ArthaLand and Japanese property giant Mitsubishi Estate partner for its first venture in the Philippines

ArthaLand Corporation (ALCO) recently signed an agreement with Mitsubishi Estate Company, Ltd. (MEC), which is one of the largest real estate developers in Japan. This agreement will be Mitsubishi Estate’s first venture in the Philippines. Mitsubishi Estate is acquiring from ALCO a 40% stake in ALCO’s ownership of Savya Land Development Corporation, which is developing the Savya Financial Center in ARCA South, Taguig City.

Artist’s perspective of the Savya Financial Center (ARCA South, Taguig City)

“We are pleased to join the promising Philippine market and collaborating with a good partner, ALCO. ArthaLand has great experience in providing valuable and sustainable developments to the Philippine society. It was one of the important elements for us in deciding who we would be working with,” said Yutaro Yotsuzuka, Managing Director of Mitsubishi Estate Asia.

Under the terms of the partnership, ArthaLand will take the lead in managing the operations of the project while Mitsubishi Estate will offer its expertise to further improve the project’s value.

“We are honored to be chosen as the partner by Mitsubishi Estate in their first venture in the country and we stand to gain from their over 100 year experience in property development, architecture research, and design,” said Jaime C. González, Vice Chairman and President & CEO of ArthaLand.

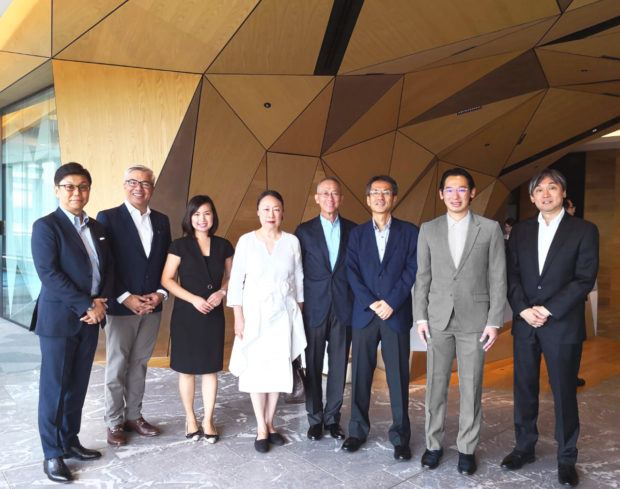

From left to right: Hiroshi Kato, Executive Director of Mitsubishi Estate Asia; Christopher G. Narciso, Executive Vice President for Business and Project Development of ArthaLand; Sheryll P. Verano, Senior Vice President for Strategic Funding and Investments of ArthaLand; Marie Constance Y. González; Jaime C. González, Vice Chairman and President of ArthaLand; Atsushi Nakajima, Senior Executive Officer of Mitsubishi Estate Company; Leonardo Arthur T. Po, Executive Vice President and Treasurer of ArthaLand; and Tetsuya Masuda, Deputy General Manager, Mitsubishi Estate Company.

The Philippines’ positive economic outlook attractive to MEC

According to Mitsubishi Estate, the Philippines has continuously grown its economy at a relatively higher level as against other ASEAN countries.

“We believe such economic growth will continue because of the current administration’s economic policies such as the Build, Build, Build as well as its strong fundamentals. Hence, we thought there will be a lot of business opportunities in this country and we also thought there will be a lot of possibility for Mitsubishi Estate Group in which it can bring its expertise,” said Yotsuzuka.

Mitsubishi Estate will proactively continue expanding its business in the Philippines.

A partnership that will withstand the test of time

According to Leonardo Arthur T. Po, Executive Vice President and Treasurer of ArthaLand, “We are aligned with Mitsubishi Estate’s values in building legacy projects. It validates our position in the industry as a leader in timeless design, high quality, and sustainable developments. We look forward to building more commercial office projects with Mitsubishi Estate.”

The partnership with Mitsubishi Estate is highly strategic. ArthaLand stands to gain from Mitsubishi Estate’s global perspective and development experience. It will allow the company to further improve its quality, its systems and learn new techniques in architectural design, engineering, and sustainability.

“It is always very important for us to have the same philosophy and corporate vision with our joint venture partners when we do business. Going through the discussion with ArthaLand, we found common interests and values,” said Yotsuzuka.

Actual photograph of ArthaLand Century Pacific Tower (5TH Avenue, Bonifacio Global City)

Mitsubishi Estate boasts of its leading position in the Japanese market, developing commercial, residential and retail properties.

With a capitalization of approx. US$24B, the strength of Mitsubishi Estate lies in its comprehensive business structure, covering businesses ranging from development to leasing and property management. As of 2018, Mitsubishi Estate has the most valuable portfolio in the Japanese real estate industry, much of which is located in the Marunouchi district of Tokyo which has grown into Japan’s leading business district. Mitsubishi Estate owns Japan’s second tallest building, the Yokohama Landmark Tower, as well as the Sanno Park Tower and Marunouchi Building in Tokyo. Around 40% of MEC’s total revenue is generated from its office building business, while its residential business generates approximately 35% and approximately 10% is from its International business.

Actual photograph of Mitsubishi Estate’s Marunouchi Park Building (Marunouchi, Tokyo)

Actual photograph of Mitsubishi Estate’s Marunouchi Building [center left] and Shin-Marunouchi Building [center right] (Marunouchi, Tokyo)

Savya Financial Center is envisioned to be the new capital address for business and commerce in ARCA South, Taguig City.

Launched in early 2019, construction is already underway for the Savya Financial Center – a new premium mid-rise office development with a fully integrated retail component. Situated in the highly connected new business district of ARCA South in Taguig City, both the North and South towers of Savya are designed and built with modern, smart and sustainable building features, pre-certified Gold with the US Green Building Council’s Leadership in Energy and Environmental Design (LEED) and registered with the Philippine Green Building Council’s BERDE. Sustainable features combined with exemplary building design, that is meant to deliver function with form, Savya aims to provide a beneficial work environment that will boost energy and resource efficiency, reduce operating costs and promote a healthier and more productive office space.

Image photo of Mitsubishi Estate’s 1271 Avenue of the Americas [under renovation] (Midtown Manhattan, New York City)