While the retail industry has experienced a general slowdown all over the world, possibly because of digital tech advancements, the Philippines’ local retail scene is far from dying, and, in fact, is seen to continue steady growth, given that foreign brands still choose to set up shop in the country’s urban centers, says a report by international real estate services firm Cushman & Wakefield.

The report “How Global Brands are Shaping the Metro Manila Retailer Landscape” details how many new foreign brands recently entered the Philippines, and the factors that make the local market attractive to them. It also discusses which retail categories—and foreign countries—are dominating the industry, as well as the locations they are choosing to establish their stores.

Over the past three years, 102 new foreign brands entered the Philippines, 68 of which opened between 2017 to 2018, states the report. An additional 34 brands opened during the period of January-November 2019.

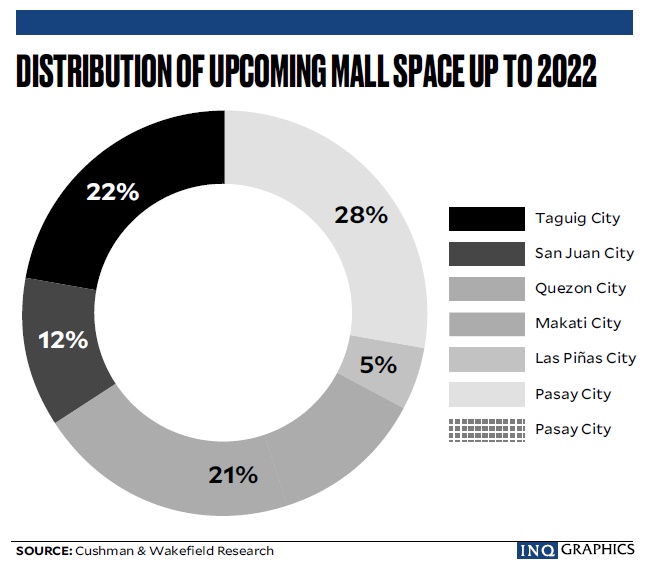

As for existing foreign retailers, the report says that these brands took advantage of the country’s “upbeat retail sector” by actively expanding, given that the number of shopping malls also continues to grow. In terms of space, mid- to high-end shopping malls in Metro Manila has occupied 8.9 million square meters as of end of 2019. Quezon City, with a population of 2.9 million (roughly 23 percent of Metro Manila), has the largest share of the existing supply. By 2022, shopping mall space in Metro Manila is expected to reach 9.8 million sq m, with major expansions happening in Bay Area, which covers the cities of Manila, Pasay and Parañaque, the report stays.

The incessant addition of retail space is just one reason why the Philippines is defying the “retail apocalypse” happening elsewhere, especially in the United States where, according to the report, almost 6,000 stores closed two years ago.

Foreign brands choose the Philippines also because of its high consumer spending (it accounts for roughly 68 percent of total gross domestic product); ideal demographics (Philippines is the second most populous country in Southeast Asia, with an estimated overall population of 107 million in 2018, half of which are below the age of 24—not to mention the growing middle class population who have more income to spend); booming tourism industry; improvements in its business climate; and overall strong macroeconomic fundamentals.

The influx of these new brands, the report further notes, is dominated by the food and beverage (F&B) segment (63 percent). However, rate of entry is just as high as rate of closure.

According to the report, foreign F&B brands, which entered the Philippine market in 2019 include Shake Shack, Popeyes Louisiana Kitchen, and Panda Express from United States; Menya Kokoro, FRNK, Shari Shari Kakigori House, and Beard Papa from Japan; Jim’s Recipe from Malaysia; Elephant Grounds, Honolulu Café, and Hui Lau Shan from Hong Kong; Ministry of Crab from Sri Lanka; and The Alley, Presotea, Original Cake, OneZo Tapioca, JLD Dragon, Grand Castella Cake, Xing Fu Tang, and Puffy’s Soufflé from Taiwan.

The report further notes that Asian brands dominate this segment (63 percent of new retailers), and that majority come from Japan and Singapore.

Still, even with the sustained growth of retail in the country, Cushman & Wakefield highlights the popularity of e-commerce and how it is shaping the future of the Philippines’ retailer market—hence the need for companies to have a digital strategy in place.

In this regard, the report recommends that brands go for omni-channel retailing—a system which integrates seamlessly the online and offline retail experience.

In detail, the report explains omni-channel retailing: “Omni-channel retailing works on the idea that consumers browse and compare products before making a purchase. Whereas its main goal is to improve physical store experience with the digital exposure, it starts even before the customers visit the store. [It] is triggered when the customers reach the brand’s website.

Basedon [their] interaction on the website, their digital footprints are immediately evaluated.

“The customers are then retargeted after leaving the website and upon their transition from one channel to another, even though they have not made any purchase yet. [They] will then be shown personalized ads and promotions. The strategy … eventually refers customers to nearby brick-and-mortar stores.”