Time is right to pick up ‘pandemic-resilient’ stocks, says Manulife

Even as the coronavirus pandemic continues to wreak havoc, it’s now a good time for investors with a longer-term horizon to sift through the rubble and pick up shares of companies that will benefit first from the reopening of the economy or have already adapted to the challenging environment.

This is according to Mark Canizares, head of equities at Manulife Asset Management and Trust Corp. (MAMTC), who said while the COVID-19 was keeping most investors at bay, his fund management firm had begun to anticipate that the economy would restart and that businesses would rebound by 2021.

“We’re nitpicking at some names,” Canizares said in an interview with the Inquirer after a webinar on Manulife’s market outlook last week. “It’s selective bullishness for us.”

“In terms of recovery, it may take a little while, but we are looking at it from a longer-term perspective. It’s hard to position when everybody wants the same names, so we want to be a bit ahead of the curve.”

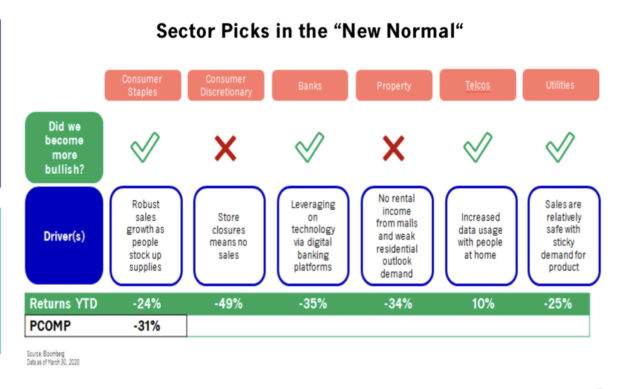

For MAMTC, this means picking the most “pandemic-resilient” sectors, such as consumer staples, banks, telecommunications and utilities. On the other hand, MAMTC is cautious on consumer discretionary and property sectors, as these are hardest-hit by the quarantine protocols that have been put in place to curb the COVID-19 contagion.

MAMTC is generally cautious on service-oriented industries like restaurants, hotel and tourism sectors, noting these would be the most labor-intensive sectors. It prefers sectors that are less labor-intensive and those that have harnessed technology to adapt to the new social and economic structures post-COVID-19.

Since the lockdown period in mid-March, MAMTC has reversed its local corporate earnings expectations from a double-digit average earnings growth to at least a 10-percent decline this 2020 to price in the two-month business disruption arising from the lockdown of Luzon and other key regions.

“But the nice thing about it is there will be a rebound coming to 2021 in terms of expectations, so whatever might not be earned this year, some of that could be moved into next year,” Canizares said.

For instance, Canizares noted that there were some manufacturers of consumer goods that were restarting production, albeit with limited workers and higher overhead costs due to higher wage subsidies. But he noted

that the higher labor cost would be partly offset by the decline in other input costs, especially with global oil prices sinking to $30 dollars per barrel.

“We like [consumer] staples mainly because of the change in consumer behavior: it’s mostly buying to fill up your pantry stocking and that’s at the expense of consumer discretionary names, including restaurants. So there will be store closures because there are no sales,” Canizares said.

For the banks and telco stocks, these sectors are able to leverage on the digital ecosystem and technology spending is starting to be utilized, he said.

But Canizares said utilities like electricity and water providers would still rank higher than telcos as “defensive” sectors because demand for their products won’t decline because of the pandemic, and in fact would even increase with the onset of summer.

“On property, we are a little bit negative because of the rental reprieve that the companies are giving their tenants and also the shutdown of the malls. On residential sales, during the two-month period when there’s limited mobility, property sales started to fall. This is because property sales require face-to-face meetings,” he said.

From hereon, Canizares said it may be more meaningful to look at month-on-month, rather than year-on-year comparison of corporate performance. Most likely, he said investors would look at how business was picking up after the lockdown period that started in mid-March.

“What can move the market higher is if numbers turn out not as bad as people are expecting for the second quarter, meaning if the restart is a bit faster,” he said.

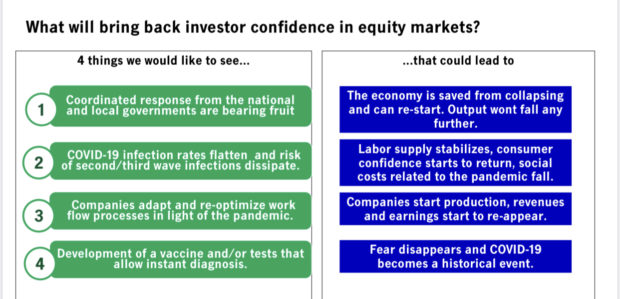

As to what would promptly bring back investor confidence to the equity markets, Canizares listed four potential catalysts:

– coordinated response from the national and local governments to prevent further economic damage;

– COVID-19 infection rates flatten and risk of second or third wave of infection dissipate; and,

– companies adapt and re-optimize work flow processes in light of the pandemic; and,

– development of a vaccine and faster tests that will eradicate fear of COVID-19. INQ