Black Thursday: Worst day ever for PSEi

The local stock barometer crashed below the critical 5,000 level on Thursday as coronavirus (COVID-19)-weary investors went on a selling frenzy after a two-day market lockdown.

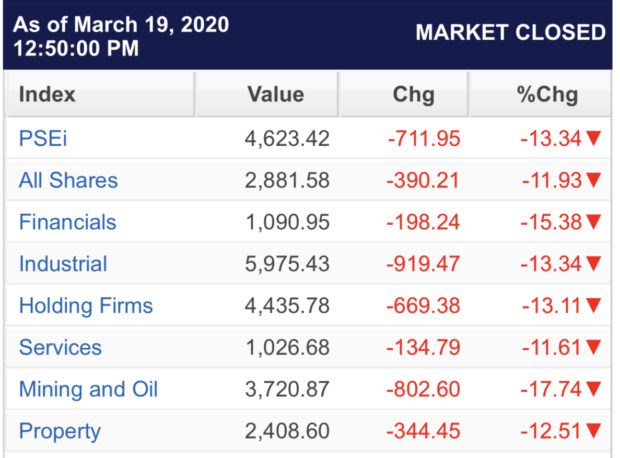

The main-share Philippine Stock Exchange index (PSEi) dived by as much as 1,296.22 points or 24 percent in early trade, before trimming some losses. The barometer still lost 711.95 points or 13.34 percent to close at an eight-year low of 4,623.42, becoming the worst performer in the region for the day.

It was the steepest single-day PSEi decline seen in history, outdoing the freefall seen in 2008, at the height of the global financial crisis.

“What we saw today is historic and unprecedented with wild intraday swings of more than 700 points. Market disruptions, despite good intentions, have their consequences. In our case, it was another circuit breaker-induced halt at the resumption of trading,” said Jose Vistan, head of research at local stock brokerage AB Capital Securities.

“The COVID-19 scare continues to be the main catalyst that’s driving market volatility. COVID-19 brings both certainty and uncertainties. What is certain is it has affected the economy in every way possible. What is uncertain is when this pandemic will end,” Vistan added.

After two days of no trading, the main index opened much lower as investors rushed to sell, triggering a circuit breaker in the first few minutes of trading, said Christopher Mangun, head of research at AAA Equities.

The circuit-breaker triggers a 15-minute trading halt after the PSEi falls by over 10 percent, but it can only be applied once within any trading session.

“Major cities all over the world are implementing a lockdown to curb the spread of the deadly disease. The spread of the virus in Europe is worse than what we saw in China, according to some health workers, spurring a massive sell off in equities across the globe. Here at the PSE, the nightmare continues,” Mangun said.

Local stock, bond and foreign exchange markets were locked down on Tuesday as Pres. Rodrigo Duterte ordered that only private establishments providing basic necessities as well as those related to food and medicine production, business process outsourcing (BPO) and export-oriented industries, may remain open during the “enhanced community quarantine” that now covers the whole of Luzon island.

As capital market infrastructure providers managed to convince the government to exempt financial markets from the lockdown, the PSE was able to resume trading after two days.