Tycoon Lucio Tan-led Philippine National Bank aims to hurdle this year the remaining stumbling block to its merger with Allied Bank and beat the record-high profit posted in 2010 with improved recurring earnings.

PNB also launched on Tuesday an offering of long-term debt notes qualifying as tier 2, or supplementary capital, worth at least P5.5 billion. The indicative yield is 6.5 to 7 percent per year.

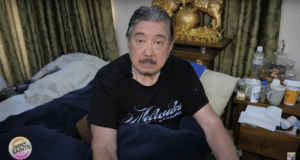

In a briefing, PNB president Eugene Acevedo estimated that the merger with Allied Bank via a share-swap would result in up to P1.5 billion in extraordinary expenses. But in the years ahead, he said synergies from the merger could translate to cost savings of about 10 percent for the surviving entity, which will be PNB.

Acevedo sees “higher chance of success” of the PNB-Allied Bank merger being cleared this year given “constructive” discussions with US banking regulators on the sale of Allied Bank’s stake in California-based Oceanic Bank. The sale of Allied Bank’s stake in the US bank is a precondition to US regulators’ consent to the much-delayed PNB-Allied Bank merger.

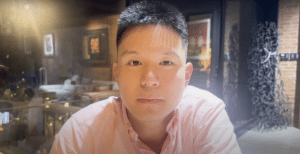

In the meantime, PNB executive vice president and head of treasury Horacio Cebrero III said proceeds from the tier 2 offering would be used to refinance P5.5 billion worth of older tier 2 notes that PNB will redeem in August.