Best tax options for small businesses

The deadline for paying the income tax for 2018 has passed, and so time again to prepare for next year’s filing.

It is a chore, but one that does not exempt working Filipinos, including the self-employed and professionals (SEPs).

All SEPs are required to file their returns, even those who are exempt.

One thing to keep in mind is that filing returns is not necessarily the same as having to pay taxes. Sometimes, the taxes have already been withheld. The taxpayer could also be exempt, as in the case of barangay microbusiness enterprises, or BMBEs.

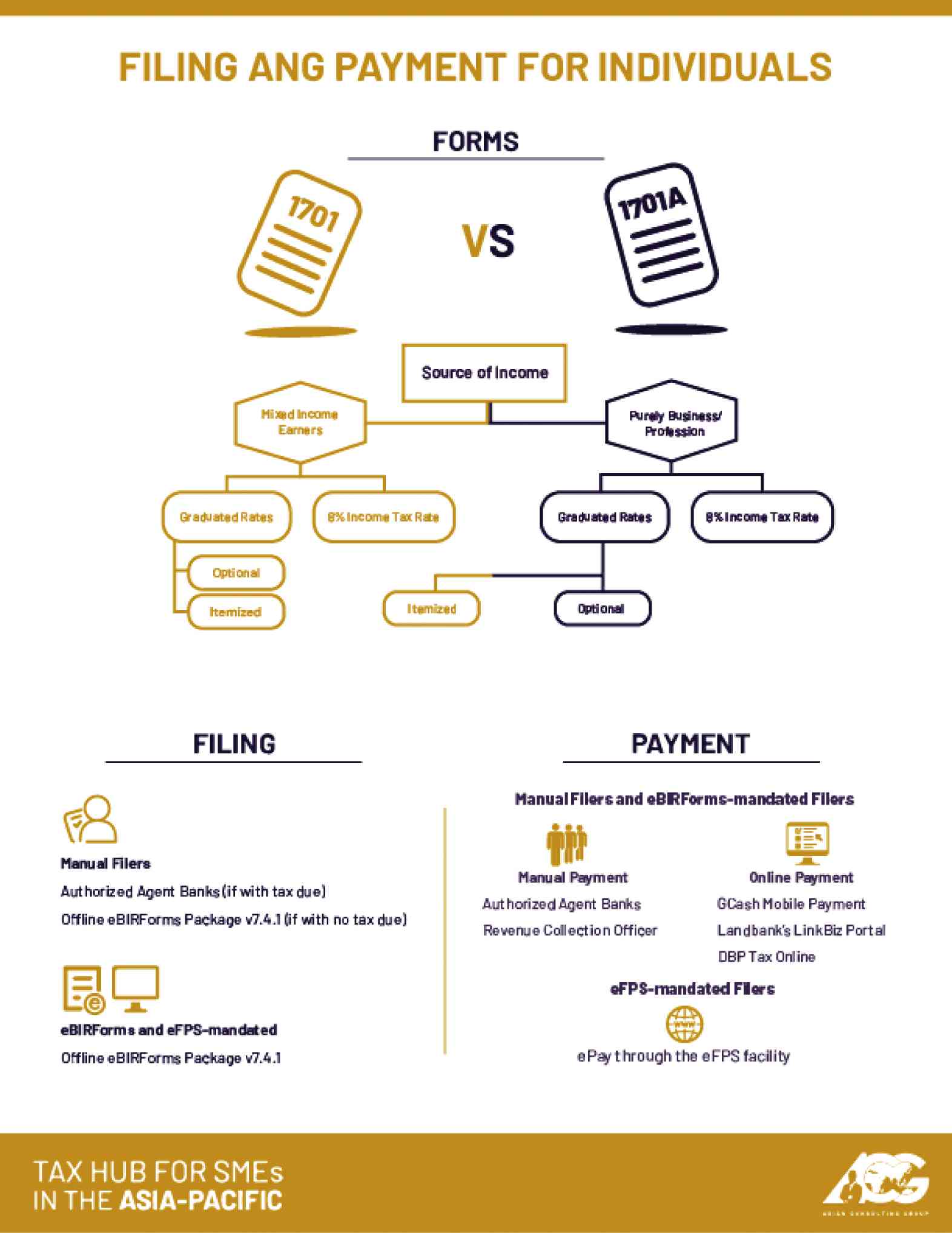

There are a variety of options that affect the taxes micro, small and medium enterprises have to pay. These options also determine the forms they should use and their method of filing and payment.

For income tax, the first option (aside from registering as a BMBE) starts with the choice of income tax schedule.

There are two main options—the default graduated income tax rates or the flat 8 percent income tax rate.

The graduated income tax imposes rates ranging from 20- 35 on taxable income. The other option calls for an 8 percent tax on gross sales/receipts.

These options require different forms and methods for filing income tax returns. But the options do not end there.

Should the taxpayer decide to use the graduated rates, they still have to choose their mode of deduction, either itemized deductions or the optional standard deduction.

Under itemized deductions, the taxpayer can list down all of his deductible expenses and could even result in the taxpayer having zero tax due.

However, the taxpayer will have to substantiate every deduction, which can be quite tiring.

Taxpayers choosing this option need to use BIR Form No. 1701, comprised of four pages. The same form needs to be used whether your income is purely from business/profession or if it is mixed income.

Under optional standard deduction (OSD), the taxpayer can avail himself of up to 40 percent of gross sales or receipts as a deduction.

This means that only 60 percent of gross sales or receipts will contribute to their taxable income.

While this deduction is generally smaller than the itemized deduction, it is also much more convenient.

From here, if the taxpayer opts to use the OSD, there are two methods of filing.

SEPs who also have compensation income are called mixed income earners and, for the purpose of tax filing, are required to use the BIR Form No. 1701 mentioned earlier.

However, SEPs who receive income purely from business or practice of profession, they can use the simpler and shorter BIR Form No. 1701A.

Aside from the graduated rates, the next option is the simpler 8 percent flat income tax rate.

However, not all taxpayers can avail themselves of this option. VAT-registered taxpayers and compensation income earners, for instance, are disqualified from using the 8 percent flat income tax rate.

Mixed income earners can still choose the 8 percent income tax but only on their business/professional income. Their compensation income will still be subjected to graduated rates.

For those earning purely from business/profession, the form to be used is BIR Form No. 1701A. Mixed income earners using the 8 percent flat income tax rate are required to use BIR Form No. 1701. —CONTRIBUTED

For more information, contact the author at consult@acg.ph or (02) 622-7720.