PH seen weathering nCoV impact

ING economists Nicholas Mapa and Rob Carnell

The Philippines can still eke out a reasonable growth rate of 6.4 percent this year despite the China-epicentered coronavirus contagion, which gnaws on regional tourism, logistics/supply chain, transportation and consumer sectors, Dutch financial giant ING said.

For now, ING does not see this phenomenon resulting in a global recession, as its assumes that the outbreak would be contained, overseas infections would be relatively low and that it will largely remain a China and a bit of Asian phenomenon, Rob Carnell, ING head of research for Asia-Pacific, said in a briefing on future.

“The future story—and we’re encouraged not to speculate wildly on this and I get that [because] we’re not medical genius—if we start seeing the data in a worrying direction, then we’ll be chopping the numbers. I’d say we’d be chopping them aggressively,” Carnell said.“The bigger question for me is if this spreads out, if it becomes global, if Europe and US are suddenly looking very soft, then we have to factor in a global recession into our numbers so it’s not just a domestic impact, not just a China impact. We have to figure out a global impact,” he added.

In the case of the Philippines, ING Philippine economist Nicholas Mapa projected that coronavirus would shave roughly 0.2 percentage points to gross domestic product (GDP) to 6.4 percent from the previous outlook of 6.6 percent.

The new GDP growth forecast is a bit short of the government’s target growth of 6.5-7.5 percent but an improvement from last year’s growth rate of 5.9 percent. Overall, Mapa said 6.4 percent would still be a “reasonable” number.

“Growth will come from capital formation rebound. Last year it was a drag, but this year, it comes back in the big way, with BSP (Bangko Sentral ng Pilipinas) cutting overnight borrowing rates by another 25 basis points in May or June. This should help revitalize capital formation,” Mapa said.

The economist said there were also some “green shoots” when it comes to bank lending, which was constrained by tight financial liquidity in the past.

Mapa said the BSP might push back the next round of reduction in the reserve requirement on banks to the second semester of the year. “But it looks like they are ready to fire as soon as they see liquidity conditions tighten, so both fiscal and monetary sector will be providing a lot of stimulus so it should cushion the fallout [from coronavirus],” he said.

Carnell said the coronavirus fear transmission in an economy would mostly affect retail, food, transportation, hospitality and recreation. INQ

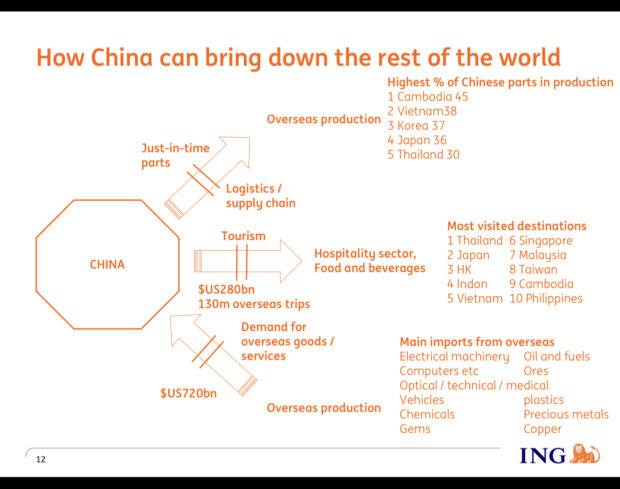

ING’s diagram on how China can affect the rest of the world