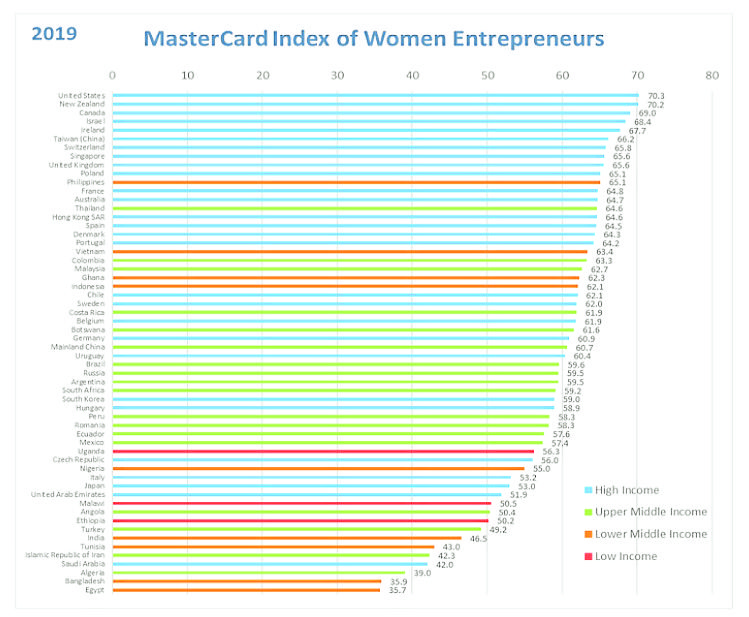

The Philippines came out as a promising outlier among the top countries in the Mastercard Index of Women Entrepreneurs (Miwe) 2019, ranking 11th out of 58 societies.

The study represents almost 80 percent of the world’s female labor force, based on data available publicly from international organizations such as the International Labour Organization, United Nations Educational, Scientific and Cultural Organization, and the Global Entrepreneurship Monitor.

It also highlights how these 58 markets differ on three of the index’s components: women’s advancement outcomes, knowledge assets and financial access, and supporting entrepreneurial factors.

Women’s progress

The Philippines, according to the report, is No. 1 when it comes to the first component, which “gauges women’s progress and degree of marginalization economically and professionally.”

Securing that top spot, says the report, means the Philippines stood out in terms of women’s ability to thrive as business leaders, professional and technical workers, entrepreneurs, and labor force participants. It also highlights the fact that Filipino women are fairly represented in the workforce, with 52 percent of business leaders and 58 percent of professional workers being female. As for their entrepreneurial skills, Filipino women were also found to be just as likely as their male counterparts to start their own venture.

Three other markets in Asia-Pacific joined the Philippines in the top 10 under the first component: Thailand (rank 4), Vietnam (rank 7) and New Zealand (rank 10).

However, despite this win for the working Filipino woman, the Philippines’ rankings under the two other components show that plenty of improvements can be made to help more female workers advance their careers.

Under the second component, knowledge assets and financial access, the Philippines ranks 20th, lagging behind a mix of high income, upper middle-income, and similar lower middle-income markets across different regions, including nine others from Asia-Pacific.

This component of the index gauges women’s progress and the degree of marginalization they face as financial customers, and academically, in terms of opportunities to enroll in tertiary institutions. It also looks at women’s inclination to borrow or save for business, and the overall support rendered for small and medium-sized enterprises (SMEs).

Financial support

The index reveals that in the Philippines, financial support for SMEs is “quite weak,” as indicated by the gender gap when it comes to access to financial services, perception on physical infrastructure, and accessibility, range and effectiveness of government programs. However, the study also notes that the country is one of the markets with the least gender divide when it comes to borrowing or saving for business.

The Philippines ranking at only 38th under the third component, supporting entrepreneurial factors, further emphasizes the lack of enabling entrepreneurial conditions in the country. This component gauges how supporting entrepreneurial conditions are either enablers or constraints of women business ownership through four indicators: ease of doing business, cultural perceptions of women entrepreneurs, quality of governance and entrepreneurial supporting factors. Dominating this component are wealthy and developed markets such as the United States, Canada, Switzerland, Canada, Denmark, the United Kingdom and Ireland, where “highly supportive entrepreneurial conditions appear to play a role in advancing women’s ability to thrive in business.”

Still, according to Mastercard, the Philippines’ overall ranking (following the top 10 markets: the United States, New Zealand, Canada, Israel, Ireland, Taiwan, Switzerland, Singapore, the United Kingdom and Poland) shows just how promising the entrepreneurial framework is in the country.

“The Miwe results show how the balance of different factors can contribute to an even better environment for women in business. It shows the importance of designing policies and solutions with women in mind, and in such a way that allows for inclusive growth in business,” Mastercard says. “By ensuring that all women in the country can access financial resources such as bank accounts, credit and insurance, and sufficient education, the Philippines will be able to foster a more supportive environment for entrepreneurship and empower women with the right tools and mind-set to proactively pursue business.” INQ

Read the full report at https://newsroom.mastercard.com/wp-content/uploads/2019/12/Mastercard-Index-of-Women-Entrepreneurs-2019.pdf.