Based on the report “Economic Conditions Snapshot, March 2020,” 86 percent of executives surveyed from March 2 to 6 identified COVID-19 as the top risk to the global economic growth in the next year, placing a huge lead over geopolitical instability (36 percent) and trade conflicts (29 percent), which were at second and third place, respectively.

Other major risks identified by respondents are: financial market volatility (22 percent), increased economic volatility (19 percent), transitions of political leadership (17), changes in trade policy (13 percent), social unrest (11 percent), domestic political conflicts (10 percent) and asset bubbles (10 percent).

The online survey garnered 1,152 responses, which represent “a full range of regions, industries, company sizes, functional specialties and tenures.”

When it comes to domestic economic growth, it is Asia-Pacific that appears most affected by the pandemic, followed by North America, the developing markets (China, the Middle East, North Africa), Europe and India. Almost 90 percent of Asia-Pacific respondents identified the coronavirus pandemic as their top threat; in North America, 71 percent; and in the developing markets, 67 percent. Only Latin America identified a different threat—domestic political conflicts—as the No. 1 problem (51 percent) surrounding their economy.

Naturally, it follows that those in Asia-Pacific were the ones most pessimistic about the state of their countries’ economies, with 85 percent saying their current condition is worse than that six months ago. The developing markets follow closely at 81 percent; India, 67 percent; Latin America, 53 percent; Europe, 51 percent; and North America, 47 percent.

And the outlook for the next six months isn’t hopeful, with the majority of regions saying they expect the economic growth rate to contract—in Asia-Pacific, it’s 73 percent of respondents; Europe, 60 percent; North America, 58 percent; and developing markets, 58 percent.

Only Latin America and India showed some positivity, with 45 percent and 60 percent of their respondents, respectively, saying their growth rate will increase in the next six months.

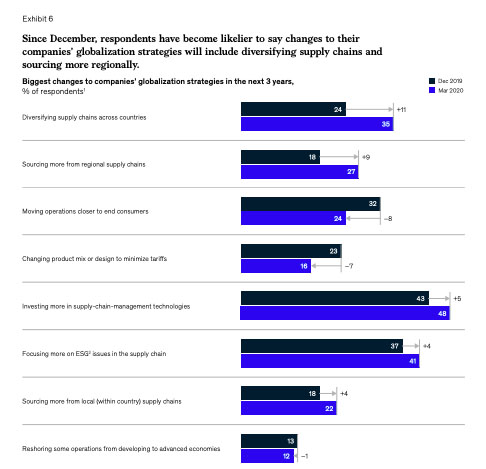

The overall somber outlook have already pushed large multinational companies to reexamine and make changes to their globalization strategies, the report says.

Such strategies include investment plans, sourcing, supply-chain management and global footprint. Respondents also said they were now more likely to diversify their supply chains, and were looking into sourcing more from regional ones.

But hope springs eternal: Respondents also say that they expect customer demand to increase than decrease (39 percent versus 28 percent), and 42 percent say they expect their companies to eventually increase profits. INQVisit https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Economic%20Conditions%20Snapshot%20March%202020%20McKinsey%20Global%20Survey%20results/Economic-Conditions-Snapshot-March-2020-McKinsey-Global-Survey-results-FINAL.ashx for more information.