A new office space hotspot

Latest data from Pronove Tai International Property Consultants and JLL Philippines showed that Quezon City has seen a remarkable rise in the number of projects being built and completed in this city.

Bulk of Q3 supply

According to Pronove Tai, Quezon City and Taguig City accounted for 82 percent of the total supply in the third quarter, adding roughly 230,000 sqm and 101,000 sqm, respectively.

“This has been Quezon City’s highest recorded supply in a quarter. We saw a 10 percent growth year on year in Quezon City coming from nine buildings. This alone accounted for 57 percent of the new supply in Metro Manila this quarter,” said Pronove Tai president and CEO Monique Pronove.

In contrast, Muntinlupa, Bay Area and Makati had only one to two buildings completed, while Ortigas Center and Mandaluyong had no recorded completions from July to September.

In total, the third quarter this year saw the completion of 15 new buildings adding 402,000 sqm to Metro Manila’s office stock. This brought the “all grade” office stock to a total of 11.4 million sqm, Pronove added.

JLL Philippines, meanwhile, reported that on the whole, about 483,600 sqm of leasable office space were completed in the third quarter, most of which are in Taguig City and Quezon City. These two cities were said to lead in terms of geography, attributed to the large amount of supply completed in the third quarter that was able to absorb large office space requirements.

Record-setting year

Overall, the office property market remained resilient amid headwinds faced by companies engaged in IT and business process management (IT-BPM) and the Philippine offshore gaming operators (Pogo). Driven by a strong demand, the office property market is reportedly on track to achieving another record-setting year, Pronove said.

To recall, the Office of the President imposed in June this year a moratorium on the issuance of Philippine Economic Zone Authority (Peza) accreditations in Metro Manila. This was part of the government’s decentralization plan to push stronger economic activity in suburban areas. In August, the Philippine Amusement and Gaming Corp. (Pagcor) said it would no longer grant licensing permits to new Pogo applicants until the end of the year.

“Amid these challenges, the office leasing market remained strong and we project it to reach 1.2 million sqm by the end of December 2019. This would breach last year’s record performance by 9 percent,” Pronove reported.

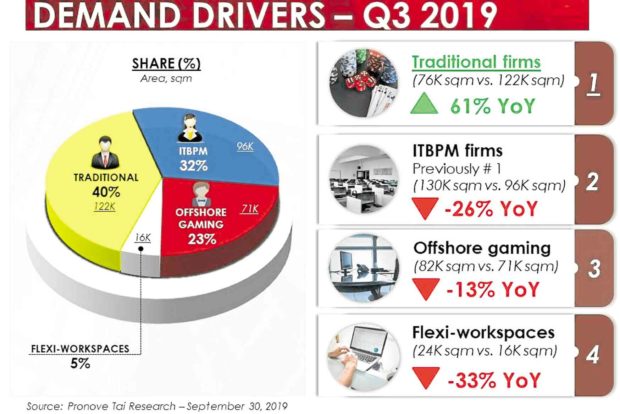

Demand drivers

Pronove Tai tracked a total of about 305,000 sqm of actual leasing and pre-leasing transactions from July to September.

Of the demand, traditional offices accounted for 40 percent or 122,000 sqm, followed by IT-BPM at 32 percent, offshore gaming at 23 percent and flexi-workspaces at 5 percent

“The third quarter proved to be an exceptionally strong period for the traditional firms with a significant 61 percent growth year on year from only 76,000 sqm last year. The top five growing industries were banking and finance, food and beverages, insurance, government offices and real estate,” Pronove said.

“Makati, the country’s premier business district, accounted for the most leasing transactions at 28 percent. The Bay Area accounted for 20 percent, characterized mostly by Pogos, and then Quezon City at 17 percent with IT-BPM accounting for most of the leasing transactions there this quarter,” she added.

JLL Philippines meanwhile reported that as of third quarter, offshoring and outsourcing (O&O) firms, Pogos and flexible work operators continue to drive demand for office spaces.

“Global firms (continue) to bank on the highly skilled talent found in the Philippines to optimize their cost of operations. Particularly, O&O leads the market in terms of lease transactions in the third quarter, making up more than half of the total size transacted,” JLL said in a statement issued Thursday.

“Offshore gaming operators from mainland China continue to bring strong leasing demand. The industry is seen to stay intact after the government’s announcement to keep operations running despite Beijing’s request to cease all forms of gambling. Lastly, both foreign and local operators of flexible workspaces (continue) to expand in several parts of Metro Manila,” it further reported.