Last Friday, we celebrated Philippine Independence Day. It’s supposed to be a proud moment for all Filipinos, reminiscing and honoring the valor of our forefathers who were brave enough to stand up to foreign oppression, fight for our rights and die for our country.

It’s supposed to be a day of celebration, a tribute to how far we have come as a country.

But this time, even if we are genuinely grateful for the freedoms we continue to enjoy, there seems to be a ball of frustration, even desperation, hanging over our heads.

The pandemic has obviously hurt everyone the world over. But it is in times like this that we need the kind of leadership displayed by those who fought for our independence: a leadership that puts country above self; a leadership that is driven by compassion for the plight of the ordinary Filipino; a leadership with an end goal to empower the people and not select persons.

Of course, love for country does not rely on leadership alone. A nation is driven by its leaders but it thrives only with the cooperation of its people.

New Zealand has declared itself COVID 19-free not only because of the outstanding leadership of Jacinda Ardern but also because of its citizens who have cooperated with their government.

But we follow the leader.

That is why when citizens who are already hurting from the effects of the pandemic see proposals, bills, directives, circulars that, on their face, are not only Macchiavellian but also the least acceptable alternative to meeting administrative objectives, one cannot help but weep for the state our country is now in.

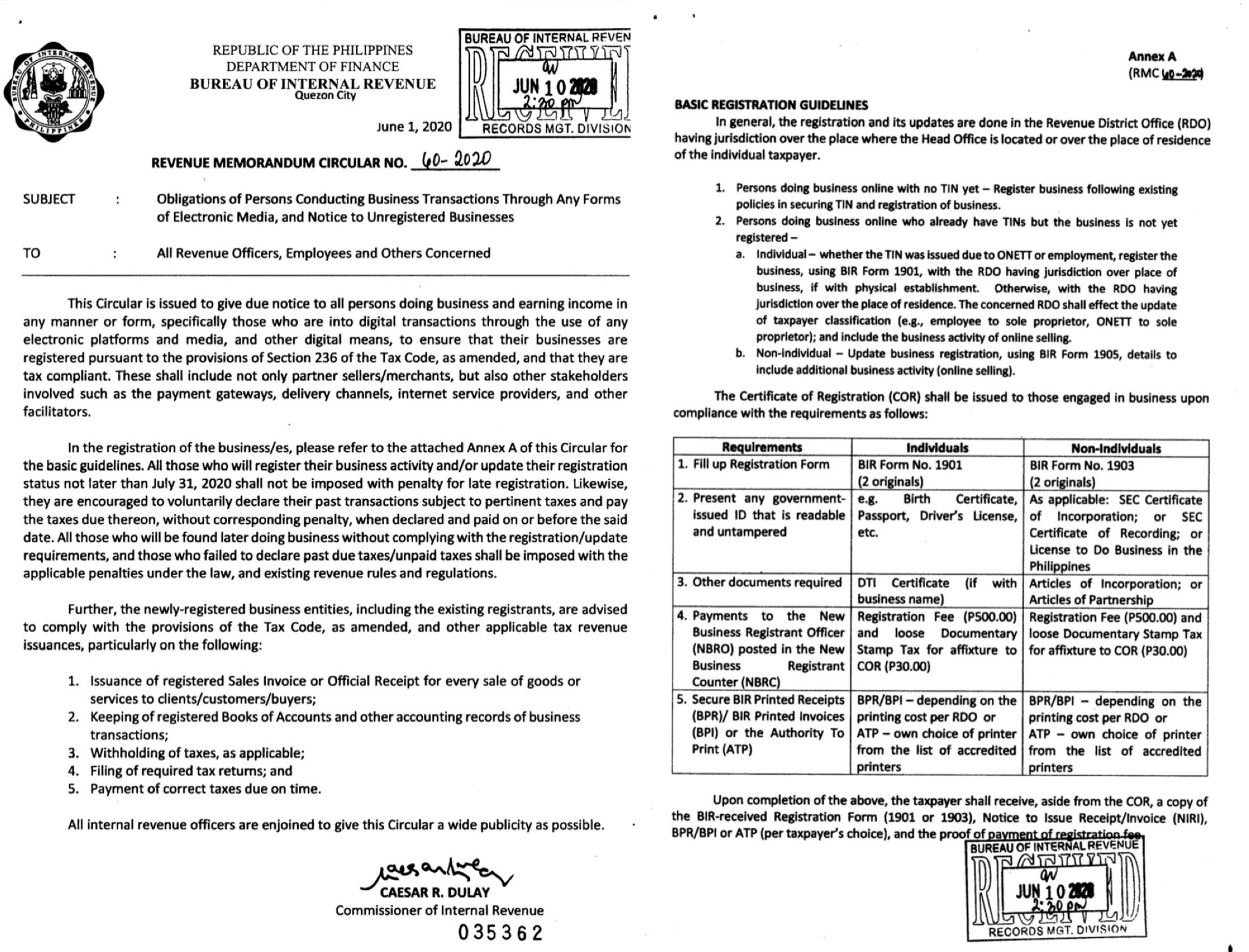

One such rule that is breaking the hearts of Filipinos in the food and beverage industry is Revenue Memorandum Circular 60-2020 issued by the Bureau of Internal Revenue (BIR) this June.

The BIR directed online sellers and other digital-based businesses to register their activities, declare previous transactions and settle their corresponding taxes no later than July 31 or else face penalties.

It states: “This Circular is issued to give due notice to all persons doing business and earning income in any manner or form, specifically those who are into digital transactions through the use of any electronic platforms and media, and other digital means, to ensure that their businesses are registered pursuant to the provisions of Section 236 of the Tax Code, as amended, and that they are tax compliant.”

Given that citizens should diligently pay proper taxes anyway, to put pressure on online sellers at this point in time when entrepreneurs are just trying to not fold is a directive that is bereft of compassion.

Sen. Joel Villanueva, at least, gets this. He was quick to reason that this directive would be an added burden to those who would like to earn an honest living, considering that many have not yet even received government aid needed and promised to get through the quarantine.

“Let’s be thankful that Filipinos are creative. We haven’t even given help to many, and now we will tax those who would like to earn an honest living,” he said in Filipino.

Presidential spokesperson Harry Roque tried to defend the circular by reasoning that those who earn less than P250,000 annually are tax-exempt anyway.

But restaurateurs, who know the realities of the business, are not buying the spokesperson’s reasoning.

Chef Myke Tatung, in a public Facebook post, showed why Roque’s attempt to calm people down cannot be accepted.

According to Tatung, those exempted, or those who earn P250,000 annually, usually make sales of above P650 on average per day. Home-based businessmen who make P700 a day are therefore already required to pay taxes both to the BIR and the city government.

“So after puhunan (investment) and tax, you won’t be able to pay yourself a salary. If you sell below P700, does it make sense to be in business? Kulang pa sa minimum wage after expenses? Di nalang kakain ang pamilya? (What’s left after expenses is even less than the minimum wage? The family won’t eat anymore?)” he said.

One suggestion to cope with the new BIR directive is to register as a Barangay Micro Business Enterprise (BMBE).

The Barangay Micro Business Enterprise Law or Republic Act No. 9178 was enacted in 2002 to encourage the growth and formation of barangay-based microenterprises.

To qualify, however, one must be barangay-based, a microenterprise in nature and scope with total assets of not more than P3 million, engaged in manufacturing, trading, or services other than the practice of profession, and issued a Certificate of Authority by the local government’s City Treasurer.

If you successfully register, a BMBE is exempt from income tax. It is, however, subject to business tax and other taxes. (Read more at taxacctgcenter.ph.)

The best solution, of course, is for government to stop going after ordinary Filipinos trying to earn an honest living and, as Villanueva proposed, focus on going after the P50 billion owed by the Pogos, or Philippine Offshore Gaming Operators.

Is it too much to ask of our present-day leaders to go after these present-day economic oppressors instead of going after ordinary Filipinos who are trying to get back on their feet and survive the pandemic?

The Japan Credit Rating Agency Ltd. (JCR) has just upgraded the Philippines’ credit rating to “A-” with a stable outlook. I hope that those in power prove this credit rating agency right.

Let the patriotism and support for Filipino businesses that the JCR saw translate to something that is truly felt by all Filipinos.

Finally, isn’t it basic that when Filipino businesses thrive, the economy should be able to bounce back as well? So why not do everything possible to lift them up instead?

We’re all in this crisis together. May our leaders who I know love this country, too, help all Filipinos bounce back.