Where’s the money?

Social media has spoken: Micro, small and medium enterprises (MSMEs) in the Philippines are still uncertain about their financial future, with many looking for ways to augment their resources as they also deal with the health and safety of their employees and loved ones.

That’s one key finding of a study by data sciences and management consulting company Cobena Business Analytics & Strategy, as presented in a social intelligence fact sheet titled “Flourish or perish: A glimpse into the experiences of Filipino MSMEs during the onset of the COVID-19 lockdown period.” The report presents an analysis of how MSMEs are dealing with the enhanced community quarantine (ECQ), based on online and social media data, which include search trends, search keywords, related search keywords and social media mentions.

Unsurprisingly, aside from the risk of getting exposed to the virus, the lack of financial resources was one of the main MSME-related challenges that surfaced in the study.

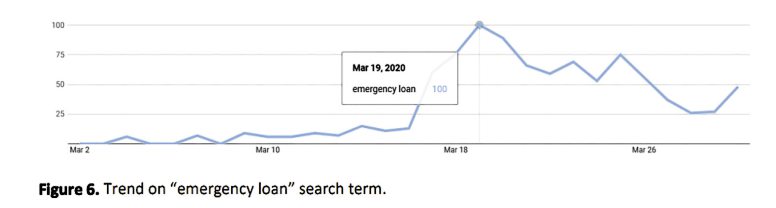

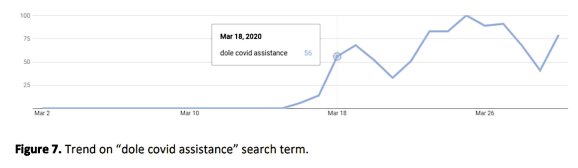

At the onset of the lockdown (week of March 16), searches about “how to apply for loans” and “how much can be loaned” were at the top of search queries, particularly for emergency loans and calamity loans. The number of searches peaked on March 19, which was around the time the Department of Labor and Employment introduced the COVID-19 Adjustment Measure Program, which would assist workers affected by the ECQ.

“In the midst of crisis, at a time when much of the public was worrying about health, safety and family, MSMEs seemed to have been at a loss on how to augment their financial resources,” Cobena’s report reads. “The increased number of searches related to loans are possibly due to enterprises realizing the detrimental effects of the quarantine within their business; thus the need for monetary support, especially for them to be able to pay expenses and support staff financially.” (To which the government, through the Department of Trade and Industry’s Small Business Corp., responded with a P1-B loan facility for MSMEs.)

Data were gathered from March 1 to 30, and “analyzed and thematized to infer the experiences of MSMEs to serve as the data-driven basis for interventions, and for further analysis, segmentation and enrichment” of the sector.

“There is a lot of value to be derived from analyzing the breadth and depth of digital data that is available in the public domain,” says Francis del Val, Cobena president and CEO. “Understanding consumer behavior online can provide us insights into their emotions and concerns: The fears and anxieties they are experiencing, particularly in this COVID situation.”

The research also reveals that within the first two days of the ECQ, there was a surge in the number of mentions (over 28,000) businesses closing down or suspending operations. In the same period, confusion over the implementation of the ECQ was evident, given that top search queries were “enhanced community quarantine meaning,” “enhanced community quarantine guideline” and “what is enhanced community quarantine.”

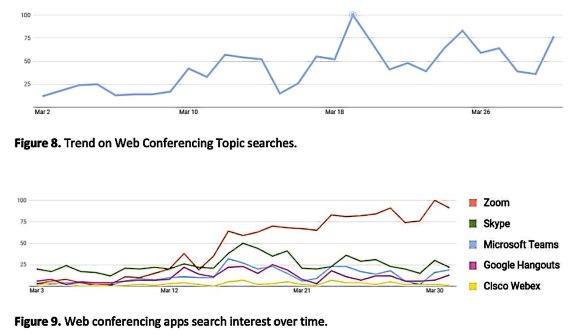

By the second week of the ECQ, however, MSMEs “bayanihan” (community) spirit kicked in, the report says, as business owners tried to support each other through advice sent online. Videoconferencing tools became extremely relevant, with Zoom as the only application with a consistently rising search volume trend.

The same period also saw conversations about businesses shifting to more action-oriented topics, such as “regular compensation” and “emergency financial assistance,” Cobena’s report says.

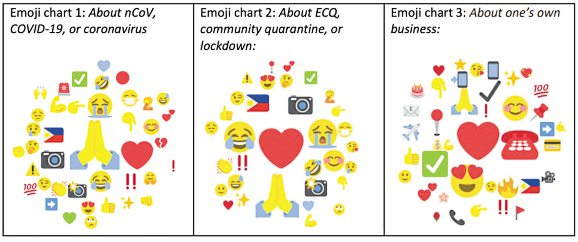

The study even took a look at the most widely used emojis by MSMEs online, and found that the heart-shaped eye and telephone icons were the most popular, indicating the sector’s positivity, and that they remain accessible to their consumers by phone.

Given all these data, Cobena recommends that five key areas be addressed to help MSMEs—and the country’s economy—survive the pandemic. These are:

1) Personal safety. Given the current information overload, it is very important that the latest scientific studies are communicated to the public in a simple manner that would empower them to make the necessary steps to protect themselves.

2) Business expenses. Financial assistance for MSMEs to help keep their business afloat, help for their employees and supply chain partners so that the MSMEs can continue to make their products accessible to their customers.

3) Employee welfare. Employees must still be able to get to and from their place of work and residence. Many employees are now displaced because they don’t have regular income and have been/ are at risk of being terminated because their employers can no longer afford to pay them because there are no revenues.

4) Consumer confidence. Consumer confidence is greatly affected and there is a lot of concern on when the lockdown will be lifted and when things will start to return to normal.

5) Business ethics. Consumers are mindful of the ethical/compassionate treatment that businesses are extending to their employees and consumers.

“To help MSMEs survive the enhanced community quarantine period, it is necessary to understand both the steps that they need to take in order to save their businesses and the gaps that hinder them from doing so. By looking into online search and social media data, informed decisions can be made to help ensure the needs of MSMEs are met,” says Pierre Samson, Cobena’s senior marketing technology and research specialist.

“Addressing these concerns proactively helps stakeholders better attend to the needs of the small- and medium-scale businesses in the country, who form the backbone of the Philippine economy,” Del Val adds.