Riding on the buoyant local property market, Sta. Lucia Land Inc. (SLI) is planning to raise as much as P8.4 billion from a follow-on or re-initial public offering (re-IPO) of shares this November.

The 23-year-old property developer has filed with the Securities and Exchange Commission (SEC) a prospectus for the offering of up to 2.7 billion primary shares plus an extra allotment of up to 300 million shares in case of excess demand.

The shares will be offered for at least P2.26 to as much as P2.80 per share and listed on the main board of the Philippine Stock Exchange (PSE), based on the prospectus dated Aug. 22.

The fresh capital will be used to fund capital expenditures for ongoing projects, strategic land banking and other general corporate purposes. SLI will not use any of it to repay debt.

China Bank Capital was mandated to underwrite the offering, which will comprise 26.79 percent of SLI’s shares after the re-IPO.

The plan is to hold the offering from Nov. 18 to 29 and list the new shares on Dec. 9—all subject to the approval of the SEC and the PSE.

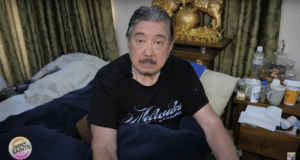

SLI, which is led by businessman Exequiel Robles, became a public company through the backdoor listing route in 2007. It is currently valued by the stock market at P20 billion. —DORIS DUMLAO-ABADILLA