The enhanced community quarantine implemented over a week ago due to the threat of the 2019 coronavirus disease (COVID-19) had people panic buying, rushing to supermarkets to ensure their pantries would not run out of stock during the lockdown. Such behavior is an example of how consumer behavior shifts upon reaching certain threshold levels related to specific events surrounding COVID-19, says a recent study by US information, data and measurement firm Nielsen.

In an article published on their website, Nielsen identified six threshold levels, which “offer early signals of spending patterns, particularly for emergency pantry items and health supplies”: proactive health-minded buying, reactive health management, pantry preparation, quarantined living preparation, restricted living, and living a new normal.

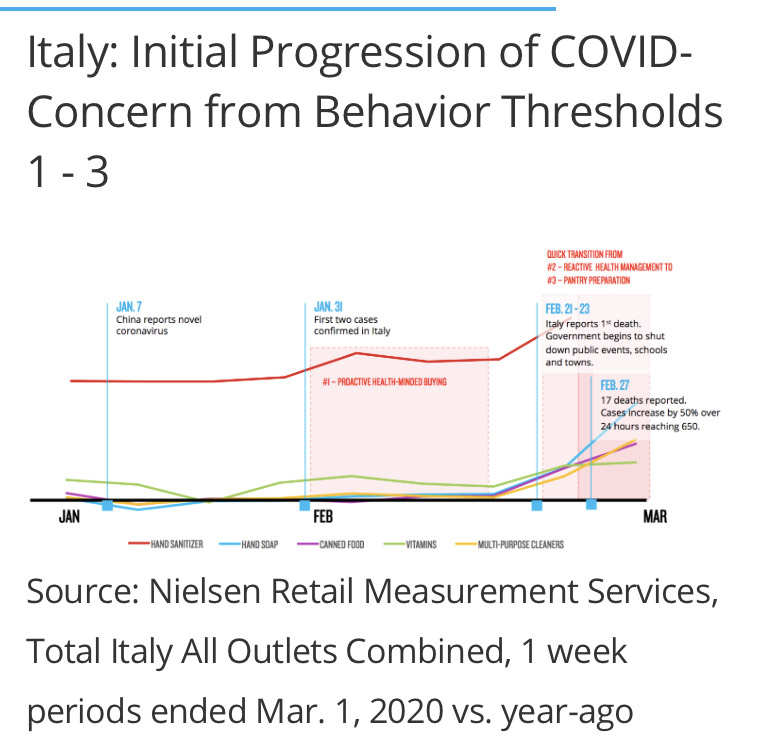

Each threshold represents, specifically, a change in consumer behavior and a COVID-19 event marker, the report says. Proactive health-minded buying starts when a country or community has minimal localized COVID-19 cases “generally linked to an arrival from another country”—a threshold that the most of the world has already passed. At this stage, consumers are merely interested in products that support overall maintenance of their health and wellness.

Threshold No. 2, reactive health management, is reached when the first local COVID-19 transmission—which has no link to other cases in other locations, or the first COVID-19-related death/s—happens. At this stage, people begin prioritizing products necessary to virus containment, health and public safety, such as face masks.

Analyzing the US market, Nielsen identifies a Feb. 26 press conference by US President Donald Trump, which included a statements on stocking up on essential items, as a “clear driver that shifted public concern” from reactive health management to the next level: pantry preparation. At this threshold, there are multiple cases of local transmission, as well as multiple deaths related to the pandemic. By this time, consumers would be stockpiling both shelf-stable foods and a wider variety of health-safety products, therefore packing stores and growing their basket sizes.

“Pantry preparations among US consumers have fueled record sales of more than just masks and hand sanitizers. Sales have also peaked for antiseptics, cleaners, over-the-counter cold remedies and other health-related essentials. Consumers also rushed to stock their pantries with shelf-stable food during the last week of February, as seen in the huge sales leaps of dried beans (+37 percent), canned meat (+32 percent) and rice (+25 percent),” the report states.

By the time threshold level four, or quarantined living preparation, is reached, consumers will have turned to online shopping (social distancing is key). Inventory and supply chain problems begin to arise. This level is marked by localized COVID-19 emergency actions, as the number of cases begins to increase.

The restricted living threshold, would see “severely” limited shopping trips, as well as fulfillment of online orders. Pricing may also be affected because of stock issues. By this time, communities would also be in lockdown (the Philippines’ current reality), and there would be mass cases of COVID-19.

South Korea and Italy appear to be at threshold levels four and five.

The final threshold level, living a new normal, is what the world eagerly anticipates: Daily routines are reinstated, but with people operating more cautiously with regard to their health. There would also be “permanent shifts” in supply chain, the use of e-commerce, and hygiene practices, too, the report states. By this time, quarantines would have been lifted.

So far, only parts of China appear to be at level 6, the report says.

Studying these threshold levels and how they affect consumer behavior—which can still change, depending on the developments that surround COVID-19—can help businesses figure out how to maintain their supplies, especially of in-demand products.

“We’re already seeing additional markets enter the threshold of ‘restricted living.’” says Nielsen’s global intelligence leader Scott McKenzie. “As patterns begin to emerge in response to news events of this nature, it will be imperative for companies to learn from these scenarios so they can sustain growth even in times where COVID-19 has uprooted people’s lives. “The outbreak has already caused an array of changes in shopping behavior and we’re focused on understanding the ones that will come next, how long they’ll last—and whether any will stay with us after the outbreak is behind us.” INQ

Read the entire article here: https://www.nielsen.com/us/en/insights/article/2020/key-consumer-behavior-thresholds-identified-as-the-coronavirus-outbreak-evolves/?utm_source=sfmc&utm_medium=email&utm_campaign=newswire&utm_content=3-18-2020