No mere lip service

When it comes to cosmetics, Pinoys love to pucker up and experiment with the one product that defines their whole look: their lipstick.

This is one key finding of “Beyond Skin Deep: Understanding the shopping journey of the Southeast Asian beauty buyer,” a report released by media intelligence company Meltwater. The report, which details the latest beauty trends in four Southeast Asian countries (the Philippines, Singapore, Malaysia and Indonesia) aims to help brands ride the “online wave” that has taken over the beauty industry.

The report is based on an analysis of online content related to beauty and cosmetics that appeared from July 1 to Dec. 31, 2018, in social media platforms, blogs, review sites and forums.

One major trend revealed by Meltwater’s research is the popularity of lip products on social media in all four markets.

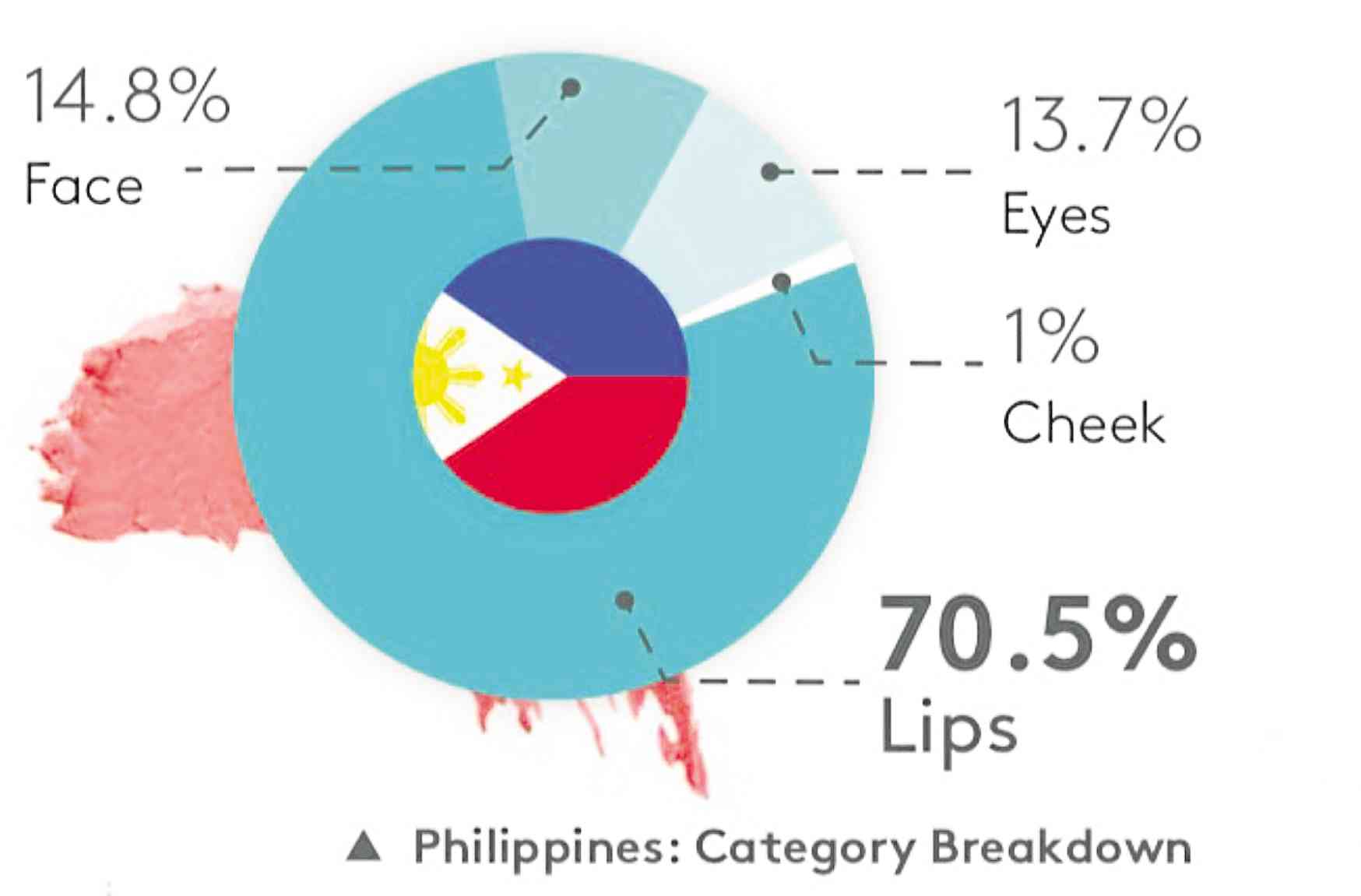

In the Philippines, over 70 percent of online conversations on makeup revolved around the lips. A deeper analysis shows consumers were most interested in product application, as well as tips on how to create unique looks by layering or mixing lip products, the report states.

Across the region, lips also dominated online chatter at 49 percent, compared to other makeup categories (face, 26 percent; eyes, 24 percent; cheek, 1 percent). Focusing on the top three lipstick shades, research revealed that most consumers searched for “orangey red,” followed by “pinkish brown,” and “real red.” As for product finish, the most discussed one was matte, followed by glossy, then satin.

The report also delved into these four markets’ favorite cosmetics brands, and found that only three multinationals dominate the beauty scene, accounting for 39 and 49 percent of the market in the mass and premium categories, respectively: Estée Lauder, Unilever and L’Oréal.

The report notes consumers are also becoming more interested in J-beauty—move over, K-beauty!—since many regional residents are traveling more frequently to Japan, consequently increasing the exposure of popular beauty products on social media.

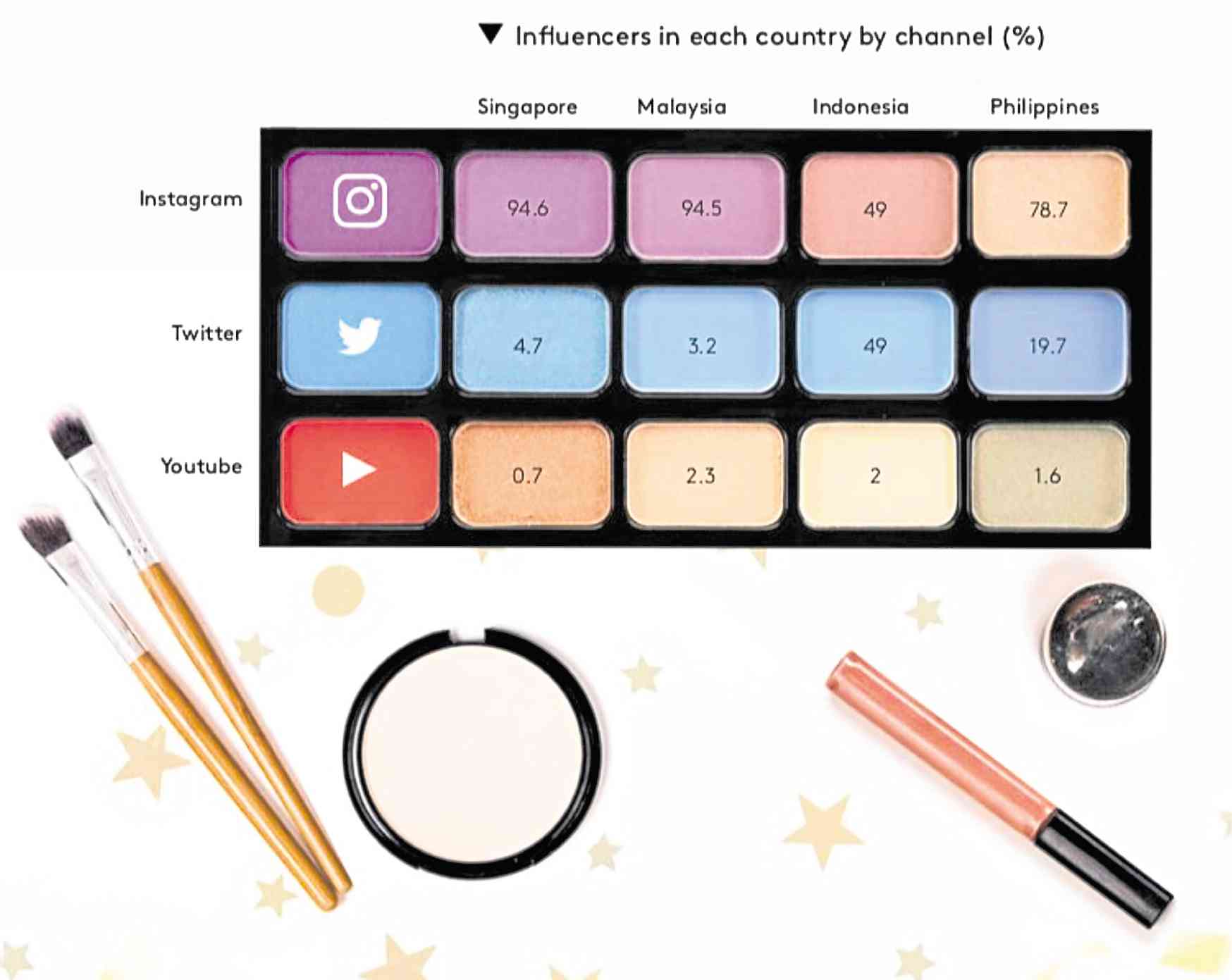

And when talking about beauty, one cannot discount the rise of online influencers. One significant finding is that Instagram is the go-to platform of brands for talent-led collaborations, and that there are eight times more beauty influencers on IG than Twitter.

Here in the Philippines, Anna Cay (@annacay) is identified by the report as the country’s top makeup vlogger and aficionado, as she received a score of 94 out of 100 on Meltwater’s social influencer discovery tool, which ranks influencers based on their popularity, content, social media presence, audience and engagement rates.

So what’s a brand to do to stay on top of these trends? The report recommends the following:

Find the right influencer talent using data. Don’t just go for the pretty face with a high number of followers; look at how well they perform in terms of engagement, and evaluate that person to see if he or she is the right fit for the brand and product.

When it comes to platform, it’s all about the ‘Gram since it apparently delivers the highest return on investment for brands and influencers.

Use sophisticated artificial intelligence and social listening tools to predict trends, to be able to better respond to consumers’ needs.

Finally, don’t present a one-size-fits-all approach—create more personalized beauty products and experiences. Inclusivity is key to brand success.