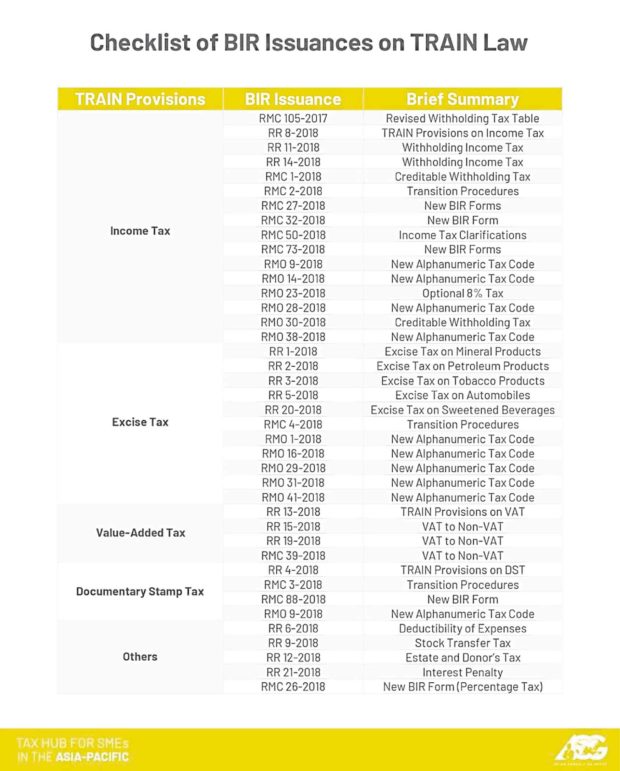

In the case of the Tax Reform for Acceleration and Inclusion (TRAIN) Act, the issuance was spread out through the year. In fact, the first of these regulations was released before 2018.

Revenue Memorandum Circular (RMC) No. 105-2017 was issued on Dec. 29, 2017.

It prescribed the revised table for the withholding tax on compensation income.

Since then, the Bureau of Internal Revenue (BIR) has released various regulations, circulars and orders to implement the first package of the government’s Comprehensive Tax Reform Program.

The first, and perhaps the most important part of the tax reform, is the lowering of the personal income tax. Subsequent regulations also clarified certain portions of the personal income tax, specifically the optional 8 percent rate.

Under TRAIN Law, self-employed and professionals were allowed to avail themselves of the optional 8 percent tax in lieu of the graduated personal income tax and percentage tax. The TRAIN Law also stated that it will be available to those whose gross sales do not exceed the VAT threshold.

Revenue Regulations (RR) No. 8-2018 clarified that VAT-registered taxpayers would not be able to avail themselves of the 8 percent rate, regardless of their gross sales. The regulation also clarified that electing the 8 percent rate should be irrevocable for the duration of the year.

It further stated that availing of the 8 percent had to be made in the First Quarter Percentage and/or Income Tax Return. Otherwise, the taxpayer would be deemed automatically subject to the graduated income tax rates.

Not all the issued regulations simply restate or clarify TRAIN. For instance, under the TRAIN Law, the rates on creditable withholding tax (CWT) shall be anywhere between 1 and 15 percent. The imposition of the specific rates is regarded as the privilege of the Secretary of Finance (upon recommendation of the BIR Commissioner).

RR 11-2018 imposed the rates for the CWT. The rate for professional fees could either be 5 percent or 10 percent for individual payees, or 10 percent or 15 percent for non-individual payees. It also clarified the new rates for various other types of income payments.

Of course, there were also regulations for the other aspects of the tax reform. As an offsetting measure, TRAIN imposed or increased excise taxes on certain products and services. These new rates needed to be supported by specific regulations.

RR 1-2018 was issued for mineral products, 2-2018 for petroleum products, and 3-2018 for tobacco products.

However, these issuances merely restated the new rates imposed by TRAIN, amending previous BIR issuances that covered the matter.

Later in the year, the BIR issued RR 5-2018 for automobiles and 20-2018 for sweetened beverages. These later issuances provided more details, explaining the new procedures and new forms to be used.

These amended tax rates (not just limited to excise taxes) required new alphanumeric tax codes as well. Revenue Memorandum Orders (RMO) were released throughout the year to cover the new rates for sweetened beverages (RMO 1-2018), personal income tax (RMO 28-2018), petroleum products (RMO 31-2018) and many others.

The implementation of these new rates will also take time. As such, the BIR released transitory procedures under RMC 2-2018, 3-2018, and 4-2018. These RMCs covered income taxes, documentary stamp tax, and excise taxes, respectively.

Another aspect of the first package is raising the VAT threshold to P3 million in annual gross sales. What TRAIN does not state is how taxpayers will actually be affected. For example, taxpayers earning P2.5 million annually will have been registered as VAT taxpayers, but were now below the threshold.

How will they transition from VAT to Non-VAT? What will happen to their receipts?

RR 13-2018 implemented the new provisions on VAT and provided its transitory provisions. According to the regulation, VAT-registered taxpayers that wanted to register as Non-VAT needed to update their registration and surrender their unused invoices.

They will still be able to use their invoices as long as they indicate that they will no longer be valid for claiming input taxes.

Taxpayers who wanted to continue as VAT taxpayers will be unable to cancel their VAT registration for a period of three years.

RR 15-2018 and, later, 19-2018 imposed the deadline for VAT taxpayers to update their registration to Non-VAT.

Other lesser-known provisions of the TRAIN Law also needed regulations to support them. Among these are estate and donor’s taxes, the deductibility of expenses, the stock transfer tax and the interest penalty.

RR 12-2018 prescribed the implementation of the donor’s tax and the estate taxes. Notably, the regulation allowed the withdrawal from the decedent’s bank account, subject to a final withholding tax.

RR 6-2018 applied the changes to the deductibility of expenses under TRAIN. The changes to the stock transfer tax were covered by RR 9-2018.

Another notable change implemented by TRAIN is the lowering of the interest penalty. Before TRAIN, the interest penalty is equivalent to 20 percent. Under TRAIN, this was changed to twice the legal interest set by the BSP. Since the current legal interest is 6 percent, this effectively lowered the rate to 12 percent.

RR 21-2018 clarified that the new interest rate would apply only to those deficiency assessments issued after the TRAIN Law passed. As such, deficiency taxes until the end of 2017 would still be subject to the 20 percent penalty.

These changes are hard to catch if taxpayers do not pay close attention. For example, there were only 25 days to update the registration from VAT to Non-VAT initially. RR 15-2018 was published on April 5, 2018, yet set the deadline to April 30, 2018.

This was later amended by RR 19-2018 to Aug. 31, 2018. Even so, it was published on Aug. 9, 2018, giving taxpayers only 22 days notice.

Taxpayers who did not pay close attention would have been locked as VAT taxpayers for three years had they missed those deadlines.

At best, these lesser known issuances could cause unwarranted hassle. At worst, it could cause failed compliance and, in turn, hefty penalties. Lack of tax education causes unnecessary expenses and penalties.

To avoid this, taxpayers must remain vigilant and continue to educate themselves.