Despite opposition from certain members of Congress, Almendras was firm in his pronouncement that the biddings would push through by July, starting off with the independent power producer administrator (IPPA) contract for the 149-megawatt Naga power facility.

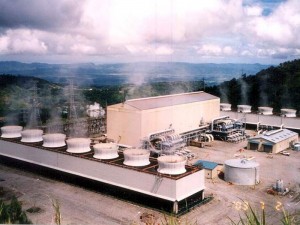

The IPPA contract for the 640-MW Unified Leyte geothermal complex would likewise be pursued within the third quarter despite a pending House bill seeking the deferment of the auction, according to Almendras.

Representative Lucy Torres-Gomez earlier filed House Bill No. 1937 seeking the deferment of the IPPA bidding for the geothermal facilities and the amendment of the Electric Power Industry Reform Act, which governs the privatization of the government’s contracted capacities in IPPs.

The sale of the Agus-Pulangi hydropower complexes in Mindanao would likewise push through although no definite date has been set. Almendras said the Department of Energy has started talks with Congress on the privatization of the hydropower facilities, which supply more than half of Mindanao’s electricity requirements.

The auctions will still be conducted by state-run Power Sector Assets and Liabilities Management Corp., of PSALM, which has been tasked under the Electric Power Industry Reform Act not only to privatize the government’s energy assets but to also manage the ballooning liabilities of another government firm, National Power Corp. (Napocor).

The energy chief said he expected the sale of all the government-owned power facilities and contracted capacities to be completed within five years’ time, after which PSALM will be spun off to become part of the Department of Finance.

Apart from stimulating competition in the energy market, the sale of these assets were meant to raise the much-needed funds to settle Napocor debts, which stood at a staggering $15.8 billion as of end-2010, down slightly from the previous year’s $16.5 billion.

So far, PSALM has managed to collect $4.85 billion from the sale of power assets, of which $4.84 billion was used to repay Napocor’s obligations. It has yet to collect $16.07 billion more from the privatization programs until 2029.