MPIC sees lower quarterly profits for the first time in its history

Manuel V. Pangilinan

For the first time in its corporate history, businessman Manuel V. Pangilinan-led infrastructure holding firm Metro Pacific Investments Corp. saw a year-on-year decline in quarterly profit as various businesses were constrained by lockdown measures meant to curb the coronavirus (COVID-19) pandemic.

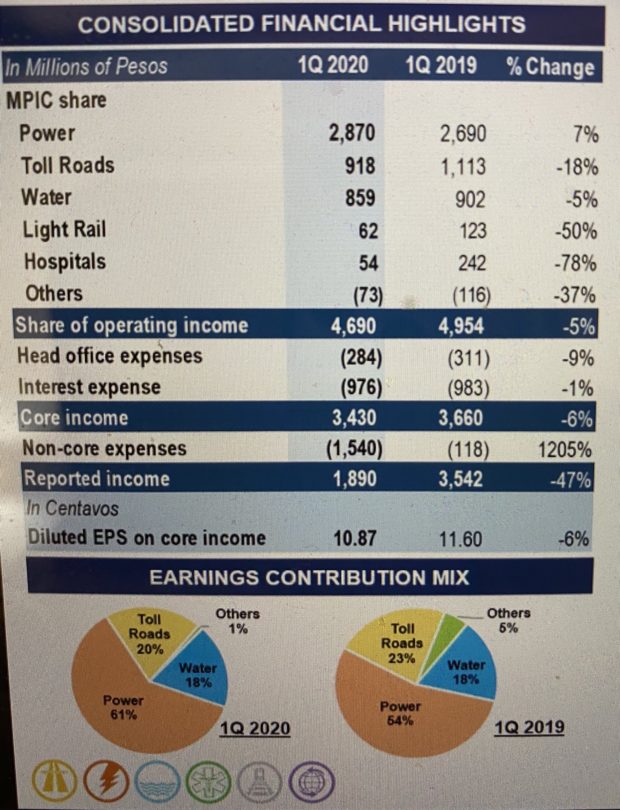

MPIC posted a 6-percent year-on-year drop in first quarter core net income to P3.4 billion. Including non-recurring items, MPIC’s net profit fell by 46.6 percent year-on-year in the first three months to P1.89 billion, the company disclosed to the Philippine Stock Exchange on Wednesday.

The enhanced community quarantine (ECQ) imposed on the whole of Luzon starting mid-March reduced toll road traffic, suspended rail services and decreased commercial and industrial demand for water and power, resulting in a decrease in contribution from operations of 5 percent.

MPIC’s Q1 performance

Power accounted for P2.87 billion or 62 percent of MPIC’s net operating income. Tollroads contributed P920 million or 20 percent and water contributed P860 million or 18 percent.

Contribution from hospitals, rail, logistics and other businesses offset each other.

“Our first ever fall in year-on-year quarterly earnings is understandable, but overall I believe the strength of our portfolio, most especially power and water, has been demonstrated in the face of the pandemic, and despite investors’ stated concerns on regulatory issues. Our thousands of hardworking front-line staff have been selfless in their dedication, especially our frontline doctors and nurses who are directly exposed to COVID risks. We owe all of them an inestimable debt of gratitude,” MPIC chair Pangilinan said.

“At this time, our priorities are, in order: welfare of our people; service to our customers; cash preservation; and then profitability. Under an extremely fluid environment, it would be difficult to provide with a fair degree of reliability a preview of what the full year 2020 could look like. But for now, it is likely that our second quarter results are likely to fall short of last year’s. That said, due to the prudent financial management of MPIC and of our major operating companies we are well placed to pull through this crisis, and in fact, likely maintain our dividends to shareholders,” he said.

The non-recurring items that affected headline net profit in the first quarter of 2020 included the provisioning in full of the carrying value of Meralco’s investment in Pacific Light Power, a gas-fired power plant in Singapore. By contrast, MPIC recorded non-recurring expenses of just P118 million a year earlier primarily due to refinancing and share issuance costs plus various project expenses.

“The robustness of our operations, even in these difficult times, reflects a decade and more of sustained capital investment. However, it is our talented management and thousands of dedicated front-line employees who deserve our gratitude in these trying times,” MPIC president and chief executive officer Jose Ma. Lim said.

”The benefits of the continued expansion in our overall customer coverage manifested early in the first quarter through increased volumes ahead of the implementation of the ECQ, and since the ECQ, in increasing service standards despite the restricted operating environment. The 5 percent reduction in contribution from operations, which we attribute to the ECQ, will accelerate in the second quarter as the ECQ has been lengthened. Meanwhile, overheads have been reduced and interest held flat resulting in our first quarter core net income falling by a modest 6 percent (our first ever) compared with a year ago.”

Looking ahead, Lim said preserving cash would be MPIC’s immediate priority.

“MPIC itself is well funded due to the P30.1 billion selldown of our interest in our hospitals business at the end of 2019. We moved to suspend our previously announced share buyback and other discretionary projects. As earlier reported, Maynilad is currently unable to pay a dividend pending the outcome of the concession agreement review, and as a result of the ECQ and other consequences of the COVID-19 outbreak, we may expect lower dividends from our power and toll roads businesses for 2020.”

Lim said it was too early to give either earnings or capital expenditure guidance for the full year 2020 due to the uncertainty surrounding recovery from the COVID-19 containment measures and various ongoing regulatory reviews. That said, he qualified: “We are in a strong position to maintain the dividend per share at the same level as for 2019 for MPIC.”