Cement-maker Eagle Cement Corp. posted a 44-percent year-on-year growth in its first semester net profit to P3.3 billion as the company sold more cement and did so at higher prices.

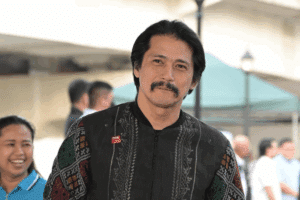

“Our robust results in the first half of the year reaffirm our positive stance toward the industry. We will continue to leverage on the growing local cement demand led by the private sector and supported by the infrastructure push of the government. We will execute this by offering world-class, quality cement products at affordable prices,” Eagle president and chief executive officer Paul Ang said in a disclosure to the Philippine Stock Exchange.

For the second quarter alone, Eagle’s net profit rose by 39 percent year-on-year to P1.7 billion.

This was driven by a 22-percent year-on-year growth in net sales to P5.1 billion while cash flow also gained by 21 percent to P2.2 billion while margin was kept at 44 percent.

For the six-month period, Eagle’s net sales rose by 28 percent year-on-year to P10.5 billion, owing to the 21-percent sales volume growth and improved cement selling prices.

First semester cash flow rose by 21 percent to P4.2 billion.

Total assets went up by 7 percent to end the first semester at P48.8 billion. Meanwhile, total liabilities grew by 11 percent to P14.1 billion and stockholder’s equity rose by 6 percent to P34.7 billion.

The company is also on track to complete its 1.5-million metric ton (MMT) grinding capacity expansion in 2020, bringing its current annual cement output to 8.6 MMT in its Bulacan plant.

For line 4 in Cebu, Eagle has secured the approval of the Department of Environment and Natural Resources Region VII for the special use agreement for protected areas (SAPA) permit needed for the construction of the port. With this, Eagle expects to sell cement in the Visayas region by end-2020. —DORIS DUMLAO-ABADILLA