PH stocks down following Fed rate hike

Philippine stocks weakened on Thursday, mirroring negative sentiments across the region after the powerful US Federal Reserve increased interest rates for the second time this year, cutting investors’ appetite for riskier assets like equities.

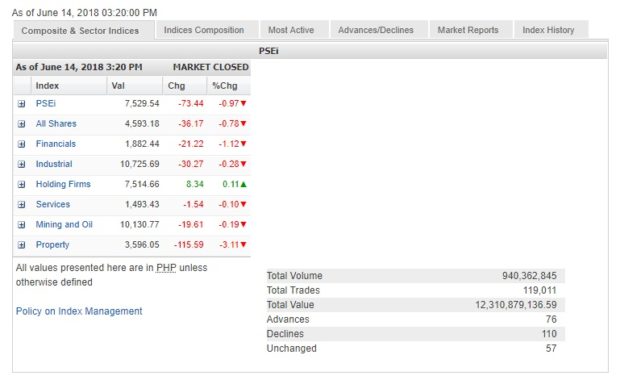

The benchmark Philippine Stock Exchange Index (PSEi) dropped close to 1 percent, or 73.44 points, to 7,529.54 by the closing bell on Thursday, the last trading day of the week. Trading will be closed on Friday, which was declared a holiday due to Eid al-Fitr or end of Ramadan.

On Thursday, the broader all-shares index was also down 0.78 percent to 4,593.18.

Among subsectors, only holding firms closed in the green with a gain of 0.11 percent. Losers were led by property, which sank 3.11 percent.

It was followed by financials, down 1.12 percent, and industrial, down 0.28 percent.

Article continues after this advertisementThe decline came amid relatively heavy volume on Thursday.

Article continues after this advertisementData from the PSE showed that 940.4 million shares valued at P12.3 billion changed hands. There were 110 losers against 76 gainers while 57 companies closed unchanged.

Property giant SM Prime Holdings Inc. was the most actively traded stock yesterday.

It dropped by 4.79 percent to P34.75 per share.

It was followed by Ayala Land Inc., another major developer, which sank 2.49 percent to P39.15.

Other actively traded companies were Metropolitan Bank & Trust Co., down 2.99 percent to P74.75; BDO Unibank Inc., unchanged at P136; and SM Investments Corp., up 0.28 percent to P902.50 a share.