TOKYO — Asian shares rose Tuesday on optimism about a potential vaccine for the coronavirus after hopes for a U.S. economic recovery in the second half of the year sent Wall Street into a rebound.

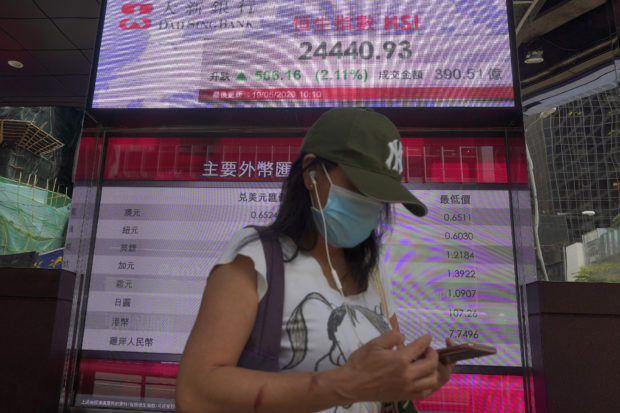

A woman wearing face mask walks past a bank electronic board showing the Hong Kong share index Tuesday, May 19, 2020. Asian shares rose Tuesday on optimism about a potential vaccine for the coronavirus after hopes for a U.S. economic recovery in the second half of the year sent Wall Street into a rebound. (AP Photo/Vincent Yu)

Japan’s benchmark Nikkei 225 added 1.9% in morning trading to 20,517.42. Australia’s S&P/ASX 200 jumped 2.0% to 5,569.20. South Korea’s Kospi was up 1.8% to 1,972.73. Hong Kong’s Hang Seng gained 1.8% to 24,362.80, while the Shanghai Composite edged up 0.5% to 2,889.42.

“The mood is assertively risk-on with sentiment having been tipped over by fresh hopes sparked for a COVID-19 vaccine,” said Jingyi Pan, market strategist for IG.

Pan said reports that drug company Moderna had found promising results on a vaccine have “no doubt been the biggest mood booster for markets, given the fact that the lingering coronavirus implications remains the single biggest issue holding back the market from recovery and a contributor to other risk factors including US-China tensions.”

Massachusetts-based Moderna saw its stock jump 20% in New York trading Monday.

The S&P 500 climbed 3.2%, its best day since early April. The gains erased all of its losses from last week, when the index posted its worst showing since late March and its third weekly loss in the last four. Bond yields rose broadly in another sign that investors were becoming more optimistic.

Investors were also encouraged by remarks over the weekend from Federal Reserve Chair Jerome Powell, who expressed optimism that the U.S. economy could begin to recover in the second half of the year. Once the outbreak has been contained, he said, the economy should be able to rebound “substantially.”

The S&P 500 gained 90.21 points to 2,953.91. The benchmark index is still down 12.8% from its all-time high on February 19.

The Dow Jones Industrial Average surged 3.9% to 24,597.37. The Nasdaq composite rose 2.4% to 9,234.83. Small-company stocks fared better than the rest of the market. The Russell 2000 index picked up 6.1%, to 1,333.69.

Investors are hoping that a working vaccine for COVID-19 can be developed and that it will help reassure people and businesses as economies reopen.

“The question of how quickly people come back, or will they come back to the way they used to do things, that’s much different if you have a vaccine,” said Megan Horneman, director of portfolio strategy at Verdence Capital Advisors.

Economies in Asia also are starting to relax restrictions, although worries remain about another surge in illnesses. In crowded cities it is difficult to maintain social distancing. As the cases drop, people are letting their guard down in going out and mingling in crowds.

But traders have been encouraged by signs that, so far at least, there hasn’t been a lot of data implying a resurgence in the number of COVID-19 cases, said Sam Stovall, chief investment strategist at CFRA.

“Of course, because we are responding to impressions, we could end up giving back some of these gains should additional information contest our beliefs,” he said.

Technology, financial and industrial stocks accounted for a big slice of Monday’s broad gains, along with companies that rely on consumer spending. Energy stocks also rose as the price of U.S. crude oil closed above $30 a barrel for the first time in two months.

Oil production cuts are kicking in at the same time that demand is rising as the U.S. and other countries ease some of the restrictions aimed at stemming the spread of the outbreak.

Benchmark U.S. crude oil was flat at $31.65 per barrel in electronic trading on the New York Mercantile Exchange after gaining $2.13 on Monday. Brent crude, the international standard, lost 10 cents to $34.71 a barrel.

Bonds yields rose overnight, another sign that pessimism was diminishing. The yield on the 10-year Treasury note, a benchmark for interest rates on many consumer loans, climbed to 0.72% from 0.64% late Friday. On Tuesday morning it was at 0.70%.

Fears of a crushing recession due to the coronavirus sent the S&P 500 into a skid of more than 30% from its high in February. Hopes for a relatively quick rebound and unprecedented moves by the Federal Reserve and Congress to stem the economic pain fueled a historic rebound for stocks in April.

May got off to a downbeat start as investors balance cautious optimism of a recovery as economies around the world slowly open up again against worries that the moves could lead to another surge in coronavirus infections and more economic uncertainty. But Monday’s strong start to the week reversed all of the market’s losses so far this month.

Wall Street is hoping that the reopening of businesses and the relaxation of stay-at-home mandates continue without any major setbacks, paving the way for corporate profits to bounce back.

The U.S. dollar inched up to 107.40 Japanese yen from 107.31 yen on Monday. The euro fell to $1.0907 from $1.0920.