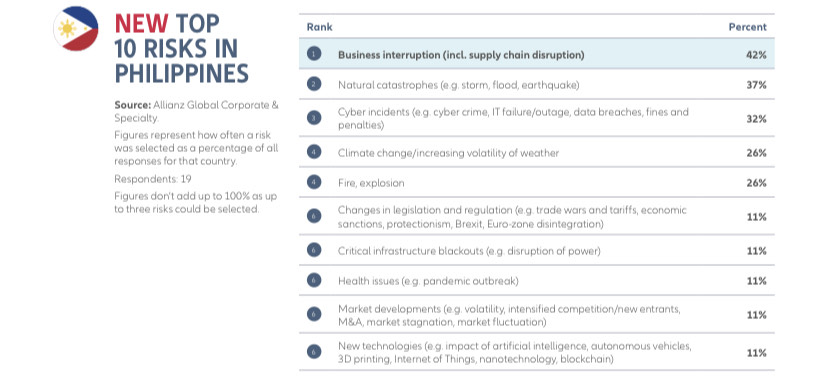

These are top three risks to businesses in the Philippines cited by local organizations, according the Allianz Risk Barometer: Identifying the Major Business Risks for 2020 report published by global corporate insurance carrier Allianz Global Corporate & Specialty (AGCS).

Now on its ninth year, the report shows the results of a survey conducted among over 2,700 respondents from 22 industry sectors, which include Allianz customers (global businesses), brokers and industry trade organizations from 102 countries. Also surveyed were risk consultants, underwriters, senior managers and claims experts in the corporate insurance segment of both AGCS and other Allianz entities.

The survey was held from October to November 2019 among a mix of large, mid and small-sized enterprises. Respondents were asked to select the industry about which they were particularly knowledgeable, and to name up to three risks they deemed most relevant to them.

While the Philippines, which makes its debut on the report this year with 19 respondents, ranked cyber incidents as its top third business threat, such risk made it to the top of the global list, after receiving 39 percent of survey responses.

These incidents include cybercrime, IT failure/outage, data breaches, fines and penalties, states the report. Seven years ago, this risk ranked only 15th on the list (6 percent); its climb to the top this year can be seen as a result of companies collecting and using larger volumes of data.

Globally, the peril of cyber incidents is followed closely by business interruption (which includes supply chain disruption), with 37 percent of responses. According to the report, this used to be identified by respondents as their No. 1 risk for several years, until it was dethroned by cyber incidents this year.

In the Philippines, however, this is still seen by organizations as their top risk (42 percent).

According to the report, business interruption and cyber-related risks are closely interlinked, especially with companies’ increased reliance on digital technology.

“The inability to access data for an extended period of time can have a significant impact on revenues—for example, if a company is unable to take orders,” the report reads.

Digital supply chains, while efficient and more transparent, also open businesses to the risk of interruption, since one glitch can have a domino effect, especially if multiple companies under one umbrella organization are sharing the same system.

The report makes an example of an incident in June 2019: an outage caused a catastrophic failure at some Google cloud services, causing several hours of disruption to a number of large online service providers, including YouTube, Uber and Snapchat.

Political violence is also another cause of business interruption, and it’s usually underestimated, the report states. In Hong Kong, for example, the civilian unrest has already caused a 40 percent year-on-year drop for the tourism industry.

Fires and natural disasters, though, remain the major causes of business interruption, which makes this risk also closely related to what Philippine companies see as their No. 2 threat: natural catastrophes, which is natural, given the number of storms, earthquakes and other disasters the country experiences in a year.

Just last month, ashfall from the Taal Volcano eruption damaged over 4,000 hectares of coffee farms, according to news reports. The Philippine Coffee Board has been quoted saying this could result to up to P2 billion in losses for the country’s coffee industry.

The eruption also continues to affect businesses in neighboring Tagaytay City, which has built its tourism industry around its cool weather and unparalleled view of the active volcano.

Other risks expected by Philippine businesses for the year 2020 include: climate change/increasing volatility of weather (identified by 26 percent of respondents); fire, explosion (26 percent); changes in legislation and regulation, such as trade wars and tariffs, economic sanctions, protectionism, Brexit, Euro-zone disintegration (11 percent); critical infrastructure blackouts (11 percent); health issues, such as a pandemic outbreak (11 percent); market developments (11 percent); and new technologies (11 percent).

(Figures don’t add up to 100 percent as up to three risks could be selected by respondents). INQ

Read the full report here: https://www.agcs.allianz.com/content/dam/onemarketing/agcs/agcs/reports/Allianz-Risk-Barometer-2020.pdf.w