The local stock barometer missed the upswing across regional markets on Monday as investors gauged the economic cost of an extended lockdown of Metro Manila.

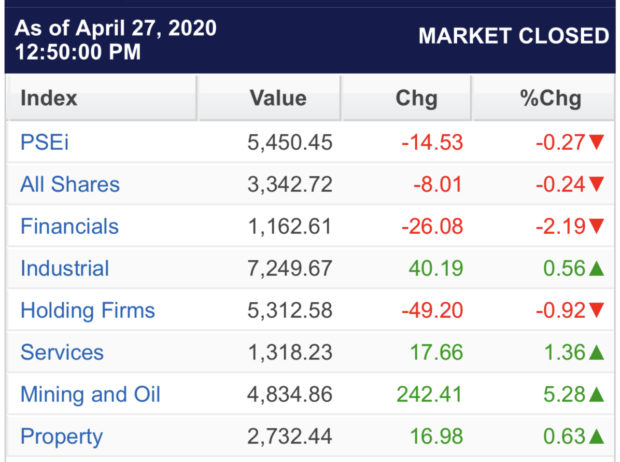

The main-share Philippine Stock Exchange index (PSEi) slipped by 14.53 points or 0.27 percent to close at 5,450.45.

Elsewhere in the region, stock markets began the week mostly upbeat as investors looked forward to massive economic stimulus measures to counter fallout from the COVID-19 pandemic.

Pres. Rodrigo Duterte extended the enhanced community quarantine (ECQ) by another 15 days until May 15, covering the high-risk parts of the country, including the National Capital Region and Calabarzon. Other regions were migrated to a more relaxed general community quarantine (GCQ).

A veteran stock broker cited the adverse impact of the prolonged lockdown on the domestic economy, particularly on employment, especially as more and more overseas Filipinos – including those working in cruise liners – were now going home due to job cuts.

At the local market, the index was weighed down most by the financial counter, which fell by 2.19 percent, as banks brace for surging credit losses amid the challenging business environment caused by the COVID-19 pandemic.

The holding firm counter also declined by 0.91 percent.

The market’s losses was tempered by the gains eked out by the industrial, services, mining/oil and property counters. The mining/oil sector gained 5.28 percent, while the services counter added 1.36 percent.

Value turnover for the day was thin at P4.07 billion. There was P823.64 million worth of net foreign selling.

There were 112 decliners that edged out 88 advancers, while 32 stocks were unchanged.

The country’s largest conglomerate, SM Investments, weighed down the market with its 4.18-percent drop, while its banking arm BDO also lost 3 percent.

BDO reported a 10-percent drop in first quarter net profit last week, citing trading and foreign exchange losses arising from turbulent financial markets.

Ty family-led Metrobank declined by 3.85 percent, while parent conglomerate GT Capital lost 1.76 percent.

Metro Pacific and Meralco fell by 2.32 percent and 1.56 percent, respectively.

Among the notable decliners outside the PSEi were Dito and MacroAsia, which declined by 8.33 percent and 4.72 percent, respectively.

On the other hand, ICTSI advanced by 5.13 percent, while URC, Ayala Corp. and JG Summit all rose by over 2 percent.

Puregold and Ayala Land both gained over 1 percent.