METHODOLOGY: DATA AND ANALYSIS ON THE TOP 5 MOST VISITED E-COMMERCE PLATFORMS IN INDONESIA, SINGAPORE, MALAYSIA, THAILAND, VIETNAM AND THE PHILIPPINES WERE OBTAINED BY SIMILAR WEB

As people turn toward online stores and marketplaces to buy what they need during the lockdown due to the COVID-19 pandemic, brands could take into consideration which platforms are most visited by consumers to ensure that they still reach their target markets—and here in the Philippines, these are Lazada, Shopee, Zalora and BeautyMNL, says the “Year-end Report on Southeast Asia’s Map of E-commerce.”

According to the report, put together by price comparison website and online catalogue iPrice Group in collaboration with mobile data and analytics platform App Annie and web analytics services company Similarweb, in the Philippines, Lazada’s market share is at 59 percent, with over 34 million visits in a month. The marketplace is followed by Shopee, with over 19 million monthly visits (33-percent market share) and Zalora, with almost two million visitors.

BeautyMNL comes in fourth place with almost 830,000 visits, and in fifth is Ebay with almost 770,000 visits. In sixth to tenth place are: argomall (484,000 visits per month), O Shopping (almost 255,000), galleon (245,000), ubuy (almost 194,000) and Sephora (145,000).

As for the mobile e-commerce apps, Lazada, Shopee and Zalora are also Filipinos’ top favorites, in that order, based on monthly active users (according to the report, an active user is defined as “a device having one or more sessions with an app in the time period,” meaning a single person could represent more than one active monthly user if he or she actively uses these apps on multiple devices).

SimilarWeb provided all data on total visits on desktop and mobile websites in the study, which were taken from the sites’ global traffic figures as of January 2020. The study, however, doesn’t include the following industries: e-ticketing, financial services, rental services, insurance, delivery service, food and beverage, meta-search, couponing, cashback websites, as well as e-commerce that solely provides classified ads/peer-to-peer service. App Annie, on the other hand, was responsible for collection of mobile usage data. Aside from the Philippines, the report analyzed five other Southeast Asian markets: Thailand, Vietnam, Malaysia, Singapore and Indonesia. The study reveals that across the region, Shopee and Lazada also dominate the e-commerce industry, with the former slightly overtaking the latter when it comes to traffic performance.

The report also looks at how much time consumers spend on e-commerce platforms, and shows that the Philippines ranks third among the six markets in terms of average duration of visit (10 minutes, two seconds). Topping the list is Thailand (12 minutes, 11 seconds), followed by Indonesia (11 minutes, 23 seconds).

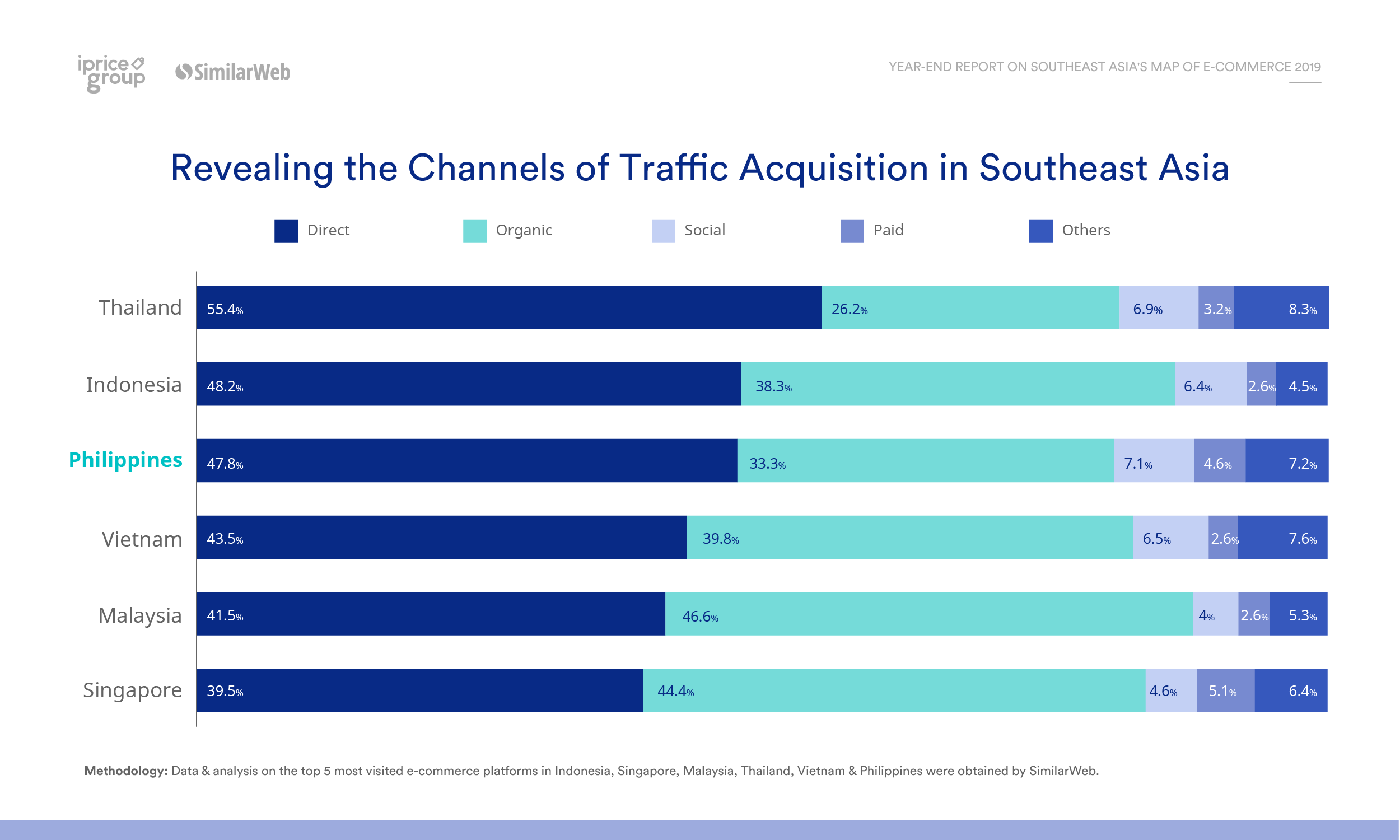

The year-end report also states that brand strength is highly important in relation to traffic acquisition, as, across Southeast Asia, 48 percent of web visits are done directly (meaning consumers type the website URL directly into their browsers). Organic searches are another main acquisition channel for e-commerce players, indicating the importance, too, of search engine optimization for these companies.

As for product categories, the ones most patronized by Southeast Asians are: electronics (40 percent, with consumers spending an average of P1,869 a day), fashion (25 percent; average spend is at P1,112) and home and living (15 percent; average spend, P1,162). The figures are roughly the same for the Philippine market, states the report.

Finally, the report highlights the vital role of “shoppertainment” in the e-commerce business. Events such as Lazada’s quiz game, “Guess It!” on its app, and Shopee’s Live Festival, which was held in six countries, don’t just drive traffic—they encourage loyalty, too, among customers.

Visit https://iprice.ph/insights/mapofecommerce/en/ to read the whole study.