D&L’s Q1 profit down 31%

Alvin Lao

After being caught offguard by the Luzon-wide lockdown starting mid-March, the worst may be over for food and chemical product manufacturer D&L Industries, although it may take some time for the business to normalize given uncertainties arising from the COVID-19 pandemic.

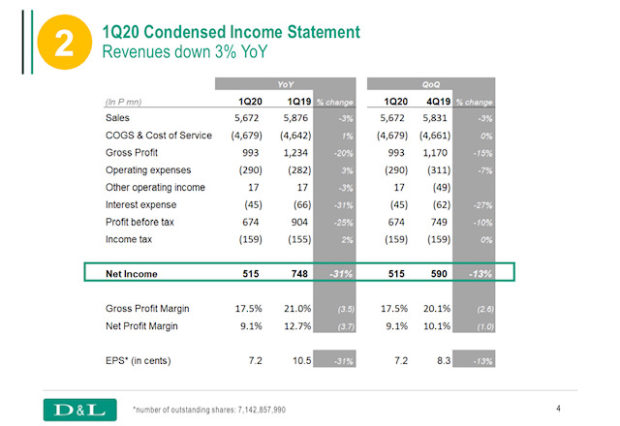

In the first quarter, D&L’s recurring net profit fell by 31 percent year-on-year to P515 million while revenues slipped by 3 percent to P5.67 billion, the company disclosed to the Philippine Stock Exchange on Tuesday.

D&L’s Q1 2020 performance

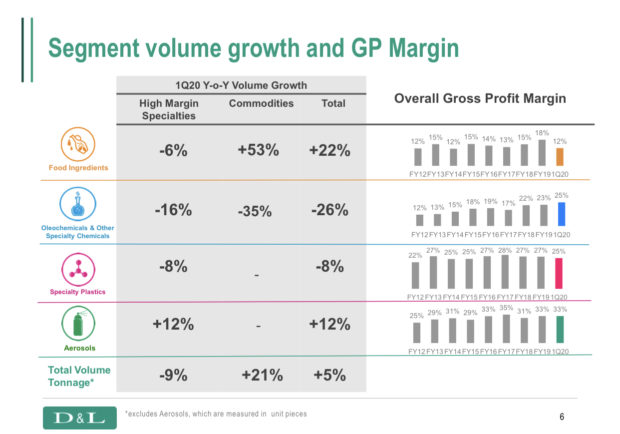

The business mix tilted towards commodities due to greater demand for basic raw materials while the enhanced community quarantine (ECQ) curbed sales of high-margin specialty products (HMSP). The HMSP segment saw a 22 percent year-on-year drop in volume in the month of March alone as many customers, including restaurant operators, shut down or streamlined operations, while other segments, such as those that involve construction, were deemed non-essential and were not allowed to operate.

The lower-margin commodities segment grew its share of D&L’s total business to 36 percent in the first quarter from only 31 percent in full-year 2019.

“The first two weeks of quarantine was the worst in the sense that a lot of food companies or brands known for delivery were not operating due to lack of manpower and (constraints) on logistics. Everyone was caught by surprise,” D&L president Alvin Lao said in a videoconference with the media on Tuesday.

“But I don’t think things are going to get worse. Things should get better, but things will not be back to normal for a while,” Lao said.

Despite the various restrictions imposed during the ECQ, D&L was still able to operate at around 50-60 percent of capacity of the business segments that were allowed to function compared to around 75-80 percent utilization rate prior to the COVID-19 contagion. About 27 percent of its workforce are able to physically report to work while another 20 percent are able to work from home in various capacities.

D&L has provided sleeping quarters at its manufacturing plant in Pasig for about 60 percent of those who are reporting to work, given the unavailability of public transportation.

Lao said D&L was not facing any imminent supply chain disruption despite the COVID-19 pandemic. “After the port congestion in the second half of last year, we had no choice but overstock on our inventory, so in a way, we were lucky.” When China locked itself down in January, this also prompted D&L to look for alternative suppliers of raw materials.

D&L also saw incremental demand from clients that were previously buying from its competitors which were unable to deliver as they were hit by the lockdown of China.

“We are able to demonstrate that we are very reliable even if faced with so many difficulties,” Lao said.

Another opportunity during the current pandemic is the strong demand for coconut oil products. As such, Lao said D&L was putting more resources into research and development (R&D) for coconut oil-based oleochemicals, especially given that virgin coconut oil is now being touted by some experts as a possible source of COVID-19 treatment.

“The COVID-19 pandemic has disrupted many aspects of our daily lives and how businesses operate,” Lao said. “However, just like any other crisis that we’ve gone through in the past, this is also an opportunity for our business to build long-term resilience. We believe that we are fundamentally equipped to weather this storm given our strong balance sheet and the essential nature of the businesses we’re in, which should see continued demand even in this challenging environment.”

D&L’s Q1 2020 performance by business segment

As of end-March, D&L’s net debt stood at only 12 percent of equity while cash flow is 18 times interest expenses. In addition, it was able to convert inventory and accounts payable into cash in 141 days in the first quarter, faster than the 161-day turnaround in 2019.

“Additionally, our extensive investments in R&D will allow us to reinvent ourselves and pursue opportunities that may have high value-added potential in the current situation. We are committed to our Batangas expansion, as we see its long-term investment merits remaining intact,” he said.

Due to COVID-19 challenges, the construction of its new plants in Batangas may be delayed by at least three months, but Lao said D&L would not want this to be delayed further.

“In our 57-year history, we’ve faced many, many adversities – may it be a severe natural calamity, political disruption, or a financial crisis. What has allowed us to survive and grow our business to where it is today are the decisions we’ve made that were anchored on our long-term strategic view. In our view, the current market sell-off is a limited window of opportunity for shareholders who, like us, seek long-term value,” he said