Visibility, incentives and customization.

These are the three main factors that affect an online merchant’s sales, whether targeted toward individual consumers or enterprises, says a recent report by multinational package delivery and supply chain management company UPS.

In “Pulse of the Online Shopper,” UPS published the results of its Asia-Pacific study derived from responses to their online survey conducted among 4,000 consumers and 240 businesses from various industries across four markets (Australia, China, Hong Kong and South Korea), between Dec. 2018 and Jan. 2019.

Focusing on individual consumers, the majority of those who responded to the survey belonged to the 25 to 34 age group (32 percent), followed by the 35- to 44-year-olds (24 percent).

Over two-thirds were residents of a metropolitan or large city, while 25 percent came from a suburban community of a city; 10 percent, a small town; and 3 percent, a rural or farming area.

To these consumers, visibility means, first and foremost, transparency, from the beginning to the end of their “purchase journey.”

It’s a journey that doesn’t necessarily start with the online shop, but the research that consumers do—also online—about the product they wish to purchase.

According to the report, individual consumers research mostly about product pricing, its details, delivery costs and the availability of promos and discounts.

In Australia and Hong Kong, the majority use the search engine as their main research tool.

In South Korea, however, consumers usually go to price comparison websites, while in China, most rely on information on marketplaces and consumer review pages.

With e-commerce going cross-border, many Asia-Pacific consumers (75 percent) said they had purchased products from international sellers.

They do make it a point, though, to check beforehand if a merchant is located overseas, otherwise, there is a large possibility that they will abandon the cart at checkout.

The report says knowing this information before the final stages of their purchase allows customers to better adjust their expectations when it comes to delivery times and shipping costs.

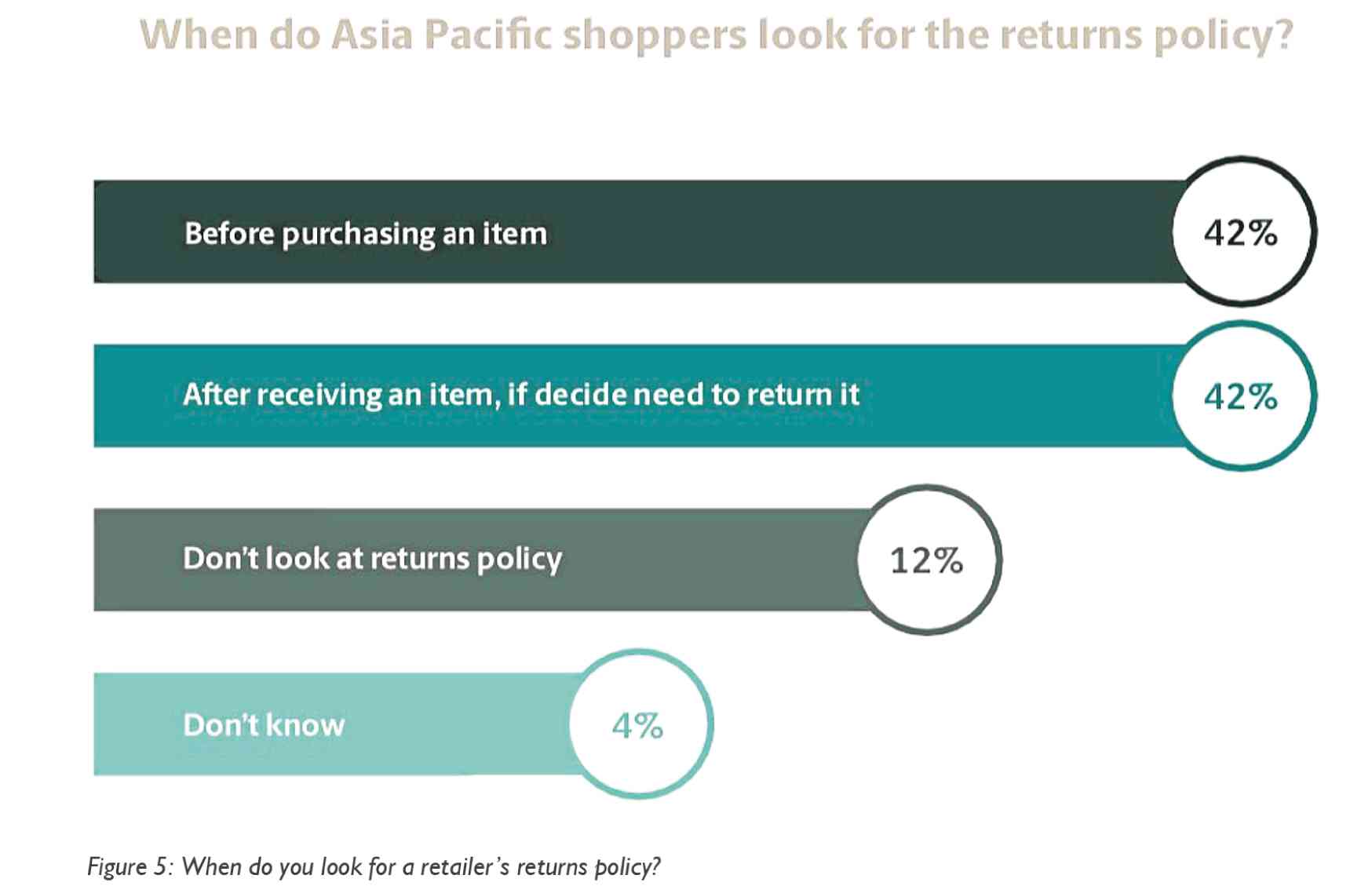

Visibility, lastly, also involves a merchant’s return policy—and they want one that is stated clearly.

However, the report says Asia-Pacific consumers are the least likely worldwide to say they are satisfied with the returns process, with almost one-fifth saying they are dissatisfied. The study further reveals that almost 70 percent of Asia-Pacific shoppers say that the returns experience impacts their overall perception of a business.

As for Asia-Pacific enterprises, most make online purchases to meet their daily business needs, says the report. To vet a supplier, most use search engines to find out more about a company (53 percent). If a supplier passes the vetting process, it must also provide clients the fully landed cost of a product (factoring in all duties and taxes) to seal the deal. Like individual shoppers, Asia-Pacific businesses are also particular about being informed about a supplier’s return policy before agreeing to any contract.

The second major factor, incentives, involves the combination of convenience and right pricing. Convenience means a seamless, hassle-free shopping experience; consumers may be discouraged to shop online if the website isn’t user friendly, for example.

Shoppers also tend to abandon their carts if the price isn’t right, especially when it comes to delivery costs—almost 40 percent admitted to doing so because the delivery fee quoted was higher than what they expected. Online merchants, however, can think of solutions to this issue, such as lowering shipping costs by lengthening the delivery period, or allowing consumers to consolidate items into a single purchase to reduce the shipping cost.

Businesses, on the other hand, are incentivized more by a product’s quality more than affordability, and, according to the report, will frequently look to international merchants to find what they need. For the majority of both businesses and individual shoppers, a sellers’ smooth returns policy, again, affects their loyalty to merchants.

Customization, lastly, means offering consumers “the flexibility to tailor their shopping experience to their needs,” the report reads. Merchants can do so by maximizing multiple sales platforms and providing flexible delivery solutions (including allowing delivery to a variety of locations, not just one’s home). As for business clients, the study reveals that it is important for them that suppliers have the ability to handle deliveries to more than just one location.

Read the full report here: https://solutions.ups.com/pulse-2019-ph-en.html?WT.mc_id=pressroom_2019apacpotos_mkto.