All things instant capture Filipinos’ fancy

As we continue to face uncertain times because of the COVID-19 pandemic, one thing remains consistent among Filipinos: their fondness for instant noodles and instant coffee.

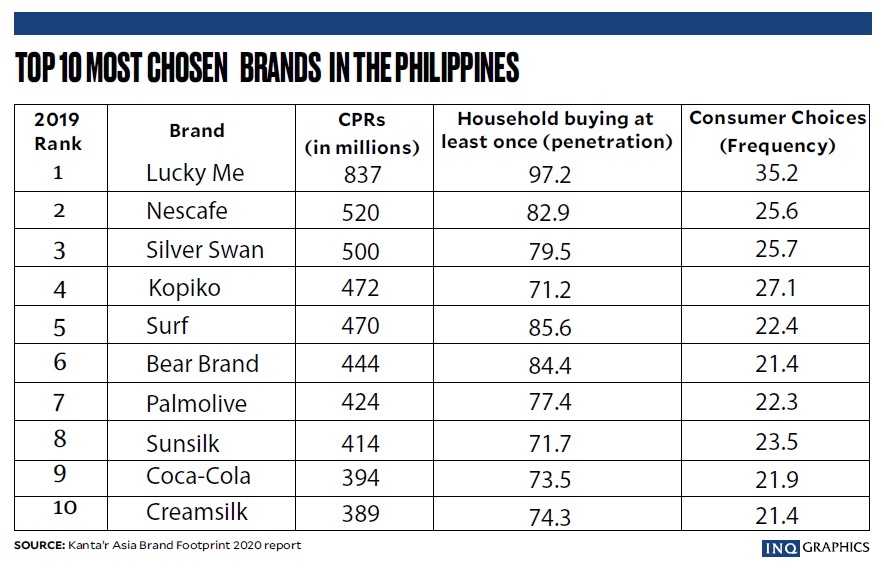

According to the 2020 Asia Brand Footprint report by global market research company Kantar, local noodle brand Lucky Me has, for the fifth consecutive year, dominated the fast-moving consumer goods (FMCG) brand category, as it was bought by nearly all Philippine households (97 percent) in 2019, or more than 35 times in the past year.

At No. 2—a spot which it has also reclaimed this year—is Nescafé instant coffee, reaching over 82 percent of households in the country.

The Asia Brand Footprint study, conducted annually by Kantar and part of a wider, global study, ranks FMCGs across eight countries in the region: the Philippines, China, Indonesia, Korea, Malaysia, Taiwan, Thailand and Vietnam. The rankings are determined by consumer reach points (CRPs), a metric unique to Kantar’s research, which measures a brand’s penetration (How many are buying the brand?) and its performance when it comes to consumer choice (How often are people buying the brand?).

According to Kantar, CRPs provide a more accurate snapshot of shoppers’ behavior, and therefore helps brands determine the opportunities they can take to increase their footprint in certain markets.

After Lucky Me (837 million CRPs) and Nescafé (520 million CRPs), the brands that ranked No. 3 and No. 4 are Silver Swan (500 million CRPs) and Kopiko (472 million CRPs), respectively. Other food and beverage brands in the Top 10 are Bear Brand (No. 6, with 444 million CRPs), and Coca-Cola (No. 9, with 394 million CRPs).

The report particularly emphasizes Coca-Cola’s inclusion in the Top 10, as it made a huge leap from its ranking last year at No. 17.

According to Kantar, the jump was a result of Coca-Cola’s effective stock keeping unit (SKU) strategy, which had been reformulated in order to aid the brand’s further expansion across the country (SKU is a product code that is used by retailers to identify and track its inventory).

Among laundry detergents, Surf is the only brand that made it to the Top 10, securing the fifth spot with 470 million CRPs. The rest of the top spots were taken by brands under the health and beauty category: Palmolive (No. 7, with 424 million CRPs), Sunsilk (No. 8, with 414 CRPs) and Creamsilk (No. 10, with 389 million CRPs).

“These brands sustain their leadership position by constantly adapting their portfolio to new consumer needs and conveying this through inspiring communications. Price, however, remains an important factor for Filipino shoppers and several of the fastest-growing brands have used this lever to gain more shoppers,” said Marie-Anne Lezoraine, general manager, Worldpanel Division, Kantar Philippines. —Annelle Tayao-Juego