The local stock barometer clawed its way back to the 7,000 level yesterday as foreign selling abated alongside selective buying of blue chips.

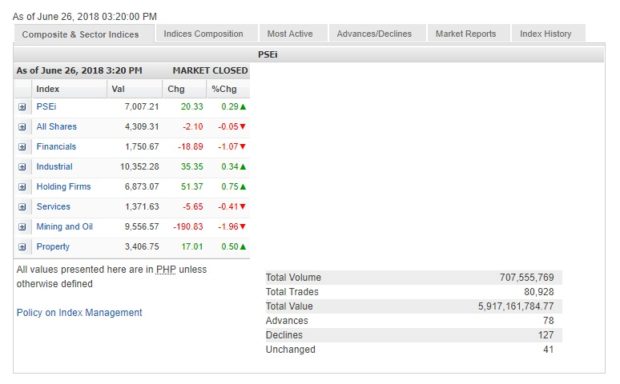

The main-share Philippine Stock Exchange index (PSEi) added 20.33 points or 0.29 percent to close at 7,007.21.

BPI Securities yesterday said that the stock market decline opened up a good buying opportunity.

BPI Securities president Haj Narvaez said: “Given the decline in the market, we believe that this would be a good entry point for newbie investors to slowly select stocks to hold on to for the next couple of years, and an opportunity for existing investors to consider undervalued companies.”

Narvaez advised beginners to proceed with caution.

“Only invest your excess cash, focus on the most heavily weighted PSEi issues, particularly conglomerates such as Ayala Corp.,” Narvaez said.

The PSEi was shored up by the industrial, holding firm and property counters, which all eked out modest gains.

On the other hand, the financial and mining/oil counters both tumbled by over 1 percent, while the services counter also slipped.

Total value turnover for the day amounted to P5.92 billion. There was a modest net foreign buying of P57.7 million yesterday.

Despite the PSEi’s gain, market breadth was negative. There were 127 decliners that edged out 78 advancers while 41 stocks were unchanged.

The PSEi was led higher by DMCI and JG Summit, which both rose by over 3 percent.

Investors also picked up shares of Ayala Corp., SM Prime, URC, Meralco and PLDT, which all gained over 1 percent.

Ayala Land, Jollibee and RLC also firmed up.