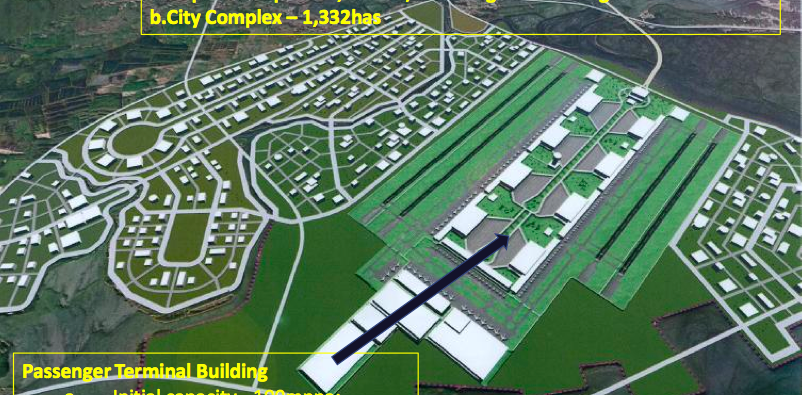

The plan for a P700-billion Bulacan Airport presented by the San Miguel Corporation to the Department of Transportation. (PHOTO FROM SMC PROPOSAL)

San Miguel Corp. (SMC) on Monday said it will abide by the demand of Finance Secretary Carlos Dominguez III for the conglomerate to financially guarantee the activities of its subsidiary that is proposing to build a P700-billion airport complex north of Metro Manila.

In a statement, the country’s biggest conglomerate said it had already indicated — as early as May of this year, after the project cleared Cabinet-level scrutiny — that it will sign an undertaking to back up San Miguel Holdings Corp. (SMHC) once the terms of the concession agreement are finalized by the government.

At a Senate hearing on the state of the country’s airports on Monday morning, Dominguez denied that his office was responsible for delaying the approval of the Bulacan airport project meant to replace the Ninoy Aquino International Airport as the country’s main aviation hub.

The Finance chief also expressed doubts that the conglomerate’s smaller subsidiary was financially capable of undertaking a project valued at over ten times its equity without the backing of the parent firm.

“San Miguel agrees with Secretary Dominguez on his position that both SMC and San Miguel Holdings Corp. should undertake a joint and several liability agreement for the New Manila International Airport project in Bulacan,” the company said.

“The final concession agreement will form the basis of what San Miguel will be guaranteeing and jointly liable for,” it added. “Very simply, the joint and several liability undertaking means that the project will be fully backed by the financial capability of San Miguel, the parent company of SMHC.”

The conglomerate said that, “given the importance, impact and urgency of building a modern, world-class airport to the nation and the Filipino people, San Miguel and SMHC will abide by the demands of the Department of Finance (DOF) to ensure the project takes off.”

San Miguel stressed that it is “more than capable” of handling the airport project, pointing to its historical performance in completing large infrastructure deals. It cited its strong balance sheet, consistent profitability and sustained growth, as well as liquidity to support its expansion and acquisition activities.

The project will be undertaken over a period of five to seven years to full completion. On average, spending levels will at about P100 billion each year which is at the level of the company’s cash from operating activities on a simple annualized basis, it said.

“There is a substantial debt space to supplement the cash requirements of the company for its priority projects including those of the other businesses,” San Miguel added. “The improving net debt to EBITDA ratio is way below the company’s debt covenant of 5.5 times.” /kga