The “new normal” is upon us, as economies reopen in the face of a health crisis and a recession—and most consumer markets can expect to be impacted negatively by this global crisis, says market research firm Euromonitor International in its recent report “How Will Consumer Markets Evolve After Coronavirus?”

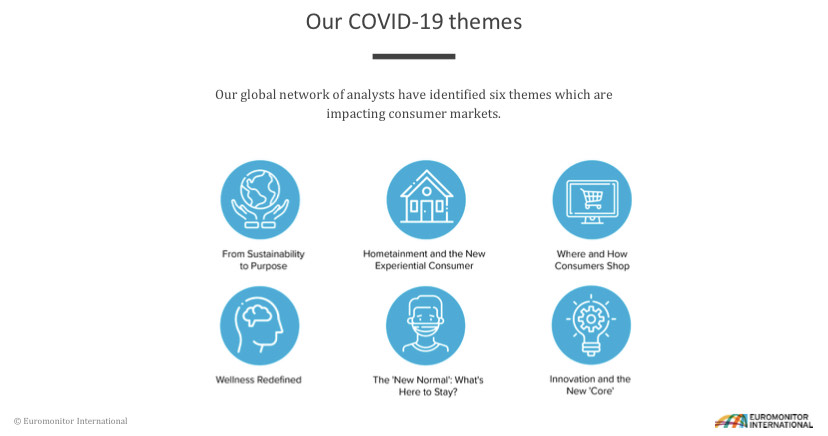

The report, penned by Euromonitor’s global research director, Sarah Boumphrey, looks at how the pandemic is affecting five consumer market categories (health, beauty and fashion; drinks and tobacco; food and technology; home and technology; and services and payments) through the lens of six COVID-19 themes identified by the firm’s network of analysts.

These themes, which come with recommendations as to how brands can navigate markets postlockdown, are:

From sustainability to purpose. According to the report, businesses were already taking a holistic approach toward sustainability, putting purpose over profit—and the pandemic has given this movement more momentum. With customers’ attitudes toward sustainability also changing, the report states that corporations “are responding by putting purpose first, while protecting the bottom line.

“Hometainment” and the new experiential consumer. Who knew that so much opportunity for brands lay in consumers simply staying at home? Personalized products and services, further digitalization and entertainment—there’s a whole new world waiting to be discovered in experiential customers’ homes.

Where and how consumers shop. Online shopping, frictionless retail, click and collect—what used to be considered trends may very well be the retail industry’s new standard sales channels.

Wellness redefined. Alongside physical health, mental and emotional well-being have taken center stage amid the pandemic. Digital tech is able to lend a hand when it comes to preventative health, and the home, being the center of everyone’s activities, is also seen as consumers’ health hub.

Innovation and the new “core.” Companies providing consumer goods and services can no longer say that business is “as usual,” and, according to the report, this has “led to a rapidly changing operating and consumer environment, and left the appetite for experimentation diminished.

The “new normal”: What’s here to stay. Shopping will continue to be done from the safety of home, and consumers will still go for the essentials, focusing on their and their family’s needs, as well as preventative and immune health. Expect remote learning, gaming and cashless and proximity payments to see increased patronage, or become the new norm.But what do these themes mean specifically for the future of consumer market categories?

For health, beauty and fashion, Euromonitor says ethical values will come to the fore for such businesses, as they also face the acceleration of e-commerce adoption and frictionless retail. As for drinks and tobacco, “countertop commerce”—the development of gadgets to create beverage at home—is what businesses will develop further, states the report. Tobacco may not be prioritized, since consumers will continue looking after their wellness, and may turn to more “responsible” stimulants, such as cannabis, caffeine and botanicals.

Occasions used to call for special meals at restaurants, but with the pandemic, and even after, cautiousness will still rule among consumers. So for food and nutrition, the category may see more at-home meals and celebrations, as many consumers have also learned the art of cooking.

When it comes to home and technology, the concept of “home as health hub” will likely stick around, with consumers also ramping up their home cleaning and hygiene practices.

Lastly, businesses under the services and payments category, such as restaurants, will increasingly experiment with groceries and delivery. While Euromonitor says physical establishments won’t close, there will be an intensified need to justify consumer visits.

“A question mark hangs over the future of innovation, with retailers and consumers becoming increasingly risk averse,” the report reads. “What could this mean for craft brands, new product development, and the innovation pipeline? What are the new core set of values and features that brands will refocus on? Health and value seem likely to be key priorities.”