Asian markets take another hit as virus quickly spreads

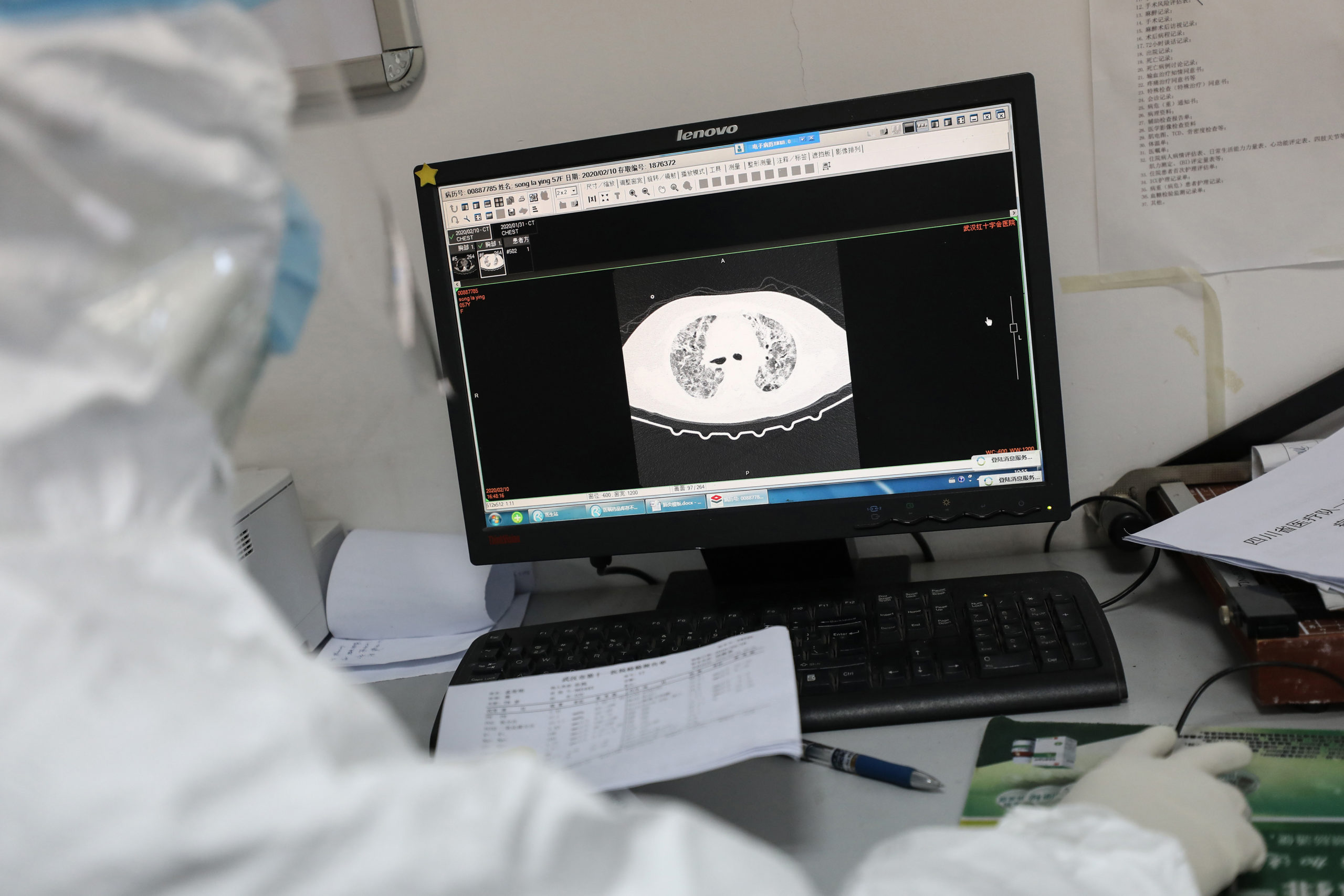

This photo taken on February 16, 2020, shows a doctor looking at a CT image at the Wuhan Red Cross Hospital in Wuhan in China’s central Hubei province. (Photo by STR / AFP) / China OUT

HONG KONG — A sea of red washed across Asian markets on Wednesday, with the coronavirus spreading rapidly around the world and health chiefs warning that governments were not prepared for the outbreak.

The heavy selling, after a day of relative calm caused by bargain-buying, followed another rout on Wall Street where all three main indexes lost around three percent after officials said COVID-19 would likely take hold in the United States.

With cases being reported in new countries – and lockdowns in some nations including Austria, Italy, and Spain – traders are growing increasingly fearful about the impact on the global economy.

The death toll is now at more than 2,700 while those infected are approaching 80,000 though new cases in China, the epicenter, are falling.

At the World Health Organization (WHO) headquarters in Geneva, Bruce Aylward, who headed an international expert mission to China, hailed the drastic quarantine and containment measures taken by the country.

Article continues after this advertisementBut he told reporters that other nations were “simply not ready” for reining in the outbreak, adding: “You have to be ready to manage this at a larger scale… and it has to be done fast.”

Article continues after this advertisementWHO said countries must “prepare for a potential pandemic” – a term used to describe an epidemic that spreads throughout the world.

Tokyo stocks ended the morning down more than one percent, having shed more than three percent Tuesday, while Hong Kong lost 0.8 percent and Shanghai fell 0.2 percent.

Sydney, Seoul, and Wellington were all down more than one percent and Manila tumbled more than three percent as it resumed trading after a one-day holiday. Jakarta, Taipei, and Singapore were also well down.

‘Concern of the unknown’

“It’s the concern of the unknown,” David Kudla, at Mainstay Capital Management LLC, told Bloomberg TV. “The question is, is the selling getting a bit overdone or is it a more appropriate response to how far coronavirus has spread, and that eventual impact to the economy.”

With panicking investors rushing into safe havens, the yield on 30-year US Treasury bills are sitting at record lows, while the Japanese yen climbed and the dollar advanced against high-yielding currencies.

However, the dollar was being kept in check by speculation the Federal Reserve could cut interest rates to support markets, though for now, officials are saying the US economy remains in rude health.

Oil prices edged up after three days of steep losses that have wiped about seven percent off both main contracts, though observers warn the virus’s spread to the giant US economy could deal it further pain.

The VIX “fear” index is at its highest level in more than a year, though gold, usually a main target for those seeking shelter from the turmoil, was subdued with analysts suggesting this could be down to traders cashing out to cover equity margin calls.

“To suggest the market is a tad skittish over the coronavirus becoming a pandemic could very well be the understatement of the century with the virus morphing into the market’s biggest macro worry of the decade,” said AxiCorp’s Stephen Innes.

Still, Gorilla Trades strategist Ken Berman added: “In light of the quick spreading of the virus, the global economy is likely to suffer, at least, a short-term shock, but should the outbreak slow down during the spring, we could see a swift economic recovery.”

Key figures around 0300 GMT

Tokyo – Nikkei 225: DOWN 1.1 percent at 22,357.39 (break)

Hong Kong – Hang Seng: DOWN 0.8 percent at 26,691.88

Shanghai – Composite: DOWN 0.2 percent at 3,008.59

Dollar/yen: UP at 110.47 from 110.20 at 2200 GMT

Euro/dollar: DOWN at $1.0867 from $1.0883

Pound/dollar: UP at $1.2998 from $1.3001

Euro/pound: DOWN at 83.61 pence from 83.69 pence

Gold: DOWN 0.5 percent at $1,645 per ounce

Brent Crude: UP 0.6 percent at $55.29 per barrel

West Texas Intermediate: UP 0.7 percent at $50.26

New York – Dow: DOWN 3.2 percent at 27,081.36 (close)

London – FTSE 100: DOWN 1.9 percent at 7,017.88 (close)

For more news about the novel coronavirus click here.

What you need to know about Coronavirus.

For more information on COVID-19, call the DOH Hotline: (02) 86517800 local 1149/1150.

The Inquirer Foundation supports our healthcare frontliners and is still accepting cash donations to be deposited at Banco de Oro (BDO) current account #007960018860 or donate through PayMaya using this link.