The Philippines is one of the fastest growing economies in the region. Its growth is mainly consumption driven, with household spending covering nearly 60 percent of the country’s annual economic output.

Growth drivers

A major plank of this growth is the overseas Filipino workers’ remittances, which account for about a tenth of the country’s gross domestic product (GDP). Remittances grew by 6 percent a year from 2010 to 2018 and are projected to increase between 3 percent and 4 percent this year.

The outsourcing market has been expanding, with mid-management to C-level executives of higher-value knowledge process outsourcing and shared service firms partly driving the demand for residential units in Metro Manila and other urban areas.

Another sector that fuels this is the micro, small, and medium enterprises (MSMEs) sector. These businesses have been expanding by an average of 3.5 percent a year since 2015. According to the Department of Trade and Industry, there are about 998,000 MSMEs in the country as of end-2018.

Meanwhile, the continued influx of foreign tourists as well as the sustained inflow of foreign direct investments over the past eight years have propelled the demand for both vertical (condominium) and horizontal (house and lot) projects.

The sustained growth of the country’s economy, rising on the back of sustained remittance and foreign investment inflows as well as outsourcing revenues, resulted in multiplier effects spilling over to other key sectors, including property. With limited investment options in the market, investing in condominium units has become one of the more viable investment vehicles in the market.

Rising purchasing power, coupled with growing acceptance for condominium living, further contributed to higher demand for vertical projects in Metro Manila, especially those targeting mid-income market.

The mid-market segment —for vertical or condominiums, and horizontal or house and lot projects—cover those priced from P3.2 million to P6 million a unit. For lots, prices range from P960,000 to P1.8 million.

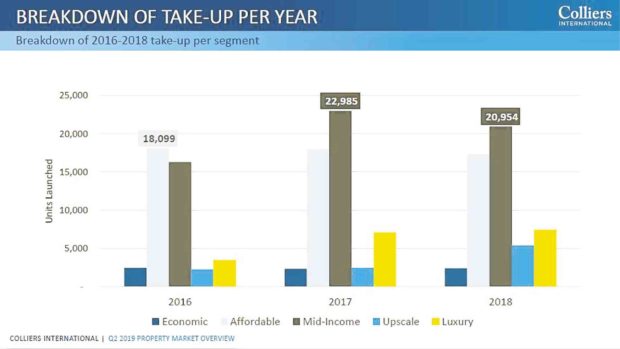

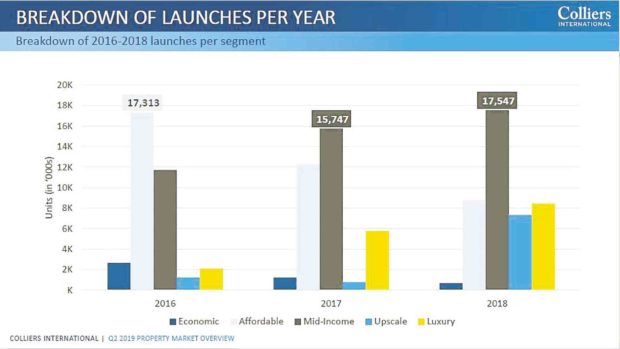

From 2016 to 2018, mid-income condominium projects in Metro Manila covered about 40 percent of total launches, with aggregate take up also accounting for 40 percent.

While developers want to launch more affordable units (priced at P1.7 million to P3.19 million a unit), firms have been scrambling to do so due to lack of developable land as well as surging land values in Metro Manila. Dearth in new affordable projects in the metro is being offset by a more aggressive launch of mid-income projects.

Previously untapped market

The Philippine real estate sector has been growing since the early 2000s due primarily to rising household incomes and an unmet demand for housing.

Mainly driven by OFW remittances, the housing sector has been on an upswing, dipping only momentarily during the global financial crisis of 2009. Unlike the previous real estate booms which were fueled by speculative buying, the current demand for housing comes from the end user, who now has the means to purchase housing.

Local developers recognize that the middle class’ housing requirement is largely untapped, prompting them to shift their development towards the thriving mid-market segment.

Developers saw this thriving opportunity in the market. We see the mid-income market being driven by an economy expanding by an average of 6.3 percent a year from 2010 to 2018.

Sustained macroeconomic growth points to a healthy liquidity in the market and these funds are being funneled into a number of residential projects, including those specifically marketed to mid-income consumers. This is primarily composed of business owners, professionals and OFWs. Some are repeat buyers of key developers.

While end-user demand is strong, some of these units are also being utilized as investments. With limited options in the market, investing in a mid-income condominium market has become a highly viable option for Filipino investors, especially for OFWs looking for feasible investment options for their hard-earned savings.

Mid-income housing in urban areas ex-Manila

Over the next three years, demand for mid-market residential units, particularly H&L, in the provinces should be supported by sustained remittances from the OFWs.

The sustained growth in remittances, along with decelerating inflation and the central bank’s decision to cut interest rates, should result in a cheaper cost of borrowing money.

Developers looking for sites with strong end-user demand for mid-income house-and-lot, and lot-only projects should consider provincial locations such as Bulacan, Pampanga, Cavite, Laguna, Batangas and Davao. These areas are located in regions that have been growing by about 7.4 percent a year from 2010 to 2018. These regions likewise cover about 38 percent of the Philippine economy.

Together with Metro Manila, these growth areas account for a whopping 74 percent of Philippine GDP and corner bulk of annual OFW remittances.

In our opinion, investors and end-users will continue to gravitate towards mid-income market, with major developers likely to cash in on this demand.

We believe that end-users will opt for mid-income units in mixed-use satellite communities as these further enhance working and living conditions.

Investors are also likely to continue choosing mid-income projects due to possible enhancement of yields.

How should developers tap the opportunities presented by a thriving mid-income market?

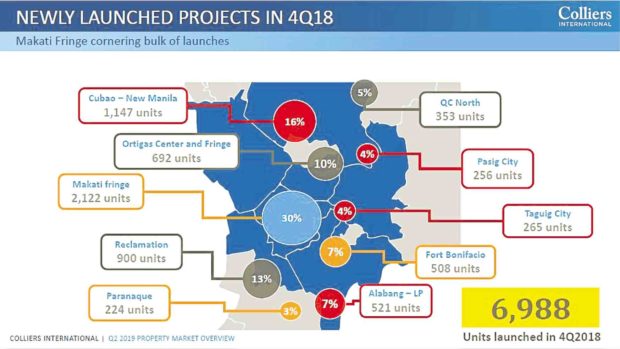

Developers should highlight features of projects in the fringes. The lack of developable land and soaring prices in central business districts are driving more investors and end-users to consider condominium units on the CBD fringe.

To capture this demand, we encourage developers to highlight the overall living experience in their projects to be considered viable options. In particular, developers should highlight their projects’ quality of life, landscape features, retail options and accessibility.

In our opinion, these are among the common features of mid-income condominium projects in the market now.

Investors should consider the potential for capital appreciation. Both the end-users and investors should look at the possible capital appreciation of condominium projects that will likely be built near future key infrastructure projects.

Increased connectivity to be brought about by the Manila Light Rail Transit and Metro Rail Transit (LRT-MRT) Common Station, MRT 7, Bonifacio Global City (BGC)-Ortigas Link bridge, LRT-1 Extension and Manila Subway, for instance, should propel property prices in key locations in Quezon City, Ortigas Center, Fort Bonifacio, Makati CBD, even the Bay Area.

The upside should extend to nearby provincial sites such as Cavite, Laguna, San Jose del Monte in Bulacan, and Clark and Angeles in Pampanga.

Attractive price points

Starting in 2016, Colliers recorded declining take-up for affordable units which we partly attribute to slower launches.

But this is being offset by the increasing sales of projects catering to the mid-income market. We encourage developers to continue launching projects for this segment while gauging its capacity for higher-priced projects over the next three years.

Outside Metro Manila, we see vast potential in developing mid-income housing units in second-tier and third-tier cities, where demand comes from end-user buyers. The markets may be smaller compared to Manila but more stable in terms of end user housing demand.