The local stock barometer ended in bear territory yesterday as foreign investors pulled more funds out of local equities ahead of the Bangko Sentral ng Pilipinas’ (BSP) widely anticipated decision to raise key interest rates by 25 basis points.

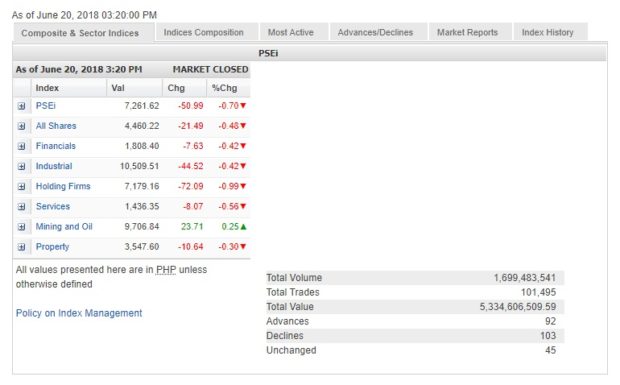

The main-share Philippine Stock Exchange index (PSEi) shed 50.99 points or 0.7 percent to close at a new 15-month low of 7,261.62, bucking the rebound across most regional markets as investors fretted over the underperforming local currency against an era of a strong US dollar.

The index has now slid by 1,816.75 or 20 percent from the record peak of 9,078.37 touched on Jan. 29, marking a reversal from a bull to a bear market. The index first touched bear territory in intraday trade on Tuesday.

Since the beginning of the year, the main stock barometer has lost a total of 1,296.8 points or 15.15 percent from last year’s finish of 8,558.42.

Gio Perez, an analyst at local stockbrokerage Papa Securities, said the BSP’s interest rate increase “may lead to a potential recovery for the PSEi as this would stem the peso’s weakness.”

In a research note, Papa Securities noted that technical indicators suggested that the market had reached oversold levels since Tuesday, a sign of potential bounce in the days ahead. The brokerage house noted that the PSEi was already close to its initial support levels between 7,100 and 7,150.

In recent months, there have been concerns that the BSP might have fallen behind the curve in setting its monetary policy amid the faster-than-expected rise in consumer prices and a sharp peso weakening against the dollar.

Foreign funds continued to dump local equities, resulting in P772.56 million in net foreign selling for the day. Since the start of the year, some $1.13 billion worth of funds have exited the local bourse.

The financial, industrial, holding firm, services and property counters declined yesterday. Only the mining/oil counter ended slightly higher.

Value turnover for the day amounted to P5.33 billion. There were 103 decliners that edged out 92 advancers while 45 stocks were unchanged.