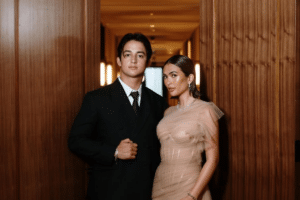

Security Bank Corp. has named ex-Citibanker Sanjiv Vohra as its new president and chief executive officer effective July 1, taking over Alfonso Salcedo Jr.

This brings the leadership of Security Bank, which is 20-percent owned by Japanese banking giant MUFG, to expatriate hands for the first time in its history.

Upon his retirement, Salcedo, 63—who served as president and CEO from 2015—will remain as director and will chair the executive committee. On the other hand, former Security Bank president Rafael Simpao Jr. will retire as director effective June 30 and will become a senior adviser to the board.

The 58-year-old Vohra is no stranger to the Philippine market as he previously headed Citibank Philippines for eight years.

In a statement on Tuesday, Security Bank chair Alberto Villarosa explained that the organizational changes reflected the bank’s focus on ensuring the continuity of the overall business strategy formulation and execution.

“With the appointment of Sanjiv Vohra, the bank is manifesting the institution’s commitment to professionalism and to bringing in leaders who not only understand the Philippine market but the global markets as well. The banking business is truly becoming globalized and cross-border transactions, partnerships and alliances are now becoming the new normal,” Villarosa said.

Villarosa cited Vohra’s deep experience in banking, having held a number of senior leadership positions in Asia at Citibank, ABN AMRO Bank, the Royal Bank of Scotland, Deutsche Bank and MUFG Bank, alongside his experience in the domestic market as country chief of Citibank Philippines.

“I am confident that he can bring Security Bank to the next level,” he said.

Vohra noted that he would be joining Security Bank at a time when the bank had built up its retail banking business “as a strong and sustainable third business pillar under the brand promise and commitment of better banking.”

“The bank has made all the right moves in these last few years. I believe that Security Bank is in a very good position to take advantage of the growing domestic market while making the most out of the synergies available through its strategic alliances, including the partnership with MUFG. I truly feel privileged in getting this opportunity to lead this franchise,” he said. —DORIS DUMLAO-ABADILLA