hoshiko)

Shares rose in Japan and Australia, but fell in Hong Kong, South Korea and Shanghai.

China said Friday that its factory output rose 4.8% from a year earlier in July, on a par with June’s increase. Retail sales fell 1.1%, as consumers remain cautious.

Widespread worries persist about a second, or third, surge in coronavirus cases in many places. Another afternoon fade for stocks left most benchmarks on Wall Street lower.

Japan’s benchmark Nikkei 225 gained 0.1% in morning trading to 23,275.27. South Korea’s Kospi slipped 1.4% to 2,403.20. Australia’s S&P/ASX 200 added 0.7% to 6,131.50. Hong Kong’s Hang Seng dipped nearly 0.2% to 25,191.68, while the Shanghai Composite index lost 0.3% to 3,309.51.

Trade tensions between the U.S. and China are also on investors’ minds as so much of Asian regional growth depends on exports to those giant economies.

The two sides are due to hold talks online later Friday on a trade deal reached in January that brought a truce in their bruising tariff war.

The data on July retail sales, industrial production and investment painted a mixed picture of some recovery amid the uncertainty.

“We are seeing Asia markets broadly assuming a mixed tone, taking a measured stance between the U.S. fiscal stimulus stalemate and the Chinese data and U.S.-China trade talks,” said Jingyi Pan, market strategist at IG in Singapore.

Overnight, the S&P 500 dipped 0.2% to 3,373.43. At one point during the day, it climbed above 3,386.15. That’s the record closing level it set in February, before investors began to understand the degree of devastation the new coronavirus pandemic would inflict on the global economy.

The Dow Jones Industrial Average dipped 0.3% to 27,896.72. The Nasdaq composite climbed 0.3%, to 11,042.50.

It was just the second loss for the S&P 500 in the last 10 days. The index began stumbling in the early afternoon, as Treasury yields were accelerating following an auction of 30-year bonds by the U.S. government and a report showing that 963,000 U.S. workers filed for unemployment benefits last week. That’s an incredibly high number, but still the lowest tally since March.

Economists said the drop in jobless claims, which was better than the market was expecting, is an encouraging step. But they also cautioned that it could be more of an outlier than a trend, and more data reports are needed to confirm it.

Early Friday, the yield on the 10-year Treasury was at 0.70%, down from 0.71% late Thursday. It was at 0.57% on Monday.

Benchmark U.S. crude inched down 1 cent to $42.23 a barrel in electronic trading on the New York Mercantile Exchange. It fell 43 cents to $42.24 per barrel on Thursday. Brent crude, the international standard, inched up a cent to $44.97 a barrel.

The dollar inched down to 106.94 Japanese yen from 106.95 yen. The euro fell to $1.1813 from $1.1815.