CLI’s Q1 net profit down 4%

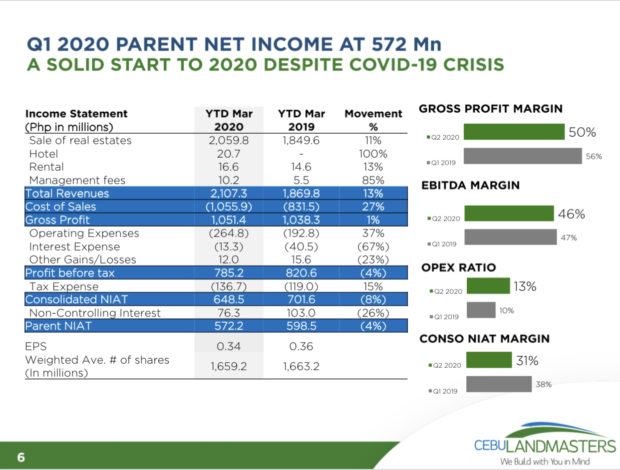

Property developer Cebu Landmasters Inc. (CLI) posted a 4 percent year-on-year decline in attributable net profit to P572 million in the first quarter as expenses grew at a faster pace than revenues and profit margins declined due to construction restrictions in the last few weeks of March.

For the full year, CLI expects net profit, revenues and capital expenditures to decline by 10 percent from 2019 level, in the worst case amid the coronavirus (COVID-19 pandemic), but in the best case scenario, these metrics are seen to grow by 10 percent.

In the first quarter, CLI’s revenues rose by 13 percent year-on-year to P2.11 billion, buoyed by all business segments, including the hotel segment which started its operations in September 2019, CLI disclosed to the Philippine Stock Exchange on Monday.

Gross profit margin (GPM) in the first quarter eased to 50 percent from 56 percent in the previous year while operating expenses rose to 13 percent from 10 percent of revenues.

In an investors briefing on Monday, CLI chief financial officer Grant Cheng explained that the company had geared up for a “big 2020” – originally anticipating a double-digit growth of 20 percent – thereby increasing its headcount and preparing for operating activities. Given the lockdown challenges, however, he said construction did not progress as much, resulting in higher operating expense and lower GPM. But this something that CLI can correct in the coming quarters, Cheng said.

CLI chief executive officer Jose Soberano III said in light of recent challenges, the company was reviewing the budget “to be more judicious and see whether there are a lot of expenses we can save, like in travel.”

Soberano added that CLI was anticipating a major hiring activity but this may have to slow down. Nonetheless, the group expects to launch more projects for the remainder of 2020 to fill the housing backlog in Visayas and Mindanao.

Cost of sales and services in the first quarter increased by 27 percent year-on-year to P1 billion, with the construction progress of existing and new real estate projects launched in 2019 and first quarter of 2020, and with additional incurred cost of hotel operations from Citadines Cebu City.

Operating expenses for the three-month period also increased by 37 percent year-on-year to P264.83 million, with salaries and employee benefits posting the highest growth of 49 percent as manpower increased to support expansion across its Visayas and Mindanao bailiwick.

But as an indicator of revenue growth in the years ahead, CLI registered P4.8 billion in reservation sales take-up in the first five months of 2020, close to its first half 2019 level of P5.26 billion.

Sales of P2 billion driven by its economic housing brand Casa Mira were recorded in the months of April and May, despite expectations of little economic activity during the period. Over-all, CLI’s unsold inventory has gone down to only 10 percent of its total stock.

“We expect demand for quality housing and residential units to rise prompted by the greater desire for safer and better planned living environments in the aftermath of (coronavirus) COVID 19. Over the years, CLI has built a reputation for offering great value to its buyers and is ideally positioned to serve this rising demand,” Soberano said.

To fund these expansions, CLI raised P8 billion from the issuance of corporate notes and several bilateral facilities with major banks, tailored per project. CLI’s incremental cost of borrowing is between 3.8 percent to 4.2 percent for five-, seven- and 10-year money, which the company believes makes it well positioned to manage its balance sheet, lower its financing costs and fund capital expenditures.

“CLI is moving forward with both prudence and conviction. We will still be launching over 13 projects total this year, especially in key segments with sustained demand including economic vertical and horizontal housing. VisMin will recover faster, as restrictions have eased sooner with strong measures in place. There is sustained demand amidst a low supply environment in key Vismin cities, as evidenced by our P2 billion sales take-up over April to May,” Soberano said.

CLI founder, president and CEO Jose Soberano with wife Marose (EVP and treasurer) and son Franco (SVP and COO)