Philippine stocks dip due to profit-taking, lingering Euro debt concerns

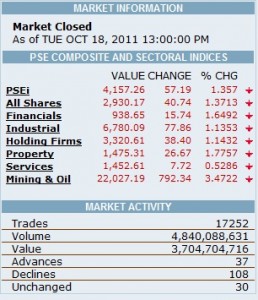

The lingering debt crisis in Europe, which, according to policy makers, might not be solved before the year ends, sent the benchmark Philippine Stock Exchange index (PSEi) down 1.36 percent, or 57.2 points, to close at 4,157.26.

The broader all-shares index fell by a similar 1.37 percent, with all sub-indices also ending the day in the red.

This came as decliners outpaced advancers by nearly three to one. A total of 30 issues were unchanged.

Mining shares lost the most, dragged down by issues like Philex Mining Corp. (4.67 percent) and Semirara Mining (3.53 percent).

A local brokerage firm earlier in the day said the market was due for a correction after several days of closing higher.

Article continues after this advertisementStocks may have also lost as a result of a “remote reaction from German leaders,” who said this week the European debt crisis might be far from being resolved. Policymakers likewise expressed fear that a Greek default would cause deep losses for many European banks.

Another issue that may continue to weigh on investors’ minds this week is the announcement that China—the region’s main growth driver—saw its economy grow 9.1 percent in the third quarter, the slowest in two years.